Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

2c.

c. Consider two zero coupon bonds in which you receive $100 at the maturity date, one

maturing in 3 years and one maturing in 5 years. Both are currently priced to yield 6

percent. Calculate the current market

maturity rises to 9 percent. Calculate the percent change in the price of each bond as the yield went from 6 to 9.

Expert Solution

arrow_forward

Step 1

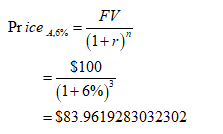

Price of Zero coupon bond “A” with maturity 3 years and yield 6% can be determined as below:

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 10) Suppose a coupon bond with 10 years remaining to maturity is reported to have a duration equal to 6.7 years. Assuming a current interest rate of 9% and an estimated decrease in the interest rate to 8.8%, calculate the estimated percentage increase in the bond's price. Hint: Duration= a) 3.3% b) 2.7% c) 1.2% d) 0.6% %AP Ai/(1+io)arrow_forward1. How to calculate the value of a 6 year 2% coupon bond with semiannual payments, 1000 par. Expected return is the risk free rate of 3%. 2. Price a 5 year 4% semiannual coupon bond if the yield to maturity is 6% (write the price as if par is 100, use 5 decimal places)arrow_forwardConsider a 25-year bond with a face value of $1,000 that has a coupon rate of 5.8%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline. a. What is the coupon payment for this bond? The coupon payment for this bond is $ *** (Round to the nearest cent.)arrow_forward

- Suppose you buy a bond with a coupon of 8.2 percent today for $1,100. The bond has 7 years to maturity. Assume interest payments are reinvested at the original YTM. a. What rate of return do you expect to earn on your investment? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Rate of return % b. Two years from now, the YTM on your bond has increased by 2 percent, and you decide to sell. What price will your bond sell for? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Pricearrow_forwardSuppose a five-year, $1000 bond with annual coupons has a price of $ 898.69 and a yield to maturity of 6.5 %. What is the bond's coupon rate? The bond's coupon rate is enter your response here%. (Round to three decimal places.)arrow_forward5. A 5-year bond with a yield of 7% (continuously compounded) pays an 8% coupon at the end of each year. What is the bond's price? What is the bond's duration? Use the duration to calculate the effect on the bond's price of a 0.2% decrease in its yield.arrow_forward

- A 2-year maturity bond with face value of $1,000 makes annual coupon payments of $88 and is selling at face value. What will be the rate of return on the bond if its yield to maturity at the end of the year is: Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. a. 6% b. 8.8% c. 10.8% Rate of Return % % %arrow_forwardConsider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity Bond B According to the expectations hypothesis, what is the market's expectation of the yield curve one year from now? Specifically, what are the expected values of next year's yields on bonds with maturities of (a) one year? (b) two years? (c) three years? (Do not round intermediate calculations. Round your answers to 2 decimal places.) с D YTM(%) 5.1% Years to Maturity 1 2 3 6.1 6.6 7.1 YTM (%) % % %arrow_forwardQuestion A .Consider a 2-year, risk-free bond with a coupon rate of 6% (annual coupons) and a face value of $1,000. If the yield on the above bond is 6%: a. What is the Macaulay duration of this bond? b. If the yield increases to 7% immediately, what does the duration approximation predict will be the percentage change in the bond price? c. If the yield decreases to 5% instead, what is the approximate percentage change in the bond price implied by the bond’s duration? d. After receiving the first coupon payment in year 1, the yield increases to 7% and you decide to sell the bond. What is your annualized HPR? Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education