FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

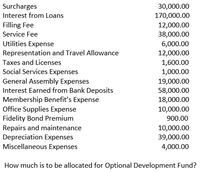

Transcribed Image Text:Surcharges

30,000.00

170,000.00

Interest from Loans

Filling Fee

12,000.00

38,000.00

6,000.00

Service Fee

Utilities Expense

Representation and Travel Allowance

12,000.00

Taxes and Licenses

1,600.00

Social Services Expenses

General Assembly Expenses

Interest Earned from Bank Deposits

Membership Benefit's Expense

Office Supplies Expense

Fidelity Bond Premium

Repairs and maintenance

Depreciation Expenses

Miscellaneous Expenses

1,000.00

19,000.00

58,000.00

18,000.00

10,000.00

900.00

10,000.00

39,000.00

4,000.00

How much is to be allocated for Optional Development Fund?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A taxpayer has a pension income of £3,100 a month and savings income of £1000. What is the personal savings allowance available? £0 £1,000 £500 £5,000arrow_forwardDetermine the value of the perpetuity annual amount $20,000 discount rate 8%arrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $987,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for four years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount being financed? $4 (b) If Darrell chooses the 4-point 9% loan, what…arrow_forward

- Savings Plans, Part 1: Frequency of Deposits for Annuities For this problem, you will be looking at the difference that the frequency of deposits and compounding makes on annuities. For all answers given as values of money, round down to the cent. For answers in percents, round to the tenth of a percent. 1. Make a table that shows how much money each person has in their annuity after 1 year, 5 years, 10 years, and 25 years. Calculate how much money each person has invested after 25 years, and how much interest they have earned after 25 years. Then express the interest earned after 25 years as a percent of the amount invested. a. Avery invests $3120 per year in an annuity with a 3.9% APR, compounded annually. b. Britt invests $780 per quarter in an annuity with a 3.9% APR, compounded quarterly. c. Casey invests $260 per month in an annuity that earns 3.9% APR, compounded monthly. d. Devyn invests $60 per week in an annuity that earns 3.9% APR, compounded weekly. (Use 52 weeks…arrow_forwardIts full one question please help ill definitely likearrow_forwardCalculate the annual change in interest expense that would occur for a drop in interest rates from 6% to 4% for a borrower with $5,000,000 in variable-rate debt. a. -$100,000 Ob. $200,000 O c. $300,000 d. $100,000arrow_forward

- Using this table as needed, calculate the required information for the mortgage. Number Table Monthly Payment (in $) Term Total Amount Interest of $1,000s Financed of Loan Factor Interest Financed Rate (years) (in $) (in $) $74,500 8.00% 30 %24arrow_forwardnt Shawn Bixby borrowed $25,000 on a 120-day, 15% note. After 60 days, Shawn paid $2,800 on the note. On day 96, Shawn paid an additional $4,800. Use ordinary interest. a. Determine the total interest use the U.S. Rule. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Total interest b. Determine the ending balance due use the U.S. Rule. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Ending balance duearrow_forwardQuestion: A debenture of $100 each is issued at $90 per debenture. How much is the discount? A. $0 B. full C . $10 D. $90arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education