FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

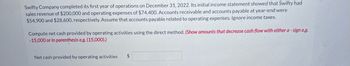

Transcribed Image Text:Swifty Company completed its first year of operations on December 31, 2022. Its initial income statement showed that Swifty had

sales revenue of $200,000 and operating expenses of $74,400. Accounts receivable and accounts payable at year-end were

$54,900 and $28,600, respectively. Assume that accounts payable related to operating expenses. Ignore income taxes.

Compute net cash provided by operating activities using the direct method. (Show amounts that decrease cash flow with either a-sign e.g.

-15,000 or in parenthesis e.g. (15,000).)

Net cash provided by operating activities $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Create a statement of cash flow for the current year using Wright Co's income statement and balance sheet. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Income Statement: Current Year Revenue 4,500.00 Cost of Goods Sold 2,250.00 Gross Margin 2,250.00 SG&A 580.00 EBITDA 1,670.00 Depreciation Expense 540.00 EBIT 1,130.00 Interest Expense 170.00 EBT 960 Taxes 336.00 Net Income 624.00 Dividends 410 Addition to Retained Earnings 214.00 Balance Sheet: Assets Prior Year Current Year Cash 800 ???? Accounts Receivables 400 425.00 Inventory 300 350.00 Total Current Assets 1,500 ???? Net Fixed Assets 5,000 5,300.00 Total Asset 6,500 ???? Liabilities and Equity Prior Year Current Year Accounts Payable 300 350.00 Notes Payable 1,000 900.00 Total Current Liabilities 1,300 1,250.00 Long-Term Debt 2,000 2,500.00 Total Liabilities 3,300 ???? Common Stock and Paid-in Capital 2,200 2,200…arrow_forwardVaughn Company completed its first year of operations on December 31, 2022. Its initial income statement showed that Vaughn had sales revenue of $196,100 and operating expenses of $89,100. Accounts receivable and accounts payable at year-end were $53,500 and $27,700, respectively. Assume that accounts payable related to operating expenses. Ignore income taxes.Compute net cash provided by operating activities using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)arrow_forwardCain Incorporated reports net income of $17,400. It's comparative balance sheet shows the following changes: accounts receivable increased $8400; inventory decreased $10, 400;prepaid insurance decreased $ 3400;accounts payable increase $5400;and taxes payable decrease $4400. Compute the cash flow from operations using the indirect method.arrow_forward

- Staley Inc. reported the following data: Net income $338,400 Depreciation expense 66,700 Loss on disposal of equipment 31,900 Increase in accounts receivable 25,200 Increase in accounts payable 10,100 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. what is the answer to this?arrow_forwardCurrent Attempt in Progress In the Crane Corporation, cash receipts from customers were $135000, cash payments for operating expenses were $101000, and one-third of the company's $8400 income taxes were paid during the year. Net cash provided by operating activities is: O $25600. O $28400. O $34000. O $31200.arrow_forwardThe balance sheets of Xenon Company reports total assets of $888,000 and $949,000 at the beginning and end of the year, respectively. Sales revenues are $1.8 million, net income is $194,000, and net cash flows from operating activities are $162,000. Required: Calculate the cash return on assets, cash flow to sales, and asset turnover. (Do not round intermediate calculations. Round your final answers to 1 decimal place.) Cash return on assets Cash flow to sales Asset turnover % % timesarrow_forward

- savitaarrow_forwardHolloway Company earned $4,300 of service revenue on account during Year 1. The company collected $3,655 cash from accounts receivable during Year 1. Based on this information alone, determine the following for Holloway Company. The amount of net cash flow from operating activities that would be reported on the Year 1 statement of cash flows. The amount of retained earnings that would be reported on the Year 1 balance sheet.arrow_forwardAccounts receivable from sales transactions were $49,313 at the beginning of the year and $62,098 at the end of the year. Net income reported on the income statement for the year was $122,531. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method would bearrow_forward

- Swifty Company uses the direct method in determining net cash provided by operating activities, During the year, operating expenses were $297500, prepaid expenses increased $25000, and accrued expenses payable increased $34700. Cash payments for operating expenses were O $287800. O $54700. O $40700. O $307200.arrow_forwardCain Incorporated reports net income of $16,200. Its comparative balance sheet shows the following changes: accounts receivable increased $7,200; inventory decreased $9,200; prepaid insurance decreased $2,200; accounts payable increased $4,200; and taxes payable decreased $3,200. Compute cash flows from operations using the indirect method. (Amounts to be deducted should be indicated by a minus sign.)arrow_forwardCribbets Company uses the direct method in determining net cash provided by operating activities, During the year, operating expenses were $290,000, prepaid expenses increased $20,000, and accrued expenses payable increased $30,000. Cash payments for operating expenses werearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education