ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Homework: Chapter 13

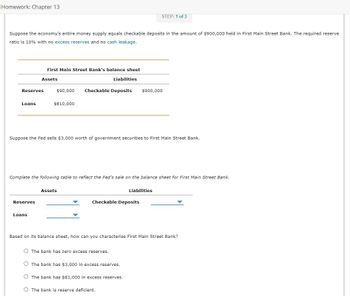

Suppose the economy's entire money supply equals checkable deposits in the amount of $900,000 held in First Main Street Bank. The required reserve

ratio is 10% with no excess reserves and no cash leakage.

Reserves

Loans

First Main Street Bank's balance sheet

Assets

Reserves

Loans

$810,000

$90,000 Checkable Deposits $900,000

Suppose the Fed sells $3,000 worth of government securities to First Main Street Bank.

Complete the following table to reflect the Fed's sale on the balance sheet for First Main Street Bank.

Liabilities

Assets

STEP: 1 of 3

Checkable Deposits

O The bank has zero excess reserves.

Liabilities

Based on its balance sheet, how can you characterise First Main Street Bank?

O The bank has $3,000 in excess reserves.

O The bank has $81,000 in excess reserves.

The bank is reserve deficient.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If a bank has excess reserves of $20,000 and demand deposit liabilities of $80,000, and if the reserve requirement is 20 percent, then the bank has total reserves of$36,000arrow_forwardSuppose First Main Street Bank, Second Republic Bank, and Third Fidelity Bank all have zero excess reserves. The required reserve ratio is 25%. Yakov, a client of First Main Street Bank, deposits $1,800,000 into his checking account at First Main Street Bank. Complete the following table to reflect any changes in First Main Street Bank's T-account (before the bank makes any new loans).arrow_forwardBank Balance Sheet Assets: Reserves =$50 million Loans =$100 million Bonds =$9 million Liabilities: Deposits =$150 million If the required reserve ratio is 25%, and the Fed buys $2 million in bonds from a bank what will be the change in the money supply?arrow_forward

- Working through a change in the reserve requirement Assume that the following table portrays the balance sheet of First Eastern bank. Assets Liabilities and Net Worth Vault Cash $150,000 Deposits $900,000 Deposits at Fed $250,000 Loans $500,000 Total $900,000 Total $900,000 If the Fed were instead to set the required reserve ratio to 0.10, required reserves would be $_, excess reserves would be$_, and the maximum increase in the money supply would be $_.arrow_forwardSuppose you examine the central bank’s balance sheet and observe that since the previous day, reserves had risen by $400 million. In addition, on the asset side of the central bank’s balance sheet, securities had risen by $400 million. What activity did the central bank carry out earlier in the day to lead to these changes in the balance sheet? Do you think by carrying out this activity the central bank was aiming to increase, decrease, or maintain the size of the money supply? The central bank conducted an open market (purchase /sale) of $400 million with a commercial bank. This transaction would involve $400 million of securities being ( added to / removed from) the central bank’s balance sheet. There would be (an increase / a fall ) of $400 million in reserves to reflect the related payment ( to / by ) the commercial bank ( from / into) its reserve account. By carrying out this activity, the central bank was aiming to (increase / decrease) maintain the size of the money supply.arrow_forwardAssume that the required reserve ratio is 7.00%, that banks do not keep excess reserves, and that all the money loaned out from Bank Uno is deposited into Bank Duo (whose loans go to other banks not shown here). Bank Uno has $2,167 in reserves and $2,167 in deposits. Once the lending and depositing process is complete, what will Bank Uno have in reserves, loans, and deposits?arrow_forward

- What is the defining difference among our various measures of money supply, such as M1 and M2? The defining difference is origin, whether the money is issued by the Federal Reserve Bank or the Federal Government The defining difference is liquidity, how quickly the instrument could be turned to cash and expended The defining difference is regulation, how much control the Federal Reserve Bank has over the relative amounts of M1 or M2 in circulation The defining difference is function, whether the money is used to meet transactions demand or asset demandarrow_forwardCan you help me answer this questionarrow_forwardOne effect of the September 11, 2001, terrorist attacks was to temporarily prevent banks from accessing reserves they needed to meet the demands of their customers. (This occurred because the attacks destroyed many records as well as the computers required to access backup records, and it took affected banks several weeks to become fully operational.) In response, the Fed made many billions of dollars of reserves available to banks, gradually withdrawing the new reserves from the banking system as that system returned to normal. Suppose the Fed had not injected reserves in this way. What would likely have happened to interest rates as a result? What would have been the likely impact on the stock market and on spending by consumers and businesses? Would the unemployment rate have gone up or down? Explain your reasoning in each case.arrow_forward

- Suppose that the required reserve ratio is 8%, currency in circulation is $600 billion, the amount of checkable deposits is $890 billion, and excess reserves are $15 billion. The money supply is $ 1490 billion. 600 billion + 890 billion = 1490 billion The currency deposit ratio is 0.67. 600/890 = 0.67 The excess reserve ratio is 0.16 or 0.02 (if we are rounding). 15/890 = 0.169 The money multiplier is 12.5 1/%8 = 1/0.08 =12.5 Suppose the central bank conducts an unusually large open market purchase of bonds held by banks of $1,300 billion due to a sharp contraction in the economy. Assuming the ratios you calculated in the previous steps are the same, the money supply should (1) _____ to $ 17,740 billion. 1300 x 12.5 = 16250 + 1490 = (the top part is just up to provide a reference for the bottom question) Suppose the central bank conducts the same open market purchase as in the previous step, except that banks choose to hold all of these proceeds as excess reserves rather than loan…arrow_forwardInitially, the banking system has a required reserve ratio of 20.0 percent, $450,000 in total deposits, and no excess reserves. If the Fed reduces the required reserve ratio to 15.0, how much unused lending capacity does the banking system now have? Multiple Choice $750,000 $3,000,000 $337,500 $150,000arrow_forwardmacmillan learning Suppose that the legal reserve ratio set by the Fed is 10% and that the Fair Bank in Fairdealing, Missouri, initially has checkable deposit equal to $240 and a reserve account of $70. A customer of Fair Bank deposits $100 into her checking account. Fair Bank loans 80% of the deposit and places the rest in its reserves at the St. Louis Fed. For simplicity, assume the borrower received the loan as cash. How much does Fair Bank have in excess reserves after the deposit and loan? Number Place the figures below to represent changes in the accounts of Fair Bank and the Federal Reserve of St. Louis' balance sheets resulting from the deposit and loan. Hint Cash: Reserves: Loans: Property: $ +$100 +$80 Balance Sheet: Fair Bank Liabilities: Net equity: +$20 -$100 -$20 +$10 -$80 -$10 Balance Sheet: Saint Louis Fed Liabilities: Cash: Property: Loans: Previous Check Answer Next Exitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education