FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:nt

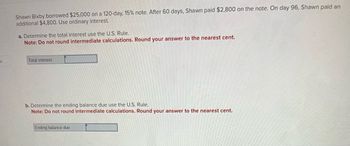

Shawn Bixby borrowed $25,000 on a 120-day, 15% note. After 60 days, Shawn paid $2,800 on the note. On day 96, Shawn paid an

additional $4,800. Use ordinary interest.

a. Determine the total interest use the U.S. Rule.

Note: Do not round intermediate calculations. Round your answer to the nearest cent.

Total interest

b. Determine the ending balance due use the U.S. Rule.

Note: Do not round intermediate calculations. Round your answer to the nearest cent.

Ending balance due

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 12, Joy Company accepted a $1,000, 60-day, 6% note from Abe, granting a time extension on a past-due account. Joy discounted the note at the bank at 9% on May 28. Use ordinary interest. Calculate Joy's proceeds.arrow_forwardMike Drago took out a for $3,900 at the Gold Coast Bank for 270 days. If the bank uses the ordinary interest method, what rate (in %) of interest was charged if the amount of interest was $239? Round your answer to the nearest tenth of a percent.arrow_forwardQ.Mr. Jasim receives a note for $60,000 which is due in 180 days with simple interest rate of 15%. The note is discounted immediately at a bank that charges 12% simple discount. How much is the proceeds from the note?arrow_forward

- The local bank is currently offering a new investment product, where deposits earn interest according to the following scheme: A ● An interest rate of r is applied on the 15th day of each month. ● A bonus interest rate of t is applied on the 30th day of every odd month. (These are the months of January, March, May, July, September, and November.) 1. Suppose that you want to deposit an amount of I dollars into the account twice: on January 1 and August 1 in 2023. If you want the value of your investment to be S by April 30, 2024, express in terms of S, r, and t. (Note that r and t are not APRs.) 2. What is the effective annual rate of the above compounding scheme?arrow_forwardZuhoor Muscat Company borrowed RO 240,000 from the bank signing a 8%, 6-month note on October 1, 2020. The recorded amount of accrued interest expense on December 31, 2020 will be: a. None of the options are correct. Ob. RO 40,000. O c. RO 240,000. Od. RO 4,800. O e. RO 9,600. NEXT PAGE 4440 025 Type here to search B. red by ws 10 S acerarrow_forwardPlease help I can not get this right !arrow_forward

- 1arrow_forwardTYPEWRITTEN ONLY PLEASE UPVOTE. DOWNVOTE FOR HANDWRITTEN. DO NOT ANSWER IF YOU ALREADY ANSWERED THISarrow_forwardFor items 16-20 Suppose that Zab borrowed P50,000 from a cooperative on January 8, 2020 and paid the entire sum including interest on April 3 of the same year, and that the interest rate is 1.5%. 16. Determine the exact time for the computation of exact interest. 17. Determine the approximate time for the computation of ordinary interest. 18. Find the amount of interest earned, if it is computed using the exact simple interest. 19. Find the amount of interest earned, if it is computed using the ordinary simple interest. 20. Find the amount of interest earned, if it is computed using the banker's rule.arrow_forward

- Use the ordinary interest method, 360 days, to solve the following word problem. Round to the nearest cent when necessary. Roni Lockard signed a $28,500 simple discount promissory note at a certain bank. The discount rate was 13%, and the note was made on February 18 (not in a leap-year) for 116 days. (a) What proceeds (in $) will Roni receive on the note? $ (b) What is the maturity date of the note?arrow_forwardOn September 12, Jody Jansen went to Sunshine Bank to borrow $2,300 at 9% interest. Jody plans to repay the loan on January 27, Assume the loan is on ordinary interest. (Use Days in a year table) a. What interest will Jody owe on January 27? Note: Do not round intermediate calculations. Round your answer to the nearest cent. Interest b. What is the total amount Jody must repay at maturity? Note: Do not round intermediate calculations. Round your answer to the nearest cent. Maturity valuearrow_forwardDave borrowed $550 on January 1, 2022, and paid it all back at once on December 31, 2022. The bank charged him a $3.50 service charge, and interest was $40.70. What was the APR? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Annual percentage rate %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education