ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:5. To advertise or not to advertise

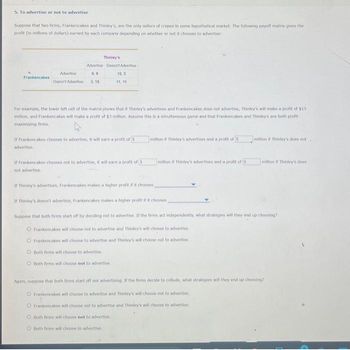

Suppose that two firms, Frankencakes and Thinley's, are the only sellers of crepes in some hypothetical market. The following payoff matrix gives the

profit (in millions of dollars) earned by each company depending on whether or not it chooses to advertise:

Frankencakes

Thinley's

Advertise Doesn't Advertise

Advertise

9,9

Doesn't Advertise 3,15

For example, the lower left cell of the matrix shows that if Thinley's advertises and Frankencakes does not advertise, Thinley's will make a profit of $15

million, and Frankencakes will make a profit of $3 million. Assume this is a simultaneous game and that Frankencakes and Thinley's are both profit-

maximizing firms.

advertise

If Frankencakes chooses to advertise, it will earn a profit of 5

15,3

11.11

If Frankencakes chooses not to advertise, it will earn a profit of S

not advertise.

Both firms will choose to advertise

O Both firms will choose not to advertise.

million if Thinley's advertises and a profit of 5

Both firms will choose not to advertise,

Both firms will choose to advertise

million if Thinley's advertises and a profit of 5

million if Thinley's does not.

If Thinley's advertises, Frankencakes makes a higher profit if it chooses

If Thinkey's doesn't advertise, Frankencakes makes a higher profit if it chooses

Suppose that both firms start off by deciding not to advertise. If the firms act independently, what strategies will they end up choosing?

O Frankencakes will choose not to advertise and Thinley's will choose to advertise

Frankencakes will choose to advertise and Thinley's will choose not to advertise

million if Thinley's does

Again, suppose that both firms start off not advertising. If the firms decide to collude, what strategies will they end up choosing?

Frankencakes will choose to advertise and Thinley's will choose not to advertise

O Frankencakes will choose not to advertise and Thinley's will choose to advertise

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- ◄ Search 12:47 PM Sun Nov 12 ← Note Nov 12, 2023 Uptown's price strategy The Nash equilibrium occurs when High Low LED RareAir's price strategy High $12 $15 The more favorable outcome would be for $12 Tt ✪ $6 B Low $6 D $8. $15 $8 S O both firms have an incentive to deviate from this strategy given the strategy of the competing firm. It is shown by the dominant strategy of cell A. 92% neither firm has an incentive to deviate from this strategy given the strategy of the competing firm. It is shown by the dominant strategy of cell D. O one firm consistently has an incentive to deviate from this strategy given the strategy of the competing firm. It is shown by the high-price strategy of cell B. O one firm consistently has an incentive to deviate from this strategy given the strategy of the competing firm. It is shown by the high-price strategy of cell C. O the firms to collude and use the high-price strategy but this strategy requires cooperation. O one firm to take the lead and let the…arrow_forwardQUESTION 13 Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by D₁(P₁, P2) = 140 - 2p1 + P2 and demand for firm 2's product is D2 (P1, P2) 140 - 2p2 + P1 Both firms have a constant marginal cost of 20. What is the Nash equilibrium price of firm 1? (Only give a full number; if necessary, round to the lower integer; no dollar sign.)arrow_forwardFor example, the lower left cell of the matrix shows that if Full Coop advertises and Lucky Bird does not advertise, Full Coop will make a profit of $14 million, and Lucky Bird will make a profit of $3 million. Assume this is a simultaneous game and that Lucky Bird and Full Coop are both profit- maximizing firms. If Lucky Bird chooses to advertise, it will earn a profit of $ advertise. million if Full Coop advertises and a profit of $ million if Full Coop does not If Lucky Bird chooses not to advertise, it will earn a profit of $ not advertise. million if Full Coop advertises and a profit of $ million if Full Coop does S If Full Coop advertises, Lucky Bird makes a higher profit if it chooses If Full Coop doesn't advertise, Lucky Bird makes a higher profit if it chooses Suppose that both firms start off by deciding not to advertise. If the firms act independently, what strategies will they end up choosing? Both firms will choose not to advertise. O Lucky Bird will choose not to…arrow_forward

- 1. What do we mean by market power in economics? What are some ways firms can attain market power? How can we, as economists, know when a firm has "too much" market power? Give an example of a firm you think has a lot of market power.2. Chapter 3 is all about game theory. Imagine you are in charge of pricing at a firm that has 20% market share in an industry where the leading firm has 50% market share. Imagine that the leader increases prices on their products. How do you think you would react? Why?arrow_forwardMCQ 27 Consider the following game in which two firms (OLD and NEW) are considering whether or not to advertise to increase sales. Each firm knows that the impact on profits depends on what the other firm chooses to do. The possible profit outcomes of the game are shown below, with OLD's profits shown as the first number in each pair and NEW's profits shown as the second number: NEW Advertise Not Advertise Advertise 10, 5 15, 1 OLD Not Advertise 5, 8 20, 3 Assuming the firms aim to earn as much profit as possible, which of the following is TRUE for the game? A I do not want to answer this question. OLD's dominant strategy is to advertise C OLD's dominant strategy is not to advertise NEW's dominant strategy is not to advertise E NEW's dominant strategy is to advertise F the dominant strategy for both OLD and NEW is to advertisearrow_forwardThere are two firms in the market (duopoly). These two firms are competingsimultaneously. The first firm chooses its output level (x) by predicting the second firm’soutput (y). Let c denote the total cost function c(x) = x and c(y) = y. Also, let’s assumethat the inverse demand function is p(Y) = 7 - Y where Y = x + y. (1) Obtain the reactionfunction of the first firm. (2) Find the equilibrium (output and profit of each firm) whentwo firms simultaneously competearrow_forward

- 16arrow_forwardplease if you can teach explainarrow_forwardSuppose that GE is trying to prevent Maytag from entering the market for high efficiency clothes dryers. Even though high efficiency dryers are more costly to produce, they are also more profitable as they command sufficiently higher prices from consumers. The following payoffs table shows the annual profits for GE and Maytag for the advertising spending and entry decisions that they are facing. GE MAYTAG Advertising = $12m Advertising = $0.7m Stay Out $0, $30m $0, $35m Enter $1m , $20m $12m, $15 Based on this information, can GE successfully prevent Maytag from entering this market by increasing its advertising levels? What is the equilibrium outcome in this game? Suppose that an analyst at GE is convinced that just a little bit more advertising by GE, say another $2m, would be sufficient to deter enough customers from buying Maytag, thus, yield less than $0 profits for Maytag in the event it enters. Suppose that spending an extra $2m on advertising…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education