ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Macmillan Learning

.

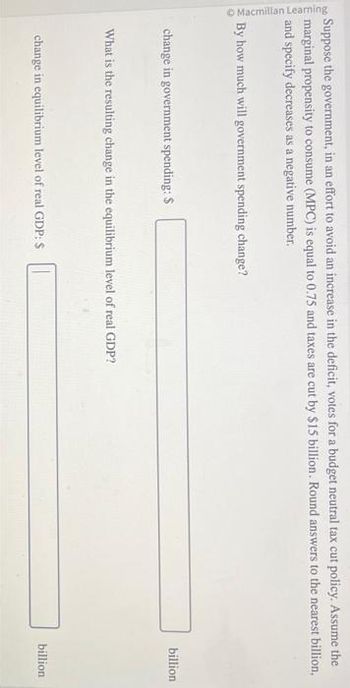

Suppose the government, in an effort to avoid an increase in the deficit, votes for a budget neutral tax cut policy. Assume the

marginal propensity to consume (MPC) is equal to 0.75 and taxes are cut by $15 billion. Round answers to the nearest billion,

and specify decreases as a negative number.

By how much will government spending change?

change in government spending: S

What is the resulting change in the equilibrium level of real GDP?

change in equilibrium level of real GDP: $

billion

billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The partial data in the table below are for the economy of Arinaka. Planned investment, government spending, and all taxes are autonomous. You may assume that the MPC, MPS, and MPM are constant. a. Fill in the blanks in table below. Y $800 850 900 950 T $120 120 120 120 YD 680 775 870 965 C $640 730 820 910 S $40 45 50 55 I $100 100 100 100 G $90 b. The value of equilibrium income is $ c. If planned investment decreases by $20, the new value of equilibrium income is $ 90 90 90 XN $10 -5 AE Unplanned Investmentarrow_forwardWhat is fiscal imbalance? Fiscal imbalance is the _______ value of the government's commitments to pay benefits minus the _______ value of its tax revenues. A. future; future B. future; present C. present; future D. present; presentarrow_forwardSuppose that real GDP is currently $1.45 trillion, potential GDP is $1.51 trillion, the government purchases multiplier is 2.4, and the tax multiplier is 2. a. Holding other factors constant, government purchases will need to be increased by $ 0.0250 trillion to bring the economy to equilibrium at potential GDP. (Round to four decimal places as needed.) b. Holding other factors constant, taxes have to be cut by $ 0.0300 trillion to bring the economy to equilibrium at potential GDP. (Round to four decimal places as needed.) c. Construct an example of a combination of increased government spending and tax cuts that will bring the economy to equilibrium at potential GDP. The combination of increasing government spending by $0.0600 trillion and cutting taxes by $ trillion will bring the economy to equilibrium at potential GDP (Round to four decimal places as needed.) $0.0600 trillion $0.1440 trillion $0.1200 trillion $0.0100 trillionarrow_forward

- Suppose there are both multiplier and crowding out effects but without any accelerator effects. An increase in government expenditures would a. always shift aggregate demand right by a smaller amount than the increase in government expenditures. b. always shift aggregate demand right by a larger amount than the increase in government expenditures. c. shift aggregate demand right by a larger, equal, or smaller amount than the increase in government expenditures. d. always shift aggregate demand right by the same amount as the increase in government expenditures.arrow_forwardAnswer exercises 11-14 on the basis of the following information. Assume that equilibrium real GDP is $800 billion, potential real GDP is $950 billion, the MPC is .80, and the MPI is .40.arrow_forwardInstructions: Round your responses to two decimal places. If taxes were cut by $1 trillion and the MPC was 0.88, by how much would total spending trillion a. increase in the first year with two spending cycles per year?arrow_forward

- 3. The Government of Wonderland decides to adopt an expansionary fiscal policy increasing its expenditure (G) by $500 billion. They know that the value of MPC is 0.6. By how much should the economy be expected to expand? Answer Here: Gxmpc=$100X0.6 200 Will Crowding Out affect the final outcome of this move? Explain your answer Answer Here:arrow_forwardAttempts 10. Crowding out effect Keep the Highest/2 Suppose economists observe that an increase in government spending of $13 billion raises the total demand for goods and servic If these economists ignore the possibility of crowding out, they would estimate the marginal propensity to consume (MPC) to be Now suppose the economists allow for crowding out. Their new estimate of the MPC would be than their initial one. Grade It Now 3/4 1/4 4 52 billion. Save & Continuearrow_forwardConsider an economy with the following situation: C = 50 +0.8 Yd I=100;T= 100 G =150 a. To eliminate the gap, the government decides to change its expenditure G. By how much should G change? Show that income AE or Ye is now 900 after the change in G. b. If the government decides to adopt balanced budget spending, by how much G and T will change to reach full employment output or income?arrow_forward

- in another economy, the MPC = 4/5, government needs to increase expenditures $20 to complete a project, but it does not want to increase debt so it increases taxes $20 also. What, if any, will be the change in output generated by this balanced - budget expenditure scenario?arrow_forwardA fiscal stimulus was initiated by President Obama in response to the economic downturn of 2008-2009. At that time, the president's economists estimated the multiplier to be a. 2.4 for government purchases and 1.4 for tax cuts. b. 3.2 for government purchases and 2.0 for tax cuts. c. 1.6 for government purchases and 0.4 for tax cuts. d. 1.6 for government purchases and 1.0 for tax cuts.arrow_forwardThe government lowers $0.9 trillion in taxes, restoring GDP from $10 trillion to its potential level of $11.2 trillion. What is the value of the tax multiplier? A -1.33 B -0.9 C -0.75 D -1 E -1.2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education