ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

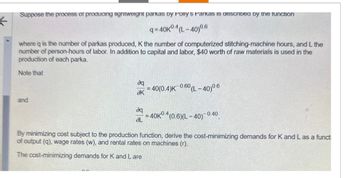

Transcribed Image Text:Suppose the process of producing lightweight parkas by Polly's Parkas is described by the function

q=40K04(L-40)0.6

where q is the number of parkas produced, K the number of computerized stitching-machine hours, and L the

number of person-hours of labor. In addition to capital and labor, $40 worth of raw materials is used in the

production of each parka.

Note that

and

да

ак

=40(0.4)K 0.60 (L-40)0.6

да

=40K04 (0.6)(L-40) 0.4

-0.40

aL

By minimizing cost subject to the production function, derive the cost-minimizing demands for K and L as a functi

of output (q), wage rates (w), and rental rates on machines (r).

The cost-minimizing demands for K and Lare

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- For the Cobb-Douglas production function P and isocost line (budget constraint, in dollars), find the amounts of labor L and capital K that maximize production, and also find the maximum production. Then evaluate and give an interpretation for |å| and use it to answer the question. (a) Maximize P = 2000L3/5K2/5 with budget constraint 15L + 32OK = 8000. L = K = P = (b) Evaluate and give an interpretation for |21. Each additional dollar of budget increases production by this amount. (c) Approximate the increase in production if the budget is increased by $80. unitsarrow_forwardShow using math and logic that for constant returns to scale production functions, MRTS between labor and capital depends only on the K/L ratio, and not the scale of production.arrow_forwardcomplete the tablearrow_forward

- Kris wants to open a BBQ restaraunt. He has signed a 12- month lease at $6,000 per month. The lease enabled him to rent a restaraunt with all the equipment he needs to make BBQ; therefore, K equals 1. Kris must pay his workers a monthly salary of $2,400 each. His production function is q = 100L1/2K1/2 where q is the quantity of BBQ prepared per month in pounds, L is the number of workers employed per month, and K is the quantity of capital employed, and, as previously indicated, K is assumed to equal 1. What does Kris's monthly total cost expressed as a function of quantity equal?arrow_forwardQuestion 37 [ DIFFICULT] Consider two firms, both producing the same product, using the same production technology given by: q = √√K This production technology implies the following MRTS: K MRTS=AY ΔΧ L where K is the amount of capital used and L is the amount of labour used to produce output. It can be shown that this production technology implies the following minimised total cost function: TC = 2q√w√r where w represents the per-unit cost of labour and r represents the per-unit cost of capital. Suppose each firm can hire labour at $1 per unit and capital at $9 per unit. Each firm produces 90 units of output. One firm (Firm 1) chooses its input combination to minimise costs of production. However, Firm 2 instead produces output using twice as much labour as Firm 1. Compared to Firm 1, how much higher are Firm 2's cost of production? a) $270 b) $67.50 c) $275 d) $135 e) $132 Hint: It can be shown that the cost-minimising quantities of capital and labour (chosen by Firm 1) are K = 30…arrow_forwardplease show graphs and table thank youarrow_forward

- Suppose the production function for widgets is given by: Q = f (K, L) = 2 ∗ KL − K2/2 − L2/2 (a) Suppose L=5 (is fixed), derive an expression for and graph the total product of capital curve (the production function for a fixed level of labor) and the average productivity of capital curve. (b) At what level of capital input does the average productivity reach a maximum? How many widgets are produced at this point? (c) Again, assuming L=5, derive an expression for and graph the MPK curve. At what level of capital input does MPK =0? (d) Does this production function exhibit constant, increasing or decreasing returns to scale?arrow_forwardSuppose that Flamerock Tires must decide where to produce one million tires: the US, where wages are 30 and the cost of capital is 5; or China, where wages are 5 and the cost of capital is 25. Production in each location follows the same technology (production function) given by: Q = f(L, K) = L^0.25 K^0.75 Computationally solve the cost - minimizing input levels in each location to produce the goal of 1 million tiresarrow_forwardSeton is interested in reducing costs while maintaining quality and patient satisfaction. You have been hired by the Seton Hospital System to improve efficiency. In particular, Seton believes that it is not efficiently combining physician labor hours (L) and physical capital units (K) in producing stent surgeries. Assume that we know that the production function is Q = KL. Assume that the price of L is $1/hr and the price of K is $4 per unit. a. How might Seton use more capital and less labor to install the same stent? What does that real-life tradeoff look like? b. We are going to find the cost minimizing way of producing 100 stent surgeries at Seton. Begin by drawing yourself a picture of how you will solve this problem. Place K on the vertical axis and L on the horizontal axis. c. Write the budget constraint and find the equation of the slope of this line (dk/dL)arrow_forward

- A software firm has only two inputs to production: domestic programmers based in the firm's U.K. office and international programmers working from home in low-cost countries. The two types of programmers are perfect substitutes but domestic programmers are more productive due to better communication in the office. The production function is: S=2D + I Where S is the amount of software written, D is the number of domestic programmers and I is the number of international programmers. Programmers can work part-time, so hiring 0.3 of a programmer would be possible. (a) The firm must produce 10 pieces of software this year. Show the firm's isoquant in a suitably labelled graph. Put "domestic programmers" on the vertical axis and "international programmers" on the horizontal axis. Label each axis from 0 to 10. (b) A domestic programmer can be hired for £100,000 per year. An international programmer can be hired for £60,000 per year. On the same graph, show the different combinations of…arrow_forwardConsider the following production function for shirts: q = v6 L3/4K/4, where L is worker-hours, and K is sewing machine-hours. a. Compute the marginal products of labor and capital, the average product of labor, and the marginal rate of technical substitution of labor for capital (i.e. how many units of capital are needed to make up for the loss of one unit of labor)? b. Are there diminishing returns to labor (that is, does the marginal product of labor decrease when labor L increases)? What about to capital? Is there diminishing marginal rate of technical substitution (MRTS)? с.arrow_forwardThe quantity, Q, of a certain product manufactured depends on the quantity of labor, L, and of capital, K, used according to the function 0 = 900LK¹³. Labor costs $100 per unit and capital costs $50 per unit. What combination of labor and capital should be used to produce 36,000 units of the goods at minimum cost? What is that minimum cost? Round your answers to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education