ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

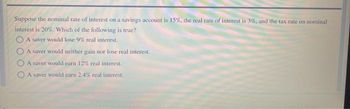

Transcribed Image Text:Suppose the nominal rate of interest on a savings account is 15%, the real rate of interest is 3%, and the tax rate on nominal

interest is 20%. Which of the following is true?

A saver would lose 9% real interest.

A saver would neither gain nor lose real interest.

A saver would earn 12% real interest.

A saver would earn 2.4% real interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You deposit $200 in a savings account on January 1, and the bank pays you interest of $10 at the end of the year. During the year, the average price level rises by 2 percent. What is the real interest rate on your savings account? The real interest rate on your savings account is _______. A. 3 percent a year B. 2 percent a year C. $6 D. 6 percent a yeararrow_forwardHousehold saving = $200, Business Saving = $400, Government Purchases = $100, Government transfer & interest payments = $100, tax revenue = $150, GDP = $2,200. Private saving = ?arrow_forwardAssume that in this economy consumption (C) is given by the equation C = 600 + 0.6(Y – T). Investment (I) is given by the equation I = 2,000 – 100r, where r is the real rate of interest in percent terms. Taxes (T) are 500 and government spending (G) is also 500. What are the values of private saving, public saving, and national saving?arrow_forward

- Harper is a short-lived human who only lives for two years: current year and next year. In the current year, Harper has an income of $189 and has to pay $36 in taxes. Harper expects that he can receive an income of $132 and has to pay $27 in taxes next year before he dies. The real interest rate between current and next year is 7%. What is Harper's lifetime wealth (in $)? Round your answer to at least 2 decimal placesarrow_forwardplease answer part 3arrow_forwardSuppose real GDP is $5,136 billion, taxes collected by the government are $535 billion, government spending is $656 billion, and consumption spending is $3,893 billion. What is the value of private saving?arrow_forward

- Assume an economy with 1000 consumers. Each consumer has income in the current period of 50 units and future income of 60 units, and pays a lump-sum tax of 10 in the current period and 20 in the future period. The market real interest rate is 8%. Of the 1000 consumers, 500 consume 60 units in the future, while 500 consume 20 units in the future. a) Determine each consumer's current consumption and current saving. b) Determine aggregate private saving, aggregate consumption in each period, government spending in the current and future periods, the current-period government deficit, of the quantity of debt issued by the government in the current period. c) Suppose that current taxes increase to 15 for each consumer. Repeat parts (a) and (b) and explain your results.arrow_forwardOn January 1, 2016, Sophie's Internet Cafe owned 10 computer terminals valued at $8,000. During 2016, Sophie's bought 5 new computer terminals at a cost of $1,250 each, and at the end of the year, the market value of all of Sophie's computer terminals was $9,000. What was Sophie's gross investment, net investment, and depreciation? Sophie's gross investment during 2016 was Sarrow_forwardCindy takes a summer job and earns an after-tax income of $5,000. Her living expenses during the summer were $1,000. What was Cindy's saving during the summer and the change, if any, in her wealth? >>> If your answer is negative, include a minus sign. If your answer is positive, do not include a plus sign. Cindy's saving during the summer is $arrow_forward

- 1. Suppose you are given the following data: Government Purchases $ 6.0 billion Imports $ 0.3 billion Transfer Payments $ 2.3 billion Consumption $11.9 billion Depreciation $ 2.2 billion Exports $ 0.5 billion Investment $ 3.7 billion Taxes $ 6.4 billion a) Calculate the value of government public savings. b) Calculate the value of household private savings. (arrow_forwardThe graph below represents the market for loanable funds for an economy. Use the graph to answer the following questions. real interest rate 6% 51000 Loanable fund $ Assume there currently is a surplus in the market for loanable funds. The current real interest rate is I Select) the equilibrium real interest rate. As the market moves to the equilibrium real interest rate we expect I Select ] Demand for loanable funds comes from the activities of ISelect) 13arrow_forwardMacmillan Learning U The graph depicts the market for loanable funds. Shift the appropriate curves to indicate what will happen to the market if there is an improvement in the technology firms use in production. As a result of this change, the real interest rate is now % Real interest rate 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 and the quantity of funds is $ billion. 0.5 Supply Demand 0.0 0 5 10 15 20 25 30 35 40 45 50 Loanable funds (in billions)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education