Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

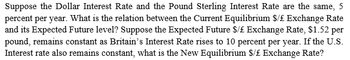

Transcribed Image Text:Suppose the Dollar Interest Rate and the Pound Sterling Interest Rate are the same, 5

percent per year. What is the relation between the Current Equilibrium $/£ Exchange Rate

and its Expected Future level? Suppose the Expected Future $/£ Exchange Rate, $1.52 per

pound, remains constant as Britain's Interest Rate rises to 10 percent per year. If the U.S.

Interest rate also remains constant, what is the New Equilibrium $/£ Exchange Rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that right now, the market price of one Chinese yuan (CNY) is USD 0.15; that is, one can purchase or sell CNY1.00 for USD0.15. The proportional standard deviation for CNY in terms of USD is 20%. The Chinese riskless return rate over a two-year period is projected to be 8%; U.S. ratesover the same period are 2%. What is the dollar value of a two-year European put on a single yuan if the exercise price of the put is USD0.20?arrow_forwardSuppose the year 1, year 2 and year 3 forecasts for the rate of inflation in Denmark are 3%, 4% and 5% respectively. Suppose also that the year 1, year 2 and year 3 forecasts for the rate of inflation in France are 11%, 9% and 8% respectively. If the expected spot rate between the Danish Krone (DKK) and the EUR is EUR0.1344/DKK at the end of year 3, what is the current spot rate? a. EUR0.119024/DKK b. EUR0.151762/DKK c. EUR0.128269/DKK d. EUR0.111027/DKK e. Not enough information to answer this question.arrow_forwardSuppose the price of wheat over the next year is expected rise to $3.50 in the United States and to £1.60 in England. What should the one-year $:£ forward rate bearrow_forward

- Assume the spot rate on the New Zealand dollar is NZ$1.0926, the risk-free nominal rate in the U.S. is 3.8 percent and 4.1 percent in New Zealand. What is the four-year forward rates best establishes the approximate interest rate parity condition?arrow_forwardA) It is now January. The current interest rate is 5% per annum annual compounding. The June future price for gold is $1846.30, while the December future rice is $1860.00. Find a strategy to explore the arbitrage opportunity. B) Suppose that the spot price of the euro is currently $1.5 USD. The one-year futures price is $1.55 USD. Is the interest rate higher in the United States or the euro zone? Justify your answer. C) OneAsx has just introduced a single-stock futures contract on Arandex stock, a company that currently pays no dividends. Each contract calls for delivery of 1,000 shares of stock in one year. The T-bill rate is 6% per year annually compounded and Arandex stock currently sells at $120 per share. If the Arandex price drops by 3%, what will be the change in the future price and the change in the investors’ margin account who has a long position in one contract?arrow_forward4. An American put option to sell a British pound for dollars has a strike price of $1.5 and a time to maturity of 1 year. The volatility of the pound/dollor exchange rate is 15% per annum, the dollar interest rate is 6%, the British pound interest rate is 7%, per annum, and the current exchange rate is 1.52. Use a three-step binomial tree to value the option.arrow_forward

- Suppose the spot price of the British pound is currently $1.50. If the risk-free interest rate on one-year government bonds is 4% in the United States and 3% in the United Kingdom, what must the forward price of the pound be for delivery one year from now? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardAssume that interest rate parity holds and that 90-day risk-free securities yield 3% in the United States and 3.3% in Germany. In the spot market, 1 euro equals $1.50. What is the 90-day forward rate?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education