Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

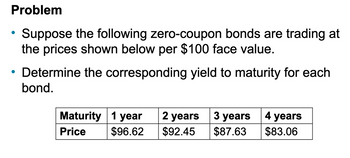

Transcribed Image Text:Problem

Suppose the following zero-coupon bonds are trading at

the prices shown below per $100 face value.

●

●

Determine the corresponding yield to maturity for each

bond.

Maturity 1 year 2 years 3 years 4 years

Price

$96.62

$92.45

$87.63

$83.06

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You observe the following yield curve for Treasury securities: Maturity Yield 1 Year 4.80% 2 Years 6.00% 3 Years 6.70% 4 Years 7.20% 5 Years 7.90% Assume that the pure expectations hypothesis holds. What does the market expect will be the yield on 4-year securities, 1 year from today? O 8.68% O 8.18% 6.68% 7.68% O 7.18%arrow_forward4.arrow_forwardO ook int ences You find the following Treasury bond quotes. To calculate the number of years until maturity, assu of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.052 6.143 Maturity Month/Year May 33 May 36 May 42 Yield to maturity Asked Bid 103.4560 103.5288 104.4900 104.6357 ?? Change Ask Yield +.3248 5.00 % +.4245 +.5353 In the above table, find the Treasury bond that matures in May 2036. What is your yield to matur Note: Do not round intermediate calculations and enter your answer as a percent rounded to 5.919 ?? 3.951arrow_forward

- Suppose a 4-year, 3% annual coupon payment bond has the following sequence of spot rates: Time to maturity Spot rates 1 year 0.39% 2 years 1.40% 3 years 2.50% 4 years 3.60% Assume a par value of $100. What is the yield to maturity for this bond? A. 4.52% B. 3.52% C. 5.12% D. 6.12%arrow_forwardThe yield curve for default-free zero-coupon bonds is currently as follows: Maturity (years) YTM 1 9.8% 2 10.8 3 11.8 Required: a. What are the implied one-year forward rates? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Maturity (years) YTM Forward rate 1 9.8% 2 3 10.8% 11.8% % % b. Assume that the pure expectations hypothesis of the term structure is correct. If market expectations are accurate, what will the pure yield curve (that is, the yields to maturity on one- and two-year zero-coupon bonds) be next year? O There will be a shift upwards in next year's curve. O There will be a shift downwards in next year's curve. O There will be no change in next year's curve. c. What will be the yield to maturity on two-year zeros? (Do not round intermediate calculations. Round your answers to 2 decimal places.) YTM % d. If you purchase a two-year zero-coupon bond now, what is the expected total rate of return over the next year? (Hint: Compute the current…arrow_forward7.6 For a particular bond market, zero-coupon bonds with face value $100, re-deemable at par, are priced as follows: • bonds redeemable in exactly 1 year are priced at $98, • bonds redeemable in exactly 2 years are priced at $93, • bonds redeemable in exactly 3 years are priced at $89, • bonds redeemable in exactly 4 years are priced at $85.50. Find the yield to maturity of a bond redeemable at 103% of the face value in 4 years with annual coupons of 5%.arrow_forward

- Q12arrow_forward* Assignment 3 i Assume coupons are paid annually. Here are the prices of three bonds with 10-year maturities. Assume face value is $100. Bond Coupon (%) 248 a. What is the yield to maturity of each bond? b. What is the duration of each bond? Price (%) 80.36 96.95 135.22 Complete this question by entering your answers in the tabs below. Required A Bond Coupon (%) 2 4 8 Required B What is the yield to maturity of each bond? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. YTM % % % Saved 22255 35445arrow_forwardMaturity (years) Price 2.83% 5.79% The above table shows the price per $100-face value bond of several risk-free, zero-coupon bonds. What is the yield to maturity of the four-year, zero- coupon, risk-free bond shown? 2.85% 12.07% 1 $97.25 2.89% 3 2 $94.53 $91.83 5 4 $89.23 $87.53arrow_forward

- Question 2A. A bond has a face value of $2000, a coupon rate of 6% and matures in 10years’ time. If its current yield to maturity is 8% what is the current price ofthe bond? If the yield falls to 4% determine the bond price. What do theseresults indicate about the relationship between the price of a bond and itsyield to maturity? B. You are asked to put a value on a bond which promises eight annual couponpayments of £70 and will repay its face value of £1000 at the end of eightyears. You observe that other similar bonds have yields to maturity of 9 percent. How much is this bond worth? You are offered the bond for a priceof £1030.44. What yield to maturity does this represent? C. Explain in detail the trade-off model of capital structure. In light of the currentglobal financial challenge, discuss which elements of the model areexpected to become most prevalent?arrow_forwardConsider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity 1 YTM(%) 5.6% 2 3 4 6.6 7.1 7.6 According to the expectations hypothesis, what is the market's expectation of the yield curve one year from now? Specifically, what are the expected values of next year's yields on bonds with maturities of (a) one year? (b) two years? (c) three years? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) APCO D Bond Years to Maturity YTM (%) B 1 % C 2 % D 3 %arrow_forwardBond Coupon Rate (%) Number of Years to Maturity Price TII $884.20 $948.90 $967.70 $456.39 W X Y 7 8 9 0 5 7 4 10 Calculate the yield to maturity for the four bonds. SOLCE USING BA2 CALC.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education