ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

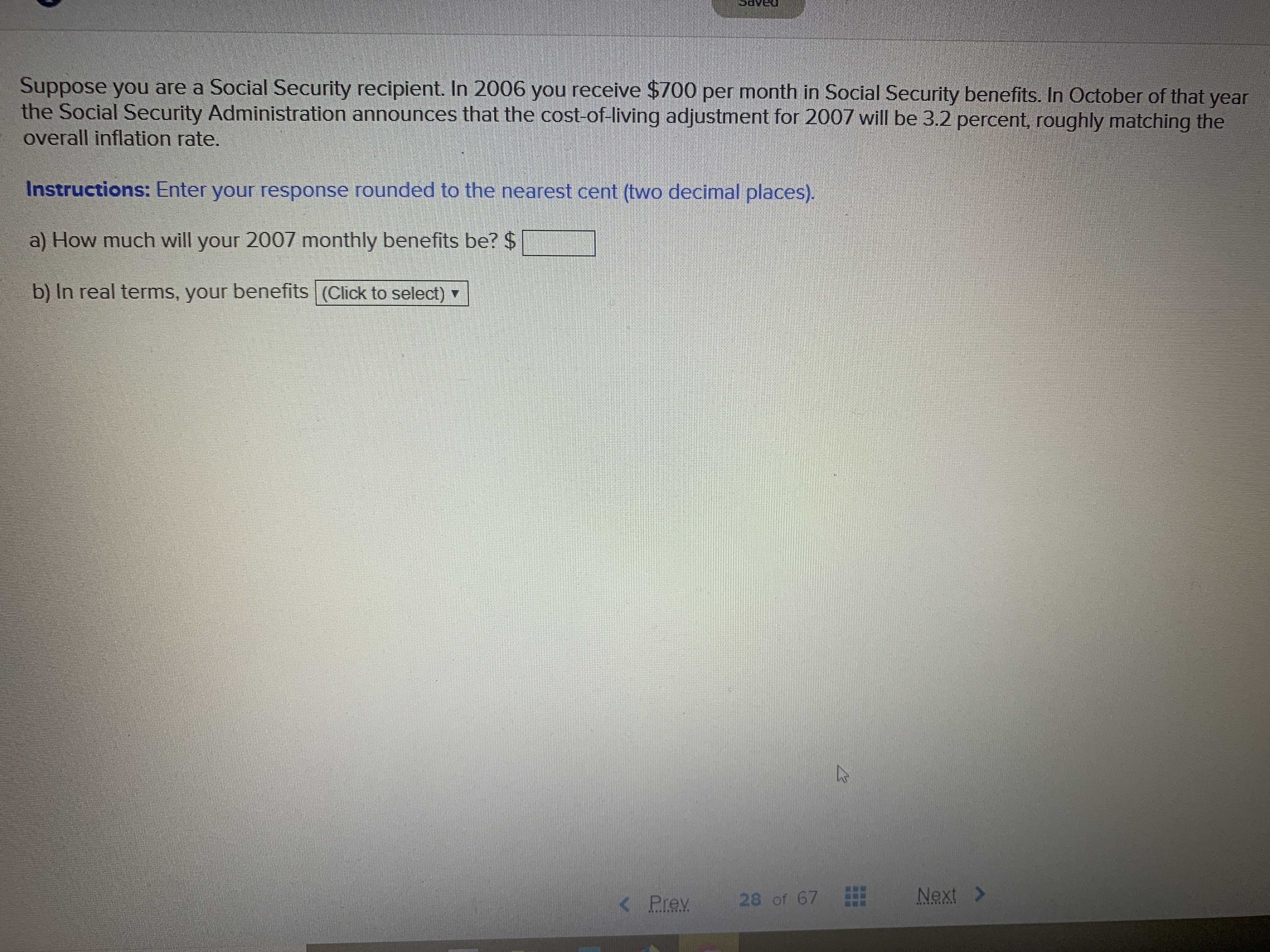

Transcribed Image Text:Suppose you are a Social Security recipient. In 2006 you receive $700 per month in Social Security benefits. In October of that year

the Social Security Administration announces that the cost-of-living adjustment for 2007 will be 3.2 percent, roughly matching the

overall inflation rate.

Instructions: Enter your response rounded to the nearest cent (two decimal places).

a) How much will your 2007 monthly benefits be? $

b) In real terms, your benefits (Click to select) v

Next

28 of 67

<Prev

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prices for fresh fruit went up 9% last year and 3% this year. What is the average inflation rate percentage for fresh fruit over the 2-year period? Enter your answer as a percentage rounded to the nearest tenth of a percent.arrow_forwarda nation has had higher inflation recently. Last year, a basket of goods cost 360 but this year that same basked cost 396. suppose the nation's institutions succeeded in getting inflation down 2%. what would the basket of goods cost next year? (the answer should be 367.2, but I dont know how to get there)arrow_forwardAutomobile insurance policies (contracts) typically are issued every 6 months. Consider an actual case during the tail part of 2018 where a policy was worth approximately $649. In March of 2019 the issued policy is projected to be approximately $700. Note that these costs are somewhat high. What is the rate of inflation in these policies over this time period? 2. Los Angeles, CA and Atlanta, GA (ATL baby!!!) are two of the most well-known cities in the U.S. These cities are also very large (with LA being the larger of the two). Given that the number of people in the labor force was 6,827,958 (LA) and 3,097,603 (ATL), and the number of people out of work for Atlanta was 110, 713 and for LA was 285,764, what was the rates of unemployment for these two cities for December 2018? 3. Here are some data for numbers of people in the labor force for some cities in the U.S.: Columbia, SC (400,750); Jacksonville, FL (775,809); Charlotte, NC (1,343,634), and Charleston, SC (379,429). What…arrow_forward

- Use the information in the table to calculate the %change in prices (inflation rate), using a chain-weighted methodology. Q1=2 Q2=3 Year (t) P1 E1 P2 E2 E(t) 2017 $1.05 $2.00 2018 $1.10 $2.10 2019 $1.10 $2.15 2020 $1.15 $2.15 Price Index Inflation Rate 2017 2018 2019 2020 Question 1: What is the inflation rate for 2019? a) 1.76% b) 1.16% c) -0.60% d) -3.02arrow_forwardSuppose the economy’s nominal GDP constantly grows at 9%, and real GDP constantly grows at 4%What is the inflation rate? How long does it take for an item that costs $1 today to cost $4?arrow_forward4) When the minimum wage was first enacted in the United States in 1938, it was a whopping $0.25 per hour. Since then, we have averagęd 3.65% annual inflation. What is the value of the $0.25 in today's dollars? :arrow_forward

- Suppose you are about to borrow $16,000 for four years to buy a new car. Which of these situations would be preferred? OA. The interest rate on the loan is 15%, and the annual inflation rate over the next four years is expected to average 5%. OB. The interest rate on the loan is 9%, and the annual inflation rate over the next four years is expected to average 3%.arrow_forwardGiven the information in the table, what was the inflation rate in 2034 (expressed as a %)? Round to one decimal place and do not enter the % sign. If your answer is 6.14%, enter 6.1. If your answer is 6.15%, enter 6.2. If appropriate, remember to enter the - sign. 2 Year 2031 2032 2033 2034 2035 2036 CPI 90 94 100 102 109 125arrow_forwardif inflation is running at 8% and you want to negotiate a 2% raise in your salary, how large a raise should you ask for? 2% 6% 8% 10%arrow_forward

- Suppose, you are planning to put away $20,000 of your savings for one year. You have the following options: 1.) Buy an indexed savings bond that earns 6.50% interest rate for the next year or, 2.) Buy a non-indexed savings bond that earns 11.00% interest rate for the next year. The inflation rate for the next year is expected to be 4.50%. Which option will you choose for the next year? OA. The non-indexed bond should be chosen as it pays a higher rate of interest. OB. The rate of inflation should not play a role in making this decision. OC. It does not matter whether the indexed or the non-indexed bonds are chosen, since they pay the same real rate of interest. D. The indexed bond option should be chosen as it protects from inflation.arrow_forwardIf inflation rate is 1% and nominal interest rate is 2.1% What will be the real interest ratearrow_forward3. An economist has predicted that for the next 5 years, the U.S. will have a 2.5% annual inflation rate, followed by 5 years at a 3.5% inflation rate. This is equivalent to what average price change per year for the entire 10-year period?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education