Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

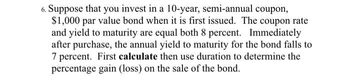

Transcribed Image Text:6. Suppose that you invest in a 10-year, semi-annual coupon,

$1,000 par value bond when it is first issued. The coupon rate

and yield to maturity are equal both 8 percent. Immediately

after purchase, the annual yield to maturity for the bond falls to

7 percent. First calculate then use duration to determine the

percentage gain (loss) on the sale of the bond.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A bond has 9 years until maturity with a coupon rate of 7% and anannual coupon payment of $50 and a future value of $1000. Calculate the Present Value. The same bond has a future value of $1,000 (keeping the same priorassumptions (9 years until maturity, 7% coupon rate), however,excluding the annual coupon payment). Calculate the Present Value.arrow_forwardA premium annual - pay bond pays a $77 coupon, has a yield to maturity of 5.77 %, and is priced at $ 1,153.43. How many years till the bond matures? Answer in years to at least two decimal places.arrow_forwardAssume that a company issues a new bond with coupon rate of 11 %, 5% yield and $100 par value bond. Coupon is paid annually. The bond has three years to maturity. (1) What is the Macaulay duration of this bond? (ii) How would you interpret the result obtained in part (e)(i) above?arrow_forward

- Assume a bond that promises eight annual coupon payments of $70 and will repay its face value of $1000 at the end of the eight years. Assuming that you are offered the bond for a price of $1035.94, use detailed workings to compute the implied YTMarrow_forwardThe current price of an annual coupon bond is 100. The yield to maturity is an annual effective rate of 8%. The derivative of the price of the bond with respect to the yield to maturity is -700. Using the bond's yield rate, calculate the Macaulay duration of the bond in years.arrow_forwardWhat is the Macaulay duration of a semi-annual bond with a coupon rate of 7 percent, five years to maturity, and a current price of $959? What is the modified duration? Duration is __. years. Modified duration is __ years.arrow_forward

- Please assist with the following question with full handwritten working: What is the value of a 10 year, 8.2% coupon bond with semiannual coupons. Assume the par value of the bond is $100 and it is redeemable at par. The interest rate (nominal, converted semiannually) is 10.6%.arrow_forwardThe bond's duration is the sum of the present value of each payment weighted by the time period in which the payment is received, with the resulting quantity divided by the price of the bond. Therefore, solve for the bond's duration given the following variables: A $1,000 par bond is priced at 95% of par, the bond's annual coupon rate is 6%, and the bond has 4 years to maturity. Additionally, show your calculator's function keys for the 5th column titled, "What is the Present Value Interest Factor at ? %" PV =, FV =, PMT =,N=, and I = .... and CPT key = ? 0.0000 CUIT CPT SET ENTER DEL INS Column 1 Column 2 Column 3 Column 4 Column 5 2ND CF NPV IRR PM AMORT DON CLR TVM PV PMT FV RAND Number (#) of "X" means "multiplied each by" payment Amount of payment "A $1,000 par bond is priced "X" means "multiplied by" What is the Present Value Interest 呢 VE 1/x HYP SIN مر at 95% of par" so $950 x .06 = $57?) 1 X $ 57 X Factor at ? % ? (show calculator function keys: PV=, FV = PMT =, N =, & I=? ? =…arrow_forwardYou purchase a bond with an invoice price of $1,170. The bond has a coupon rate of 7.2 percent, and there are 2 months to the next semiannual coupon date. What is the clean price of the bond? Assume a par value of $1,000.arrow_forward

- The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? a. Compute the yield to maturity for each bond. The yield on the 1-year bond is 3.92 %. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) Price (per $100 face value) 1 $95.51 2 3 $91.10 $86.55 $81.69 $76.45 Print Dondayarrow_forwardAssume that the real, risk-free rate of interest is expected to be constant over time at 3 percent, and that the annual yield on a 6-year corporate bond is 8.00 percent, while the annual yield on a 10-year corporate bond is 7.75 percent: you may assume that the default risk and liquidity premium are the same for both bonds. Also assume that the maturity risk premium for all securities can be estimated as MRP, (0.1%) *(t-1), where t is the number of periods until maturity. Finally assume that inflation is expected to be constant at 3 percent for Years 1-6, and then constant at some rate for Years 7-10 (4 years). Given this information, determine what the market must anticipate the average annual rate of inflation will be for Years 7-10. 2.583% O 1979% 2.281% 1.375 % O 1.677 % 4arrow_forwardAssume you buy a five-year, $1,000 par value bond with a 6% coupon and a 7% yield. Immediately after you acquire the bond, the yield increases to 8% and remains there until maturity. Calculate the realised horizon yield on a bond that you intend to keep till maturity. Annual interest is paid.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education