ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

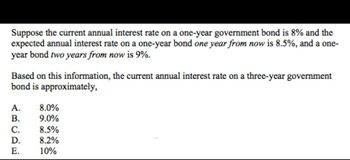

Transcribed Image Text:Suppose the current annual interest rate on a one-year government bond is 8% and the

expected annual interest rate on a one-year bond one year from now is 8.5%, and a one-

year bond two years from now is 9%.

Based on this information, the current annual interest rate on a three-year government

bond is approximately,

A. 8.0%

B. 9.0%

8.5%

D. 8.2%

10%

ABCDE

C.

E.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The table below shows current and expected future one-year interest rates, as well as current interest rates on multiyear bonds. Use the table to calculate the liquidity premium for each multiyear bond. One-Year Bond Rate 2.00% 5.00% 8.00% 11.00% 13.00% The liquidity premiums for each year are given as: (Enter your responses rounded to two decimal places.) 131 = = 151 = % % % % Year 1 2345 2 Multiyear Bond Rate 2.00% 5.00% 6.00% 8.00% 10.00%arrow_forward00 4. * C0 IM 5- 511 4. 2) 1. Price ($/cup) LU Refer to the accompanying figure, which shows the market for cups of coffee. Consider the original supply and the original demand curve. If the government imposes a price ceiling of $1.00 on a cup of coffee, then there would be: Original Supply 3.5 3. New Supply 2.5 1.5 New Demand 0.5 Original Demand 10 20 08 06 09 Quantity (cups/hour) Multiple Choice an excess supply of coffee. 1:54 PM 92°F Sunny (罗 10/8/2021 here to search 五 0 *P11 Delete PrtSc Insert W/4 F12 23 & Backspace Lock 8 7. 6. 5) P. TO Enter D] K. Shift C) Alt Ctrlarrow_forwardIn this question, use the approximate formula-as given by the Fisher equation-for calculating the the real rate of interest. Assume a fixed real interest rate and everyone believes the Central Bank's forecasts. Believing that inflation will be 1% for the year, the current yield on a government bond that matures in one year is 2.9%. The Central Bank then revises its inflation forecast to 1.6% for the year. What will be the yield on government bonds maturing in one year after this revision? Round to one decimal place and do not enter the % sign. If your answer is 1.333%, enter 1.3. If your answer is 1.666%, enter 1.7. If appropriate, remember to enter the negative sign.arrow_forward

- Bond A pays $8,000 in 28 years. Bond B pays $8,000 in 14 years. (To keep things simple, assume these are zero-coupon bonds, which means the $8,000 is the only payment the bondholder receives.) Suppose the interest rate is 5 percent. Using the rule of 70, the value of Bond A is approximately Now suppose the interest rate increases to 10 percent. Using the rule of 70, the value of Bond A is now approximately I The value of a bond rate. and the value of Bond B is approximately and the value of Bond B is approximately Comparing each bond's value at 5 percent versus 10 percent, Bond A's value decreases by a when the interest rate increases, and bonds with a longer time to maturity are percentage than Bond B's value. sensitive to changes in the interestarrow_forward26arrow_forward3. Effects of a government budget deficit Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving, domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently experiencing a balanced government budget. Real Interest Rate (Percent) 7 National Saving (Billions of dollars) 55 Domestic Investment (Billions of dollars) Net Capital Outflow (Billions of dollars) 30 -15 6 50 40 -10 5 45 50 -5 4 40 60 0 3 35 70 5 2 30 80 10 Given the information in the preceding table, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market. Market for Loanable Funds 10 O Demand 8 O Supply *+ Equilibrium 20 40 80 60 QUANTITY OF LOANABLE FUNDS REAL INTEREST…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education