Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

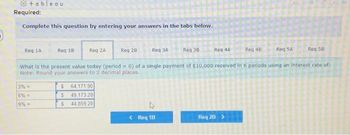

Transcribed Image Text:+ableau

Required:

Complete this question by entering your answers in the tabs below.

Reg 1A

Req 18

3% =

6% =

9%-

S

64.171.90

S 49 173 20

$ 44,859 20

Req 4A

< Req 18

Req 2A. Req 28

Req 3A Req 3B

What is the present value today (period= 0) of a single payment of $10,000 received in 6 periods using an interest rate of:

Note: Round your answers to 2 decimal places.

Reg 4B

Req 28 >

Req 5A

Req 58

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3arrow_forwardSolve for the unknown interest rate in each of the following: Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Present Value $ 750 940 18,500 73,800 Years 5 6 17 20 Interest Rate % % % % Future Value $ 1,451 1,788 145,332 319,815arrow_forwardMallings Review View Help e Search AaBbCcDd AaBbCcDd AaBbC AaBb AaBbCcD 三加三三、、田、 1 Normal 1 No Spac. Heading 1 Heading 2 Heading 3 Paragraph Styles 1) Find the amount accumulated FV in the given annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $2,800 is deposited quarterly for 20 years at 5% per year FV = $ 梦 0 93arrow_forward

- Solve for the unknown interest rate in each of the following: Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Present Value $ 755 945 19,000 74,300 Years 6 7 18 21 Interest Rate % % % % Future Value $ 1,461 1,798 145,832 320,815arrow_forwardPls help ASAParrow_forwardPls help on this question ASAP. Pls do the whole question pls pls pls pls pls i beg.arrow_forward

- Can you solve thisarrow_forwardSolve for the unknown interest rate in each of the following (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.):arrow_forwardQ 2 To borrow $750, you are offered an add on interest loan at 9.1 percent with 12 monthly payments. Compute the 12 equal payments. (Round your answer to 2 decimal places.) EQUAL PAYMENTS? Use the amount you borrowed and the monthly payments you computed to calculate the APR of the loan. Then, use that APR to compute the EAR of the loan. (Do not round intermediate calculations and round your answer to 2 decimal places.) EAR?arrow_forward

- Solve for the unknown interest rate in each of the following: Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Present Value 730 920 16,500 71,800 Years 5 6 17 20 Interest Rate % % % % Future Value $ 1,411 1,748 143,332 315,815arrow_forwardFollowing the calculation for years 1 and 2, what would be the payment adjustments and loan balances for years 3 to 5? Replicate the numbers in the table.arrow_forwardSolve for the unknown interest rate in each of the following: (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Present Value $ 290 410 44,000 43,261 Years 3 18 20 Interest Rate % % % % Future Value $ 345 1,253 209,290 388,485arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education