Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

Transcribed Image Text:Problem

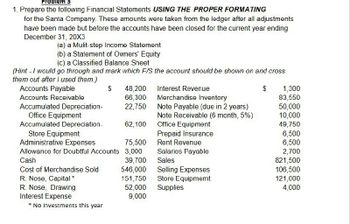

1. Prepare the following Financial Statements USING THE PROPER FORMATING

for the Santa Company. These amounts were taken from the ledger after all adjustments

have been made but before the accounts have been closed for the current year ending

December 31, 20X3

(a) a Mulit-step Income Statement

(b) a Statement of Owners' Equity

(c) a Classified Balance Sheet

(Hint - I would go through and mark which F/S the account should be shown on and cross

them out after I used them.)

Accounts Payable

$

48,200

Interest Revenue

$

1,300

Accounts Receivable

66,300

Merchandise Inventory

83,550

Accumulated Depreciation-

22,750

Note Payable (due in 2 years)

50,000

Office Equipment

Note Receivable (6 month, 5%)

10,000

Accumulated Depreciation-

62,100

Office Equipment

49,750

Store Equipment

Prepaid Insurance

6,500

Administrative Expenses

75,500

Rent Revenue

6,500

Allowance for Doubtful Accounts

3,000

Salaries Payable

2,700

Cash

39,700

Sales

821,500

Cost of Merchandise Sold

546,000

Selling Expenses

106,500

R. Nose, Capital *

151,750

Store Equipmemt

121,000

R. Nose, Drawing

52,000

Supplies

4,000

Interest Expense

9,000

*

No Investments this year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- What is the significance of preparing the Income Statementarrow_forwardPlease! help me with this questionarrow_forwardSelect the letter of the item below that best matches the definitions that follow. a. Balance Sheet Standard report. b. To date c. Summary Balance Sheet report d. QuickZoom e. Transactions by Account report f. % of Column g. Memorizing a report h. Divided by 1000 1. ________ When selected in the Modify Report window, this check box requires QuickBooks Accountant to add a column representing the percentage of each item compared to total assets. 2. ________ When selected in the Modify Report window, this check box requires QuickBooks Accountant to round amounts to the nearest whole dollar. 3. ________ The start of the reporting period. 4. ________ A financial statement reporting in detail the assets, liabilities, and equities of a business as of a certain date. 5. ________ A process by which modified reports are saved for later use. 6. ________ When selected in the Modify Report window, this check box requires QuickBooks Accountant to report amounts in thousands. 7. ________ The end…arrow_forward

- Please answer within the format with detailed working, please answer in text form (without image)arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardWhat is the operating income and the net income?arrow_forward

- Select 30 transactions of various kinds such as sales, costs (direct and indirect), revenues earned, revenue received in advance, expenses incurred, paid in advance, outstanding expenses, assets (current, non-current), liabilities (current, long term), Equity and so on.1. Record those transactions in journal,2. post them to ledger,3. Transfer the balances in trail balance,4. Prepare income statement and balance sheet.5. Follow the proper format considering IAS-1.6. Explanation: At the end, apply the concepts such as long term assets, capital or revenueincomes or expenses and their treatment involved in your above requirements Transactions of Mr. Akram travel world business Mr Akram started business with cash for rs 400,000. Paid wages rs 20,000. Paid office rent in advance 2000. Paid rs 10000 for insurance in advance. Babar and sons paid 2500 for goods on advance. Purchased office equipment on credit rs 5000. Paid 7000 for advertising expenses. Paid 3000 to accounts payable. Provided…arrow_forwardPlz explain properlyarrow_forwardI need help with this practice problem. Put the balances from the adjusted trial balance into the T accountsCreate properly formatted income statement and balance sheet for the year and the balance sheet as of 12/31.Create the closing entries.Post the results of the closing entries into the T accountDraw off balances for the T accounts.Create the post-closing trial balancearrow_forward

- The first step in posting the sales journal to the general ledger is to total and verify the equality of the amount columns. enter the date in the Date column of the ledger account. enter the new balance in the Balance columns of the ledger account. enter the ledger account number below the column totals in the journal.arrow_forwardRead each definition below and write the number of the definition in the blank beside the appropriate term. The quiz solutions appear at the end of the chapter. Event External event Internal event Transaction Source document Account Chart of accounts General ledger Debit Credit Double-entry system Journal Posting Journalizing General journal Trial balance A numerical list of all accounts used by a company. A list of each account and its balance; used to prove equality of debits and credits. A happening of consequence to an entity. An entry on the right side of an account. An event occurring entirely within an entity. A piece of paper that is used as evidence to record a transaction. The act of recording journal entries. An entry on the left side of an account. The process of transferring amounts from a journal to the ledger accounts. An event involving interaction between an entity and its environment. A record used to accumulate amounts for each individual asset, liability, revenue, expense, and component of stockholders equity. A book, a file, a hard drive, or another device containing all of the accounts. A chronological record of transactions. Any event that is recognized in a set of financial statements. The journal used in place of a specialized journal. A system of accounting in which every transaction is recorded with equal debits and credits and the accounting equation is kept in balance.arrow_forwardWhat is the total liabilities, please break down.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,