Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

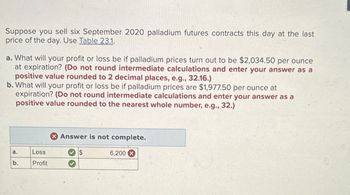

Transcribed Image Text:Suppose you sell six September 2020 palladium futures contracts this day at the last

price of the day. Use Table 23.1.

a. What will your profit or loss be if palladium prices turn out to be $2,034.50 per ounce

at expiration? (Do not round intermediate calculations and enter your answer as a

positive value rounded to 2 decimal places, e.g., 32.16.)

b. What will your profit or loss be if palladium prices are $1,977.50 per ounce at

expiration? (Do not round intermediate calculations and enter your answer as a

positive value rounded to the nearest whole number, e.g., 32.)

a.

Loss

b.

Profit

Answer is not complete.

6,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Find the price of an American call option on a futures if the current spot price is 30, the exercise price is 25, the futures price is 33.70, the risk-free interest rate is 6 percent, the spot asset can go up by 10 percent or down by 8 percent per period and the call expires in two periods, which is also when the futures expires. Show your working. A. 9.98 B. 8.70 C. 7.73 D. 8.22arrow_forwardJune 2019 Mexican peso futures contract has a price of $0.05197 per MXN. You believe the spot price in June will be 0.05831 per MXN a. What speculative position would you enter into to attempt to profit from your beliefs? O Short position O Long Position b. Calculate your anticipated profits, assuming you take a position in three contracts. (Do not round intermediate calculations. Round your answer to the nearest whole number.) Anticipated profit c. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes? (A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number)arrow_forwardA farm that produces corn is looking to hedge their exposure to price fluctuations in the future. It is now May 15th and they expect their crop to be ready for harvest September 30th. You have gathered the following information: Bushels of corn they expect to produce 44,000 May 15th price per bushel $3.08 Sept 30 futures contract per bushel $3.22 Actual market price Sept 30 $3.37 Required (round to the nearest dollar): Calculate the gain or loss on the futures contract and net proceeds on the sale of the corn. Net gain or loss on future $Answer Sell the corn $Answer Net $Answerarrow_forward

- Please answer it with no descriptions or details, with the question numbers and answers, the exact way it should go on according to the red regulations, thank you!arrow_forwardJune 2021 Mexican peso futures contract has a price of $0.05197 per MXN. You believe the spot price in June will be $0.05831 per MXN. MXN500,000 is the contract size of one MXN contract. Required: What speculative position would you enter into to attempt to profit from your beliefs? Calculate your anticipated profits, assuming you take a position in three contracts. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes?arrow_forwardIf you put on the futures position from 2 at a price of 0.043 $/peso, and if the peso appreciates from the spot rate of 0.045 $/peso by 15% in the next 6 months, what will be the total value of your position (the payable plus the future) in 6 months (again, this should be a negative number)?arrow_forward

- In January 5th of 2018, you took a short position on 100 Feeder Cattle futures contracts that matures in September 2018. The maintenance margin is 60% of the contract size (= 148.05 * 100 * 60%) and if your margin goes below the maintenance margin you will get a margin call. Determine the following: 1) Based on futures prices in January 5th, what is the market’s expectation on future price movements of cattle spots? 2) Based on your position, are you a hedger or a speculator? 3) As of at the end of Apr 2018, is this position profitable? 4) Did you have any margin calls before the end of April?arrow_forwardJune 2021 Mexican peso futures contract has a price of $0.05194 per MXN. You believe the spot price in June will be $0.04525 per MXN. Required: a. What speculative position would you enter into to attempt to profit from your beliefs? b. Calculate your anticipated profits, assuming you take a position in three contracts. c. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes? Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate your anticipated profits, assuming you take a position in three contracts. Note: Do not round intermediate calculations. Round your answer to the nearest whole number. Anticipated profitarrow_forward(Futures) You enter to short Japanese Yen 12,500,000 futures delivered in 6 months. The future price is F6(\/$)=116.9. If at the maturity, the spot rate is ¥93.2/$, and your position is still alive, then your profit(loss) is $_ ______. (Two decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education