FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

General Accounting

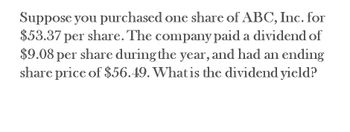

Transcribed Image Text:Suppose you purchased one share of ABC, Inc. for

$53.37 per share. The company paid a dividend of

$9.08 per share during the year, and had an ending

share price of $56.49. What is the dividend yield?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose a stock had an initial price of $86 per share, paid a dividend of $1.70 per share during the year, and had an ending share price of $12.50. Compute the percentage total return. What was the dividend yield? What was the capital gains yield?arrow_forwardIf current price of stock is $25 and you hold it for one year and received dividend of $2.5. You sold it at $27. How much return you received? Show dividend yield and capital gain separately.arrow_forwardA stock is bought for $25.84 and sold for $26.44 a year later, immediately after it has paid a dividend of $4.59. What is the capital gain rate for this transaction?arrow_forward

- What is the dividend yield if the annual dividend per share is $7.50 and the market price of a share of stock is $97?arrow_forwardIf a security offers a dividend amounting to P 5.23/ share and an investor purchased 200 shares at P 77.50/share, what is his Total Investment Return at the end of the year if the share price increased by 8%? Based on the given above, compute for the Dividend Yield Rate, Capital Gains Rate, and Total Investment Return Rate.arrow_forwardSuppose a stock had an initial price of $98 per share, paid a dividend of $3.20 per share during the year, and had an ending share price of $106.What was the dividend yield?arrow_forward

- The Moreau Corporation is paying an annual dividend of $0.65 per share. If the price of a share of the stock is $81.25, what is the dividend yield on the stock?arrow_forwardRed, Inc., Yellow Corp., and BlueCompany each will pay a dividend of $2.35 next year. The growth rate in dividendsfor all three companies is 5 percent. The required return for each company’s stockis 8 percent, 11 percent, and 14 percent, respectively. What is the stock price foreach company? What do you conclude about the relationship between the requiredreturn and the stock price?arrow_forwardYou just purchased a share of SPCC for $97.95. You expect to receive a dividend of $5.64 in one year. If you expect the price after the dividend is paid to be $107.44, what total return will you have earned over the year? What was your dividend yield? Your capital gain rate? The total return you will have earned over the year is %. (Round to two decimal places.)arrow_forward

- Suppose you bought a stock for $22.7 per share and then sold it for $14.7 per share. In the mean time, you received dividends of $1 per share. What was your total return from this investment? Answer in percent rounded to one decimal place.arrow_forwardSuppose you bought 1,050 shares of stock at an initial price of $55 per share. The stock paid a dividend of $.64 per share during the following year, and the share price at the end of the year was $50. a. Compute your total dollar return on this investment. (A negative value should be indicated by a minus sign.) b. What is the capital gains yield? (A negative value should be indicated by a minus sign. c. What is the dividend yield?arrow_forwardAt the start of the year, you purchased a single stock for $49.15 and one year later received a dividend of $2.88 and then sold the stock for $54.91. What was your total nominal return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education