FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Required 2

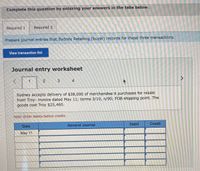

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.

View transaction list

Journal entry worksheet

1

2.

3

<>

Sydney accepts delivery of $38,000 of merchandise it purchases for resale

from Troy: invoice dated May 11; terms 3/10, n/90; FOB shipping point. The

goods cost Troy $25,460.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

May 11

Transcribed Image Text:Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions.

May 11 Sydney accepts delivery of $38,000 of merchandise it purchases for resale from Troy: invoice dated May 11; terms

3/10, n/90; FOB shipping point. The goods cost Troy $25,460. Sydney pays $425 cash to Express Shipping for

delivery charges on the merchandise.

12 Sydney returns $1,500 of the $38,000 of goods to Troy, who receives them the same day and restores them to its

inventory. The returned goods had cost Troy $1,005.

20 Sydney pays Troy for the amount owed. Troy receives the cash immediately.

(Both Sydney and Troy use a perpetual inventory system and the gross method.)

1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.

2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions.

Complete this question by entering your answers in the tabs below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] The transactions listed below are typical of those involving Southern Sporting Goods (SSG) and Sports R Us (SRU). SSG is a wholesale merchandiser and SRU is a retail merchandiser. Assume all sales of merchandise from SSG to SRU are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended December 31. a. SSG sold merchandise to SRU at a selling price of $140,000. The merchandise had cost SSG $100,000. b. Two days later, SRU complained to SSG that some of the merchandise differed from what SRU had ordered. SSG agreed to give an allowance of $4,500 to SRU. SRU also returned some sporting goods, which had cost SSG $13,500 and had been sold to SRU for $18,000. No further returns are expected c. Just three days later SRU paid SSG, which settled all amounts owed. . Prepare…arrow_forwarddetermine missing amountarrow_forward4.arrow_forward

- Journal Entries Under the Perpetual Inventory System Bhushan Building Supplies entered into the following transactions. June 1 Purchased merchandise on account from Brij Builder's Materials, $30,000. 3 Purchased merchandise for cash, $24,000. * Sold merchandise on account to Champa Construction for $50,000. The merchandise cost $37,500. Prepare journal entries under the perpetual inventory system. Page: 1 DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 20-- 1 June 1 2 3 3 4 June 3 4 6. 6. June 5 7 8. 8. 9. 10 June 5 10 11 11 12 12arrow_forwardPlease help mearrow_forwardScore $250 vork i Saved Exercise 4-7 Recording sales, purchases, shipping, and returns-buyer and seller LO P1, P2 Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts delivery of $25,000 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90, FOB shipping point. The goods cost Troy $16,750. Sydney pays $675 cash to Express Shipping for delivery charges on the merchandise. 12 Sydney returns $1,100 of the $25,000 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $737. 20 Sydney pays Troy for the amount owed. Troy receives the cash immediately. (Both Sydney and Troy use a perpetual inventory system and the gross method.) 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions. 2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions. Complete this…arrow_forward

- Confused as to what is needed to be donearrow_forwardUse the following sales journal to record the transactions. All credit sales are terms of n/30. (If a box is not used in the journal leave the box empty; do not select information or enter a zero.) A (Click the icon to view the transactions.) Sales Journal Page Invoice Customer Post. Accounts Receivable DR Cost of Goods Sold DR Date No. Account Debited Ref. Sales Revenue CR Merchandise Inventory CR 2024 Jun. More Info Jun. 1 Sold merchandise inventory on account to Fred Jig, $1,270. Cost of goods, $1,000. Invoice no. 101. Jun. 8 Sold merchandise inventory on account to lan Frog, $2,225. Cost of goods, $1,580. Invoice no. 102. Jun. 13 Sold merchandise inventory on account to Jillian Trump, $380. Cost of goods, $300. Invoice no. 103. Jun. 28 Sold merchandise inventory on account to Glen Whitney, $900. Cost of goods, $610. Invoice no. 104. Print Donearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education