Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

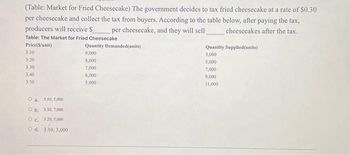

Transcribed Image Text:(Table: Market for Fried Cheesecake) The government decides to tax fried cheesecake at a rate of $0.30

per cheesecake and collect the tax from buyers. According to the table below, after paying the tax,

producers will receive S

per cheesecake, and they will sell

cheesecakes after the tax.

Table: The Market for Fried Cheesecake

Price(S/unit)

3.10

3.20

3.30

3.40

3.50

Oa. 3.50, 5,000.

b. 3.30, 7,000

OC 3.20, 5,000

O d. 3.10; 3,000

Quantity Demanded (units)

9,000

8,000

7,000

6,000

5,000

Quantity Supplied (units)

3,000

5,000

7,000

9,000

11,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Determine the given information:

VIEW Step 2: Determine the demand equation:

VIEW Step 3: Determine the effective demand equation after tax imposed on consumer:

VIEW Step 4: Determine the new quantity demanded schedule at given prices:

VIEW Step 5: Determine the price received by producers and quantity sold in the market after tax:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assume the government imposes a $0.75 excise tax on the sale of every 2 liter bottle of soda. The tax is to be paid by the producers of soda. The figure below shows the annual market for 2 liter bottles of soda before and after the tax is imposed. Price (per bottle) 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0 Market for Soda 2 3 1 5 6 S Quantity (billions of bottles) S 0 7 8 Instructions: Round your answers for price to 2 decimal places. Enter your answers for quantity as a whole number a. Before the tax is imposed, the equilibrium price is $ per bottle and the equilibrium quantity is b. After the excise tax is imposed, consumers pay a price of $ c. After the excise tax is imposed. the price (or amoum) producers keep after the tax is paid is $ d. After the tax is imposed, the equilibrium quantity is billion bottles. e. The government is able to collect $ billion of tax revenue from the tax per bottle per bottle billion bottles.arrow_forwardAssume the government imposes a $0.75 excise tax on the sale of every 2 liter bottle of soda. The tax is to be paid by the producers of soda. The figure below shows the annual market for 2 liter bottles of soda before and after the tax is imposed. Price (per bottle) 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0 Market for Soda 2 3 1 5 6 S Quantity (billions of bottles) S 0 7 8 Instructions: Round your answers for price to 2 decimal places. Enter your answers for quantity as a whole number a. Before the tax is imposed, the equilibrium price is $ per bottle and the equilibrium quantity is b. After the excise tax is imposed, consumers pay a price of $ c. After the excise tax is imposed. the price (or amount) producers keep after the tax is paid is $ d. After the tax is imposed, the equilibrium quamtity is billion bottles. e. The government is able to collect $ billion of tax revenue from the tax per bottle per bottle billion bottles.arrow_forwardThe government of a small country is considering the introduction of a unit subsidy on the production of organic meat as its consumption has been proved to have health benefits. The effect following the introduction of the tax is shown in the graph below. Price per pound of organic meat £28 S1 £24 £20 £17 D Quantity of pounds of organic meat 8,200 10,500 22,000 2. Calculate the unit subsidy on organic meat and the totalamount spent by the government on subsidising its production. You are required to show your workingsarrow_forward

- On June 2, 2008, the State of New York imposed a tax of $1.25 per pack of cigarettes. Prior to the tax, the market price was $5.82 per pack and there were 1 million New York smokers. Assume that each smoker consumes one pack of cigarettes per day. After the tax, N.Y. Health Commissioner estimated that 140,000 people stopped smoking and the market price of cigarettes increased from $5.82/pack to $6.57/pack. Calculate the price elasticity of demand based on these estimates and assumptions.arrow_forwarddo fastarrow_forward11arrow_forward

- Figure: The Market for Lattes Price (per latte) $4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0 200 S D 1,800 600 1,000 1,400 Quantity of lattes (in cups) 2. Figure: The Market for Lattes) If the government assesses a tax of $0.75 on sellers of lattes, a. What is the consumer price and producer price after tax was imposed? b. What is the new PS?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardTable: The Market for Chocolate-Covered Peanuts Price (per bag) $0.90 0.80 0.70 0.60 0.50 0.40 0.30 Quantity Demanded (bags per month) 70 105 140 175 210 245 280 Quantity Supplied (bags per month) 280 245 210 175 140 105 70 (Ref 6-4 Table: The Market for Chocolate-Covered Peanuts) Use Table: The Market for Chocolate-Covered Peanuts. A surplus of per bag. 210 bags of chocolate-covered peanuts per month exists if the price is O a. $0.80 O b. $0.90 c. $0.40 O d. $0.60arrow_forward

- Assume the government taxes packs of cigarettes both to discourage cigarette smoking and to raise tax revenue. The average excise tax on a pack of cigarettes is $2.50 per pack. The table below presents the annual demand and supply schedules, In billions of packs. both before and after the tax on packs of cigarettes. Market for Cigarettes Price (dollars par pack) $10.00 9.75 9.50 9.29 8.75 8.58 8.25 3.08 7.75 7.58 7.25 7.08 6.75 6.58 4.25 6.00 5.75 5.58 9.25 5.00 4.75 4.50 Quantity of Cigarettes Demanded (Dillions of packa) 5.0 7.5 10:0 12.5 15.0 17.5 28.0 22.5 25.0 27.5 32.5 39.0 37.5 42.5 45.8 47.5 50.0 52.5 55.0 57.5 60.0 Quantity of cigarettes supplied (billions of packs) 65.0 62.5 60.0 57.5 52.9 50.0 47.5 45.0 42.5 37.5 35.0 32.5 30.0 27.5 25.0 22.5 28.0 $2.50 per pack $0.50 per pack $1.75 per pack $700 Ft paci 17.5 15.0 12.5 18.0 Quantity of Cigarettes Supplied with Tax (billiona of packs) 49.0 37.5 35.0 32.5 30.0 27.5 25.8 22.5 28.8 17.5 15.8 12,5 18.0 a. What are the equilibrium…arrow_forwardPrice (dollars per gallon) S2 $5.50 3.50 2.50 D Quantity (millions of gallons per month) 30 40 45 Assume the graph above illustrates a new tax put into the market for soft drinks. S2 is the supply curve with the $2 tax in place. What price would consumers pay if the tax was placed on consumers instead of producers? 1) $2.00 O 2) $3.50 3) $2.50 4) $1.50arrow_forwardPRICE (Dollars per pack) 50 45 TAX REVENUE (Dollars) 40 35 30 25 400 360 320 At this tax amount, the equilibrium quantity of cigarettes is government collects $ in tax revenue. 280 240 0 Suppose the government imposes a $10-per-pack tax on suppliers. 200 160 120 0 5 80 40 Supply Now calculate the government's tax revenue if it sets a tax of $0, $10, $20, $25, $30, $40, or $50 per pack. (Hint: To find the equilibrium quantity after the tax, adjust the "Quantity" field until the Tax equals the value of the per-unit tax.) Using the data you generate, plot a Laffer curve by using the green points (triangle symbol) to plot total tax revenue at each of those tax levels. 0 Demand Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically. 10 15 20 25 30 35 40 45 50 QUANTITY (Packs) 5 True O False Graph Input Tool Market for Cigarettes Quantity (Packs) 10 15 20 25 30 TAX (Dollars per pack) Demand Price (Dollars per pack) Tax…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning