Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

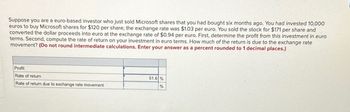

Transcribed Image Text:Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months ago. You had invested 10,000

euros to buy Microsoft shares for $120 per share; the exchange rate was $1.03 per euro. You sold the stock for $171 per share and

converted the dollar proceeds into euro at the exchange rate of $0.94 per euro. First, determine the profit from this investment in euro

terms. Second, compute the rate of return on your investment in euro terms. How much of the return is due to the exchange rate

movement? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal places.)

Profit

Rate of return

51.6 %

Rate of return due to exchange rate movement

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- After a 1 year investment you receive 7.4% interest (nominal) from your bank. However, looking at how prices have changed, you soon realize that the real rate of interest was actually 3.4%. How much was inflation during that year? Enter your answer as a percentage, rounded to 2 decimals, and without the percentage sign ('%'). For example, if your answer is 0.02345, then enter 2.35arrow_forwardYou run a construction firm. You have just won a contract to build a government office complex. Building it will require an investment of $9.5 million today and $5.5 million in one year. The government will pay you $21.7 million in one year upon the building's completion. Suppose the interest rate is 10.3%. a. What is the NPV of this opportunity? b. How can your firm turn this NPV into cash today? www. a. What is the NPV of this opportunity? The NPV of the proposal is $ million. (Round to two decimal places.) b. How can your firm turn this NPV into cash today? (Select the best choice below.) O A. The firm can borrow $19.67 million today and pay it back with 10.3% interest using the $21.7 million it will receive from the government. B. The firm can borrow $15.0 million today and pay it back with 10.3% interest using the $21.7 million it will receive from the government. O C. The firm can borrow $15.0 million today and pay it back with 10.3% interest using the $19.67 million it will…arrow_forwardWhen you logged on to your brokerage account this morning, you saw that the Brazil Real is trading at 50.2970. Gold is trading at $200 per ounce. You have $10,000 to invest, and you think you might be able to make arbitrage profits in the gold market. How many Reals could you buy at the posted price? How much gold could you buy at the dollar price in the gold market? What would the gold be worth if the Real price is 750 BRL per ounce? If the Real price for gold is 750 BRL per ounce, how would you make arbitrage profits? How much would you make with your $10,000 investment?arrow_forward

- Given are three FOREX quotes as follows: $1/€ $0.5/SF SF2.5 / € What will be arbitrage profit if you start the process with €1,000?arrow_forwardSuppose an investor is interested in purchasing the following income producing property at a current market price of $ 1,490,000. The prospective buyer has estimated the expected cash flows over the next five years to be as follows: Year 1 = $88,000, Year 2 = $90,662, Year 3 = $91,923, Year 4 = $95,778, Year 5 = $97,000. Assuming that the required rate of return is 15% and the estimated proceeds from selling the property at the end of year five is $1,860,000, what is the NPV of the project? What is the IRR of the project?arrow_forwardYou invested $2,500 in Awesome Software, Inc. The company did well that year, and you received a check for $300. What was your rate of rate of return on this investment?arrow_forward

- Suppose that you have the following utility function: U=E(r) – ½ Aσ2 and A=3 Suppose that you have $10 million to invest for one year and you want to invest that money into ETFs tracking the S&P 500 (US) and S&P/TSX 60 (Canada) index, which are often used as proxies for the US and Canadian stock markets, respectively, and the Canadian one-year T-bill. Assume that the interest rate of the one-year T-bill is 0.35% per annum. You have found two ETFs that you are interested in. From a set of their historical data between 2001 and 2019, you have estimated the annual expected returns, standard deviations, and covariance as follows: ETFUS : E(r)= 0.070584 0.173687 ETFCDA : E(r)= 0.073763 0.16816 Covariance between ETFUS and ETFCDA = 0.02397 Answer the following questions using Excel: What is the optimal portfolio of ETFUS and ETFCDA? Also submit an Excel file to show your work.arrow_forwardSuppose the quotes for currencies in the three money centers are given as follows: At London center: 1GBP = 150 JPY At Tokyo center: 1USD = 115 JPY At New York center: 1USD = 0.86GBP An investor has 100,000 USD. Is there any opportunity for arbitrage? If yes, explain how does the investor use arbitrage to take advantage of these data? And how much could he or she earn from this?arrow_forwardAn employee at Azai Bank seeks to evaluate a transaction using the risk-adjusted return on capital (RAROC) model. The transaction entails extending a loan to an agro-based entity with the following details:- The risk-free rate of return is 7%- Loss given default (LGD) = 51%- Exposure at default (EAD) = ZMW 2.5 million- Probability of default (PD) = 40 basis points The bank's economic capital (EC) model assesses an EC charge for the firm, equivalent to 5% of EAD, amounting to ZMW 100,000. Assuming a RAROC hurdle rate of 15%, the transaction yields a net profit of ZMW 14,000 before other adjustments. Tasks:A. Calculate the bank’s risk-adjusted rate of return on the loan to the agricultural company. B. Additionally, consider the scenario where the bank could have extended a loan of the same amount, generating an identical net profit of ZMW 14,000 before adjustments to a pharmaceutical products manufacturing firm, with an EC of 2.5%. C. Determine which loan the bank should prioritize…arrow_forward

- A property investor purchased a retail property in London with a market value of £250.0 million. The property is multi-tenanted. The purchase is financed with a £170.0 million “5-year loan” with an annual debt service due of £9.0 million that includes a £3.4 million annual amortisation. The net average annual cash flow of the investor is £14.85 million. You are a rating analyst and being asked to estimate the following: a) Estimate the Debt Service Coverage Ratio (DSCR).b) Based on your estimate of the DSCR and a diversity score of 5: i) Estimate the Tenant’s Contribution (TC) to the DSCR. ii) What is the Term default risk rating equivalent? c) As a rating analyst, you haircut the market value of the property by 10.0%. Based on this haircut: i) Estimate the Haircut property value and Haircut Loan-to-Value (LTV) ratio.ii) Estimate the Refinancing Haircut LTV ratio. Table 1 provides the mapping of different DSCRs to the Term default risk rating equivalent. Refer to the image…arrow_forward2. Assume that you went to your bank to buy ¥10 million. The bank quoted that you can buy ¥120 for $1. Based on this information, answer the following questions: (15 Points) a. Is this a direct quote or an indirect quote? b. If it is a direct quote, what is the indirect quote or if it is an indirect quote what is the direct quote? C. How much dollar you need to buy ¥10 million? U Direct 1/120 =.0083 # B1 = 1/120 C,33,333.33arrow_forwardPlease no written by hand solution Suppose you observe the following rates in a market. $0.80 = 1.0 euros $1.50 = 1.00 pounds 0.55 pound = 1.00 euro If you have $1 million, you will get arbitrage profits by buying a currency with $1 million, then buying another currency with the currency you bought, and lastly buying dollars with the currency you bought. The arbitrage profit with the operation will be ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education