ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Need help on q1

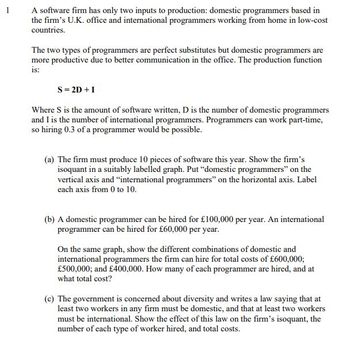

Transcribed Image Text:A software firm has only two inputs to production: domestic programmers based in

the firm's U.K. office and international programmers working from home in low-cost

countries.

The two types of programmers are perfect substitutes but domestic programmers are

more productive due to better communication in the office. The production function

is:

S = 2D + I

Where S is the amount of software written, D is the number of domestic programmers

and I is the number of international programmers. Programmers can work part-time,

so hiring 0.3 of a programmer would be possible.

(a) The firm must produce 10 pieces of software this year. Show the firm's

isoquant in a suitably labelled graph. Put "domestic programmers" on the

vertical axis and "international programmers" on the horizontal axis. Label

each axis from 0 to 10.

(b) A domestic programmer can be hired for £100,000 per year. An international

programmer can be hired for £60,000 per year.

On the same graph, show the different combinations of domestic and

international programmers the firm can hire for total costs of £600,000;

£500,000; and £400,000. How many of each programmer are hired, and at

what total cost?

(c) The government is concerned about diversity and writes a law saying that at

least two workers in any firm must be domestic, and that at least two workers

must be international. Show the effect of this law on the firm's isoquant, the

number of each type of worker hired, and total costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Write the Summary of Compound-Interest Formulas?arrow_forwardYou have $10,000 to invest. Your bank offers the following 10 year CD's. Account 1 offers 6.85% simple interest. Account 2 offers 6.57% compounded annually. a. How much money will you have at the end of 10 years if Account 1 is chosen? s b. How much money will you have at the end of 10 years if Account 2 is chosen?S Account is the better choice.arrow_forwardTyrone wants to spend $15,000 on a new car three years from now. He opens a savings account and deposits $3,000 today. One year from now, he plans to deposit $3,000 in the account, and one year after that, he plans to deposit another $3,000. If the account earns 5% interest per year, how much additional money will Tyrone need three years from now to meet his $15,000 goal? [Enter your answer with no dollar sign or comma.].arrow_forward

- Chelsea has to pay a series of uniform annual payments over a fixed period of time to repay a loan that would amount to $1,000,000. If Chelsea has to pay $30,000 per year for a rate of 6%, how long should she pay these uniform payments in order to repay her loan? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardto be valid, a trust must have a trustor, a trustee, at least one beneficiary, and a lawful trust purpose, True or False?arrow_forwardWhat equation can determine whether a cryptocurrency is significantly overvalued?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education