ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

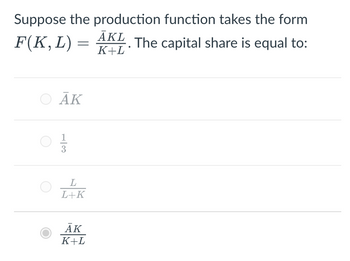

Transcribed Image Text:Suppose the production function takes the form

F(K, L) =

The capital share is equal to:

ⒸĀK

13

L

L+K

ĀK

K+L

ĀKL

K+L

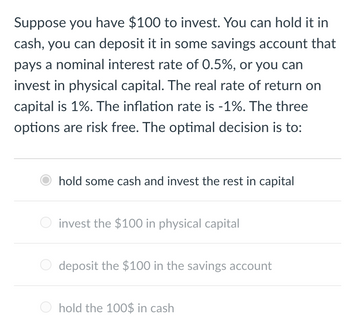

Transcribed Image Text:Suppose you have $100 to invest. You can hold it in

cash, you can deposit it in some savings account that

pays a nominal interest rate of 0.5%, or you can

invest in physical capital. The real rate of return on

capital is 1%. The inflation rate is -1%. The three

options are risk free. The optimal decision is to:

hold some cash and invest the rest in capital

invest the $100 in physical capital

deposit the $100 in the savings account

hold the 100$ in cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The inflation over four consecutive quarter is fl=1%,f2=0.5%, fs-0.5%, f-196. what is the inflation for the entire year?arrow_forwardif inflation is running at 8% and you want to negotiate a 2% raise in your salary, how large a raise should you ask for? 2% 6% 8% 10%arrow_forwardYogajothi is thinking of investing in a rental house. The total cost to purchase the house, including legal fees and taxes, is $240,000. All but $30,000 of this amount will be mortgaged. He will pay $1700 per month in mortgage payments. At the end of two years, he will sell the house and at that time expects to clear $50,000 after paying off the remaining mortgage principal (in other words, he will pay off all his debts for the house and still have $50,000 left). Rents will earn him $2500 per month for the first year and $2900 per month for the second year. The house is in fairly good condition now, so he doesn't expect to have any maintenance costs for the first six months. For the seventh month, Yogajothi has budgeted $500. This figure will be increased by $50 per month thereafter (e.g., the expected month 7 expense will be $500, month 8, $550, month 9, $600, etc.). If interest is 6 percent compounded monthly, what is the present worth of this investment? Given that Yogajothi's…arrow_forward

- The average inflation rate is calculated on the basis of the CPI for all the items in the market basket. True or false?arrow_forwardThere is a persistent fear that there will be a high level of deflation. Many economists warn that it may be worse for the economy than if there is high inflation. Suppose that Herb is in debt and has to pay a 5.255.25% nominal interest rate. He expected inflation to be 1.501.50%. Instead, inflation is −2.00−2.00% (deflation). What is the real interest rate that Herb is expected to pay and that Herb is actually paying?arrow_forwardM6arrow_forward

- If the price index in 2017 is 132 and the price index in 2018 is 114, the rate of inflation between 2017 and 2018 is -5.8% 15.8% 6.4% -13.6%arrow_forwardAnswer A is incorrect. Please help mearrow_forwardKaren loaned Jerre $25,000 at 12% interest compounded annually. Jerre will repay the loan in 6 equal end-of-year payments. The estimated inflation rate during this period is 3%. After taking the estimated inflation rate into account, what approximate rate of return is Karen really receiving on the loan? Group of answer choices 5.46% 7.65% 8.74% 9.00%arrow_forward

- The lower the interest rate: the greater the level of inflation the smaller the present value of a future amount the greater the present value of a future amount None of the statements associated with this question are correct.arrow_forwardIf the consumer price index (CPI) says that inflation equaled 10% last year, then the chained CPI for urban consumers is likely to say that inflation equaled 9.7% last year. a) True b) Falsearrow_forwardMichelle has won a prize that will pay her $1000 per year, starting one year from today,for 15 years. Inflation is expected to be 3% per year for the next 15 years, and her interest rate is 5% per year. What is the present value of this prize today? (Treat the 3% inflation as a negative 8, thus g = -3%, and i is 5%)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education