Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

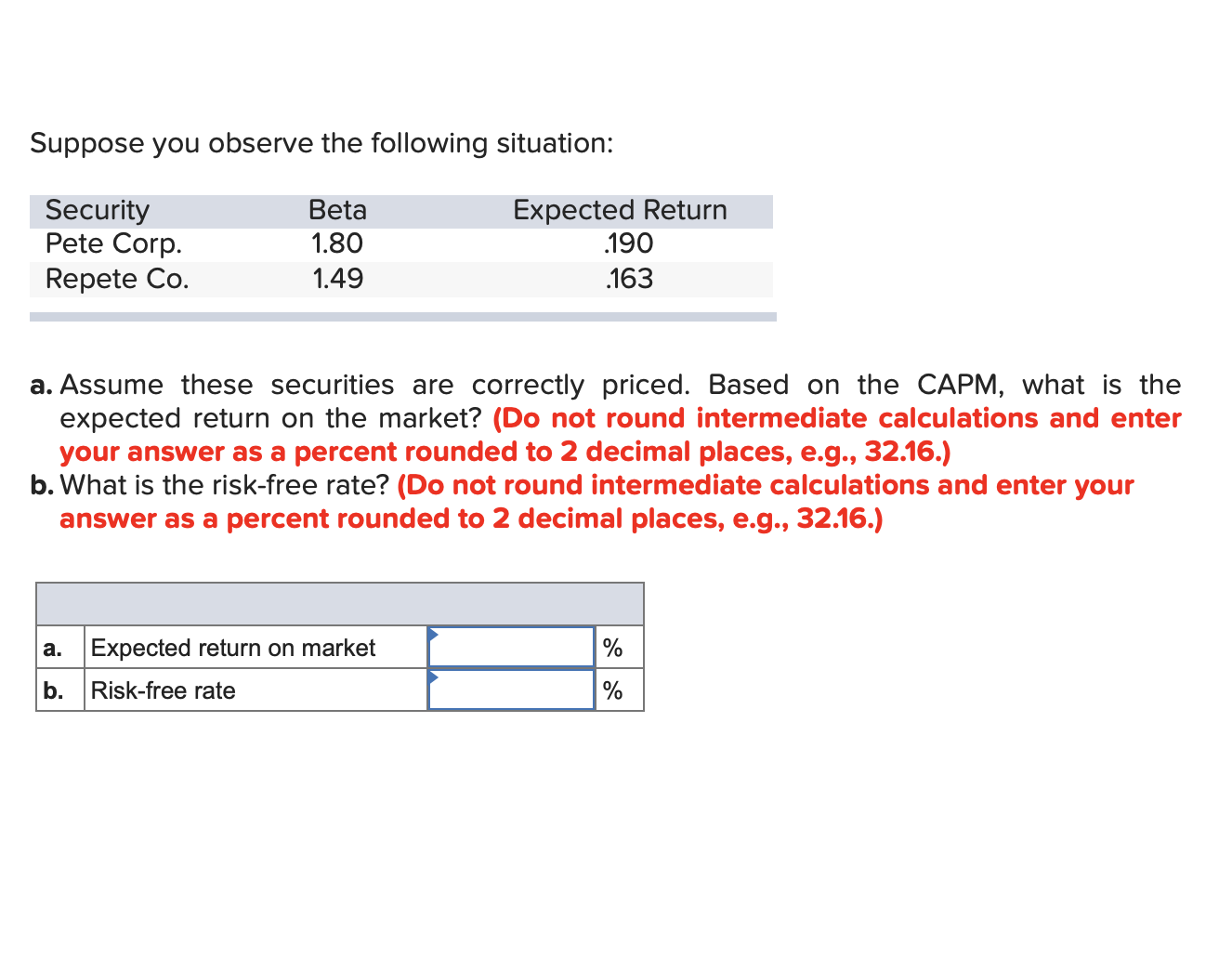

Transcribed Image Text:Suppose you observe the following situation:

Security

Pete Corp.

Expected Return

.190

Beta

1.80

Repete Co.

1.49

.163

a. Assume these securities are correctly priced. Based on the CAPM, what is the

expected return on the market? (Do not round intermediate calculations and enter

your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

b. What is the risk-free rate? (Do not round intermediate calculations and enter your

answer as a percent rounded to 2 decimal places, e.g., 32.16.)

a. Expected return on market

b.

Risk-free rate

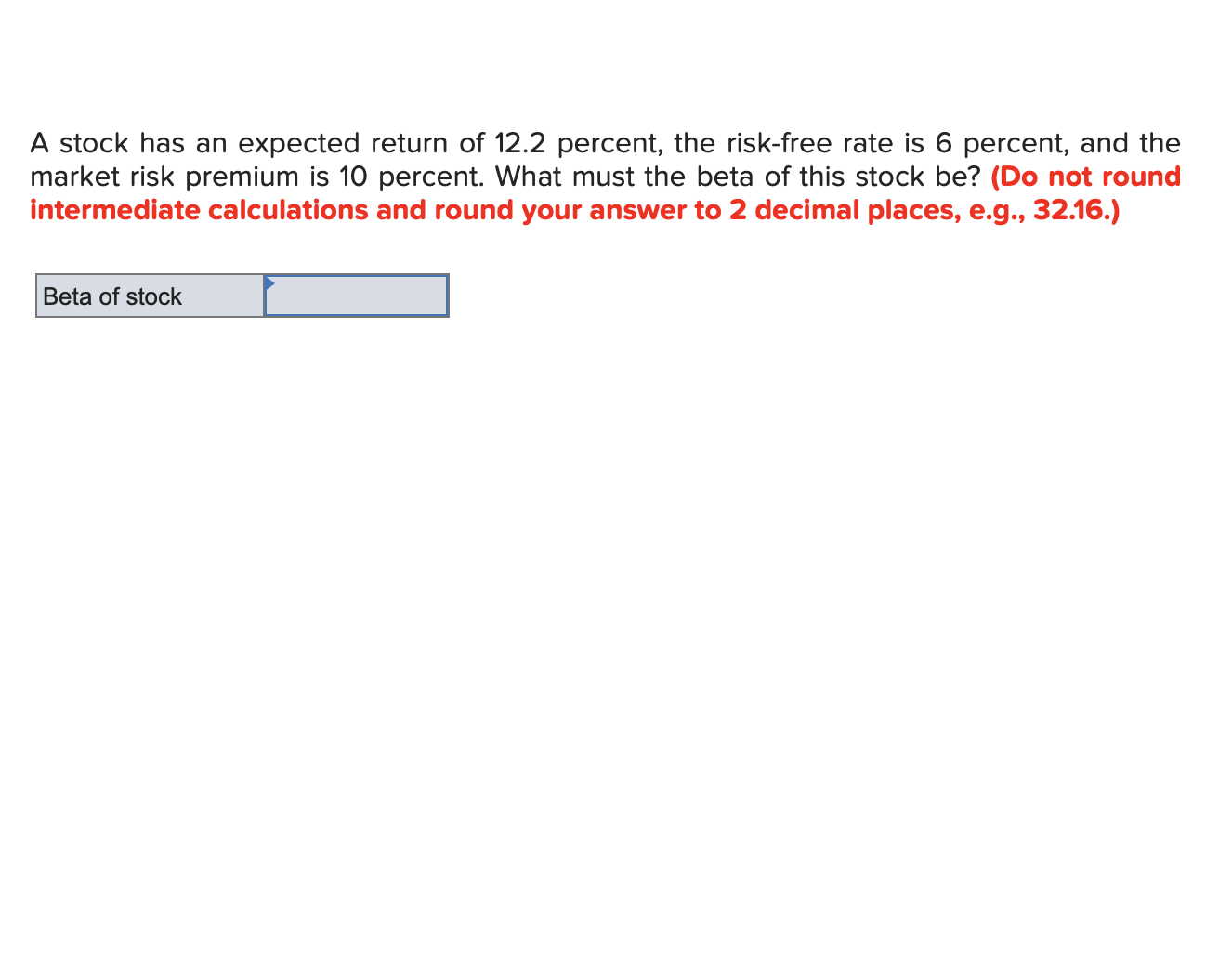

Transcribed Image Text:A stock has an expected return of 12.2 percent, the risk-free rate is 6 percent, and the

market risk premium is 10 percent. What must the beta of this stock be? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Beta of stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 5 images

Knowledge Booster

Similar questions

- Which of the following firms: ANY ال لا لا لا لا لا Fem & year Expected (BIT Firm A, business Firm A, financial Frim B, business Firm B, financial is subject to a lower EWIT Fum Risk? Expected EBIT inarrow_forwardChanging the market risk premium A. Changes neither the y-intercept nor the slope of the security market line B. Changes only the y-intercept of the security market line C. Changes only the slope of the security market line D. Changes both the y-intercept and the slope of the security market linearrow_forwardPlease answer both QUESTION 7 According to the capital asset pricing model (CAPM), fairly priced securities should have A. A non-zero alpha. в.A fair return based on the level of systematic risk. C. A fair return based on the level of unsystematic risk. D.A beta of 1. QUESTION 8 Diversification can increase fair return. True Falsearrow_forward

- Consider a capital market with two securities. The payoffs of these securities in the two equally likely states of the world are given in the table below. Payoff Price Security A в State 1 State 2 PA = 2 Pg = 3 4 2 3 4 a) Discuss the concepts of complete capital markets, pure (Arrow-Debreu) securities, and pure factor portfolios. Establish whether the capital market in this case is complete and determine the prices of the pure securities by arbitrage.arrow_forwardAssume a security follows a geometric Brownian motion with volatility parameter = 0.2. Assume the initial price of the security is 21 and the interest rate is 0. It is known that the price of a down-and-in barrier option and a down-and-out barrier option with strike price 19 and expiration 30 days have equal risk-neutral prices. Compute this common risk-neutral price.arrow_forward. Suppose interest rates are increasing enough that it can be modeled with r →∞.(a) What is the value of a Call?(b) What is the value of a Put?(c) Explain both answers in terms of finance.arrow_forward

- What does WRF = -0.50 mean? Group of answer choices The investor can borrow money at the risk-free rate. The investor can lend money at the current market rate. The investor can borrow money at the current market rate. The investor can borrow money at the prime rate of interest. The investor can lend money at the prime rate of interest.arrow_forward1. An estimation by marginal investor, a higher expected return is earned on A. more risky securities B . less risky securities C. less premium D. high premium Don't use chatgpt otherwise give 10 downvotesarrow_forwardIf we assume that investor can borrow at risk-free interest rate, then the efficient frontier is 1) AB 2) MV-B 3) Rf-T-A 4) Rf-T-B 5) Rf-T-Larrow_forward

- An estimation by marginal investor, a higher expected return is earned on A. more risky securities B. less risky securities C. less premium D. high premium (Don't use chatgpt otherwise give 10 downvotes)arrow_forward1) Please indicate whether the following statements are true or false. In case of a false statement, briefly specify why the statement is false. 1. A real asset is different from a financial asset because a real asset must take a physical form. 2. In the financial market, an investor buys financial securities from dealers at the ask price and sells financial securities to dealers at the bid price. 3. Mankowitz portfolio theory assumes average investors have a utility function as an increasing and concave function of future portfolio return. 4. According to CAPM, all well-diversified portfolios on the capital market line have the same Sharpe ratio. 5. The Markowitz portfolio theory assumes that investors hold homogenous expectations about risk and returns of financial securities.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education