A property investor purchased a retail property in London with a market value of £250.0 million. The property is multi-tenanted. The purchase is financed with a £170.0 million “5-year loan” with an annual debt service due of £9.0 million that includes a £3.4 million annual amortisation. The net average annual cash flow of the investor is £14.85 million.

You are a rating analyst and being asked to estimate the following:

a) Estimate the Debt Service Coverage Ratio (DSCR).

b) Based on your estimate of the DSCR and a diversity score of 5:

i) Estimate the Tenant’s Contribution (TC) to the DSCR.

ii) What is the Term default risk rating equivalent?

c) As a rating analyst, you haircut the market value of the property by 10.0%. Based on this haircut:

i) Estimate the Haircut property value and Haircut Loan-to-Value (LTV) ratio.

ii) Estimate the Refinancing Haircut LTV ratio.

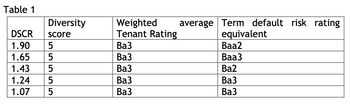

Table 1 provides the mapping of different DSCRs to the Term default risk rating equivalent.

Refer to the image attached below for Table 1

Step by stepSolved in 3 steps

- You are thinking about investing $4,692 in your friend's landscaping business. Even though you know the investment is risky and you can't be sure, you expect your investment to be worth $5,738 next year. You notice that the rate for one-year Treasury bills is 1%. However, you feel that other investments of equal risk to your friend's landscape business offer an expected return of 8% for the year. What should you do?.arrow_forwardAn investor is looking for a loan for an investment property that he has found. He can afford a monthly payment of $1,475. The interest rated quoted to him was 7.25%. He built the following table from that information. A $74,049 $125,638 $161,580 t 5 10 15 a) A(5) = b) If the investment property cost $161,580, how many years must the investor make monthly payments? t 20 25 30 A $186,620 $204,066 $216,220arrow_forwardWhat is the internal rate of return for this rental condominium investment?arrow_forward

- Jolly Banker is calculating the loan price for a $500,000 operating loan to Kelly business. If approved, this loan will be funded with 35% equity capital, and the remaining funds will come from the bank's debt capital. You have the following information about your bank’s outlays: Administrative costs 0.45% Cost of debt 7.00% Cost of equity 5.00% Probability of loss 0.55% Fees paid by the borrower 1.00% Calculate the weighted average cost of debt for this funding request. (Enter your answer in percentage. Round your answer to 2 decimal places)arrow_forwardYou have been asked to estimate the market value of an income-producing property. The table below provides 5 years of projected cash flows for the property. Use the discounted cash flow approach to income valuation to calculate the market value. Assume that you sell the property at the end of year 5 and that the net proceeds from the sale are $5 million. Also assume that the discount rate is 10%. PGI EGI NOI Year 1 $4.18 million $750,000 $780,000 $811,200 $637,500 $663,000 $689,520 $318,750 $331,500 $344,760 $6.11 million $4.12 million Year 2 $4.40 million Year 3 Year 4 $843,648 $717,101 $358,550 Year 5 $877,394 $745,785 $372,892arrow_forwardYou own a one-year European call option to buy one acre of Los Angeles real estate. The exercise price is $2.03 million. Suppose the land is occupied by a warehouse generating rents of $165,000 after real estate taxes and all other out-of-pocket costs. The present value of the land plus the warehouse is $1.73 million. The annual standard deviation is 18% and the interest rate is 11%.How much is your call worth? (Enter your answer in dollars not in millions. Do not round intermediate calculations.)arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education