ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

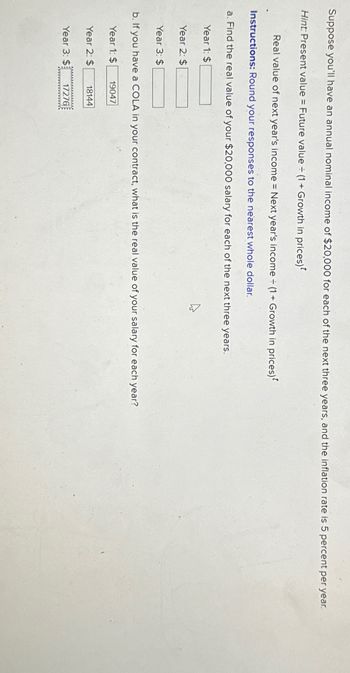

Transcribed Image Text:Suppose you'll have an annual nominal income of $20,000 for each of the next three years, and the inflation rate is 5 percent per year.

Hint: Present value = Future value = (1 + Growth in prices)*

=

Real value of next year's income = Next year's income ÷ (1+ Growth in prices)

Instructions: Round your responses to the nearest whole dollar.

a. Find the real value of your $20,000 salary for each of the next three years.

Year 1: $

Year 2: $

Year 3: $

b. If you have a COLA in your contract, what is the real value of your salary for each year?

Year 1: $

19047

Year 2: $

18144

Year 3: $

17276

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the interest rate is 4 percent. Instructions: Enter your answers rounded to 2 decimal places. a. What is the future value of $100 four years from now? $ How much of the future value is total interest? $ b. By how much would total interest be greater at an interest rate of 6 percent than at an interest rate of 4 percent? %24arrow_forwardYou borrowed $200 and repaid $211 at the end of the year. During the year, inflation was 0.7%. What was the real interest rate, in percent? (Please use the Fisher effect to approximate your answer if appropriate.) Round to one decimal place digit and do not enter the % sign. If your answer is 6.14%, enter 6.1. If your answer is 6.16%, enter 6.2. If appropriate, remember to enter the-sign 4.8arrow_forwardSuppose the nominal rate of interest on a savings account is 15%, the real rate of interest is 3%, and the tax rate on nominal interest is 20%. Which of the following is true? A saver would lose 9% real interest. A saver would neither gain nor lose real interest. A saver would earn 12% real interest. A saver would earn 2.4% real interest.arrow_forward

- D Your pension is $8,000 per month when you retire. In the first year after you retire, inflation is 2%. In the next year, inflation is 1%. If your pension is indexed to inflation, what is the nominal value of your monthly pension after this second year, in dollars? Remember: Round to whole cents, and do no enter the dollar sign. If the answer is $93.625, enter 93.63. 8.241.6arrow_forwardthe nominal rate on a $1,000 investment is 12.75 percent. the expected rate of inflation is 2.25 percent. find the exact expected real rate of interest .arrow_forward2 0 0 1 2 3 4 5 6 7 8 Year According to the graph in the figure above, which year experienced the most rapid change in employment? Year 3 Year 5 Year 4 Year 2 Employment (in millions) 5arrow_forward

- Harper is a short-lived human who only lives for two years: current year and next year. In the current year, Harper has an income of $189 and has to pay $36 in taxes. Harper expects that he can receive an income of $132 and has to pay $27 in taxes next year before he dies. The real interest rate between current and next year is 7%. What is Harper's lifetime wealth (in $)? Round your answer to at least 2 decimal placesarrow_forwardSuppose Poornima is an avid reader and buys only comic books. Poornima deposits $3,000 in a bank account that pays an annual nominal interest rate of 10%. Assume this interest rate is fixed-that is, it won't change over time. At the time of her deposit, a comic book is priced at $15.00. Initially, the purchasing power of Poornima's $3,000 deposit is comic books. For each of the annual inflation rates given in the following table, first determine the new price of a comic book, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Poornima's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest comic book. For example, if you find that the deposit will cover 20.7 comic books, you would round the purchasing power down to 20 comic books under the assumption that Poornima will…arrow_forwardSome friends of yours have just had a child. Thinking ahead, and realizing the power of compound interest, they are considering investing for their child's college education, which will begin in 18 years. Assume that the cost of a college education today is $125,000. Also assume there is no inflation and no tax on interest income used to pay college tuition and expenses. Instructions: Enter your responses rounded to the nearest dollar. Do not round intermediate calculations. a. If the interest rate is 5 percent, how much money will your friends need to put into their savings account today to have $125,000 in 18 years? They would need to put $ 36982.9 into their savings account today. b. What if the interest rate were 7 percent? They would need to put $ into their savings account today. c. The chance that the price of a college education will be the same 18 years from now as it is today seems remote. Assuming that the price will rise 3 percent per year, and that today's interest rate is…arrow_forward

- helparrow_forwardTamika is lending Juan $1,000 for one year. The CPI is 1.60 at the time the loan is made, and they both expect it to be 1.68 in one year. If Tamika and Juan agree that Tamika should earn a 3 percent real return for the year, the nominal interest rate on this loan should be percent.arrow_forwardPlease only send solutions to question D and E Thanks in advancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education