FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

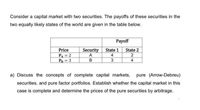

Transcribed Image Text:Consider a capital market with two securities. The payoffs of these securities in the

two equally likely states of the world are given in the table below.

Payoff

Price

Security

A

в

State 1

State 2

PA = 2

Pg = 3

4

2

3

4

a) Discuss the concepts of complete capital markets,

pure (Arrow-Debreu)

securities, and pure factor portfolios. Establish whether the capital market in this

case is complete and determine the prices of the pure securities by arbitrage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- How can fi nancial statement analysis be used to screen for potential equity investments?arrow_forward1) Financial markets may be categorized as? A). debt securities markets B). Equity securities markets C). Derivative securities markets D). Foreign exchange markets. Required : Please answer this question by choosing the correct option.arrow_forwardWhat are equity carve-outs?arrow_forward

- What are the differences between stocks and bonds in terms of predicted future payments? Which sort of investment is regarded to be riskier (stocks or bonds)? Given your knowledge, which investment (stocks or bonds) do you believe is often referred to as "fixed income"?arrow_forwardDefine Arbitrage (risk-free) portfolioarrow_forwardUsing a graph, explain when a security is overpriced, under-priced or fairly priced according to the Capital Asset Pricing Model.arrow_forward

- Identify which refers to the relationship of interest and time of maturity of securities. Group of answer choices a. Term structure of interest rates b. Phillip's Curve c. Equilibrium interest and quantity d. Equilibrium price and quantity.arrow_forwardQuestion 4 a) Explain the relationship between risk and return on Investment b) Describe the Markowitz portfolio selection model/theory and state its assumptions c) Describe the CAPITAL ASSET PRICING MODEL and state its Assumptions d) Explain the Portfolio Investment Processarrow_forwardWhich of these is defined as a combination of investment assets held by an investor? Multiple Choice bundle market basket portfolio All of these choices are correct.arrow_forward

- Highlight the relevance of portfolio theory in understanding nature of investments and effective portfolio managementarrow_forwardIn Capital Asset Pricing Model a) describe the model b) what are the assumptions in the model c) what are weakness does the model havearrow_forwardWhat are the main differences between the Capital Asset Pricing Model (CAPM) and the Arbitrage Pricing Theory (APT) model? What are each model’s underlying assumptions, strengths and weaknesses?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education