ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

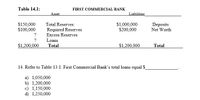

Transcribed Image Text:Table 14.1:

FIRST COMMERCIAL BANK

Asset

Liabilities

Total Reserves:

S150,000

$100,000

$1,000,000

$200,000

Deposits

Net Worth

Required Reserves

Excess Reserves

?

?

Loans

$1,200,000

Total

$1,200,000

Total

14. Refer to Table 13.1. First Commercial Bank's total loans equal S

a) 1,050,000

b) 1,200,000

c) 1,150,000

d) 1,250,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 35 If a bank has a required reserve ratio of 25% and there are $5,300,000 in deposits, what is amount of required reserves? $25,000 $280,000 $1,325,000 $2,275,000 $5,005,000arrow_forward29. For a given return on assets, holding other factors constant, Question 29 options: a) a lower capital-to-asset ratio has no effect on the return on equity of the bank. b) the lower is bank capital relative to assets, the higher is the return on equity of the bank. c) the lower is bank capital relative to assets, the lower is the credit risk for the owners of the bank. d) the lower is bank capital relative to assets, the lower is the return on equity of the bank.arrow_forward26. Compared to commercial banks and thrift institutions, finance companies are Question 26 options: a) heavily regulated. b) able to attract small depositors. c) prevented from making relatively small loans. d) virtually unregulated.arrow_forward

- 2arrow_forwardStealth bank has deposits of $300 million. It holds reserves of $20 million and has purchased government bonds worth $300 million. The bank's loans, if sold at current market value, would be worth $600 million. What does Stealth bank’s net worth equal? a. $1.22 billion b. $920 million c. $620 million d. $20 millionarrow_forwardAssets Answer: Liabilities Required Reserves: $460000 Loans $150000 Bonds: $1940000 The above is the T-Accounts for TD bank. If the reserve ratio is 10 percent, what is the change in loans after the excess reserves are loaned out? Deposits: $2550000 Capital: 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education