Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

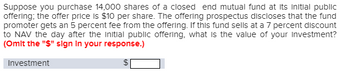

Transcribed Image Text:Suppose you purchase 14,000 shares of a closed end mutual fund at its initial public

offering; the offer price is $10 per share. The offering prospectus discloses that the fund

promoter gets an 5 percent fee from the offering. If this fund sells at a 7 percent discount

to NAV the day after the initial public offering, what is the value of your investment?

(Omit the "$" sign in your response.)

Investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following table shows the average returns for some of the largest mutual funds commonly found in retirement plans. (Assume end-of-month deposits and withdrawals and monthly compounding, and assume that the quoted rate of return continues indefinitely.) Mutual Fund Fidelity Growth Company Vanguard 500 Index PIMCO Total Return Vanguard Total Bond Market Index Rate of Return 14.83% 14.25% 3.77% 3.67% Stock fund Stock fund Type Bond fund Bond fund How much should you pay each month into a retirement account invested in the Vanguard bond fund if you wish to retire in 35 years with an investment valued at three million dollars? HINT [See Quick Example 2.] (Round your answer to the nearest cent.) $arrow_forwardLouis Hall read in the paper that Fidelity Growth Fund has an NAV of $13.94. He called Fidelity and asked how the NA Fidelity gave him the following information: Current market value of fund investment Current liabilities Number of shares outstanding Did Fidelity provide Louis with the correct information? O Yes O No $8,780,000 $ 975,000 560,000arrow_forwardYou purchased 1,000 shares of a mutual fund at an offer price of $13.88 per share. Several months later you sold the shares for $14.42 per share. During the time you owned the shares, the fund paid a dividend of $0.65 per share. What was your return on investment? Round to the nearest tenth.arrow_forward

- A year ago, an investor bought 100 shares of a mutual fund at $7.64 per share. This year, the fund has paid dividends of $0.71 per share and had a capital gains distribution of $0.52 per share. a. Find the investor's holding period return, given that this no-load fund now has a net asset value of $8.13. b. Find the holding period return, assuming all the dividends and capital gains distributions are reinvested in additional shares of the fund at an average price of $7.76 per share. a. Given that this no-load fund now has a net asset value of $8.13, the investor's holding period return is %. (Round to two decimal places.)arrow_forwardplease answer within 30 minutes.arrow_forwardExplain well all point of question with proper answer.arrow_forward

- Nn. 119.arrow_forwardThe Emerging Growth and Equity Fund is a "low-load" fund. The current offer price quotation for this mutual fund is $21.72, and the front-end load is 1.95 percent. a. What is the NAV? (Round your answer to 2 decimal places.) Net asset value dived b. If there are 18.7 million shares outstanding, what is the current market value of assets owned by the fund? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Market value of assetsarrow_forwardYou invested $90,000 in a mutual fund at the beginning of the year when the NAV was $54.3. At the end of the year, the fund paid $.40 in short-term distributions and $.57 in long-term distributions. If the NAV of the fund at the end of the year was $63.94, what was your return for the year? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

- Suppose that at the start of the year, no-load mutual fund has a net asset value of $27.65 per share. During the year, it pays its shareholders a capital gain and dividend distribution of $1.18 per share and finishes the year with an NAV of $30.84. a. What is the return to an investor who holds 257.616 shares of this fund in his (nontaxable) retirement account? Do not round intermediate calculations. Round your answer to two decimal places. % b. What is the after-tax return for the same investor these shares were held in an ordinary savings account? Assume that the investor is in the 30% tax bracket, Do not round intermediate calculations. Round your answer to two decimal places. % c. If the investment company allowed the investor to automatically reinvest his cash distribution in additional fund shares, how many additional shares could the investor acquire? Assume that the distribution occurred at year end and that the proceeds from the distribution can be reinvested at the year-end…arrow_forwardOpen-end Fund A has 187 shares of ATT valued at $46 each and 41 shares of Toro valued at $86 each. Closed-end Fund B has 86 shares of ATT and 83 shares of Toro. Both funds have 1,000 shares outstanding.a. What is the NAV of each fund using these prices? (Round your answers to 3 decimal places. (e.g., 32.161))b. If the price of ATT stock increases to $47.25 and the price of Toro stock declines to $83.292, how does that impact the NAV of both funds? (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))c. Assume that another 166 shares of ATT valued at $46 are added to Fund A. The funds needed to buy the new shares are obtained by selling 630 more shares in Fund A. What is the effect on Fund A’s NAV if the prices remain unchanged from the original prices?arrow_forwardYou purchased 1000 shares of a mutual fund at an offer price of $13.88 per share. Several months later you sold the shares for $14.42 per share during the time you owned the shares the fund paid a dividend of $0.61 per share. What was the return on the investment round to the nearest tenth.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education