ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

None

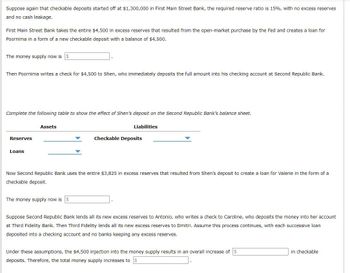

Transcribed Image Text:Suppose again that checkable deposits started off at $1,300,000 in First Main Street Bank, the required reserve ratio is 15%, with no excess reserves

and no cash leakage.

First Main Street Bank takes the entire $4,500 in excess reserves that resulted from the open-market purchase by the Fed and creates a loan for

Poornima in a form of a new checkable deposit with a balance of $4,500.

The money supply now is $

Then Poornima writes a check for $4,500 to Shen, who immediately deposits the full amount into his checking account at Second Republic Bank.

Complete the following table to show the effect of Shen's deposit on the Second Republic Bank's balance sheet.

Reserves

Loans

Assets

Liabilities

Checkable Deposits

Now Second Republic Bank uses the entire $3,825 in excess reserves that resulted from Shen's deposit to create a loan for Valerie in the form of a

checkable deposit.

The money supply now is $

Suppose Second Republic Bank lends all its new excess reserves to Antonio, who writes a check to Caroline, who deposits the money into her account

at Third Fidelity Bank. Then Third Fidelity lends all its new excess reserves to Dmitri. Assume this process continues, with each successive loan

deposited into a checking account and no banks keeping any excess reserves.

Under these assumptions, the $4,500 injection into the money supply results in an overall increase of $

deposits. Therefore, the total money supply increases to $

in checkable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Connor has a summer job which pays $1,589 for the entire summer. If 22% is taken out for federal taxes, then how much is deductedarrow_forwardJeff, a 56 year old professor is subject to a 28% tax rate. He has had a family emergency and must withdraw $5,000 from his IRA to fund it. How much money will he owe the government for this withdrawal?arrow_forwardA compulsary legal and unilateral payment made to the government is known as _______arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education