MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

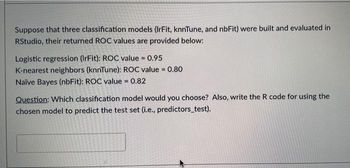

Transcribed Image Text:Suppose that three classification models (IrFit, knnTune, and nbFit) were built and evaluated in

RStudio, their returned ROC values are provided below:

Logistic regression (IrFit): ROC value = 0.95

K-nearest neighbors (knnTune): ROC value = 0.80

Naïve Bayes (nbFit): ROC value = 0.82

Question: Which classification model would you choose? Also, write the R code for using the

chosen model to predict the test set (i.e., predictors_test).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Female and Smoke are binary indicator variables ( 0 and 1). Age and Education is measured continuously in years. Loan Default is a binary indicator variable (0 = no default, 1=default). Are the predictor variables in Models A statistically significant at the 5% significance level? Carefully interpret the coefficients for Female and Education in Models A Generate a forecast from all 3 models when Age=10, Educ=10, Sex=1, Smoke=0 You are unsure if education has a linear effect on loan default. What are possible transformations you can do to check for non-linearity?arrow_forwardInterpret the following graphs for multiple linear regression and comment on the validity of model assumptionsarrow_forwardThis dataset continues our saga of modeling the price of this popular Honda automobile. The dataset has now been cleaned to remove the columns with the dealership where the car was offered for sale and specific trim. (a) write out your model in econometric notation. Be very precise! (b) using the 93 observations in the dataset, estimate a model where price is a function of age, mileage and trim of the car. Be sure to avoid the dummy variable trap!! Fully report the results of your model. In this case, interpretation of the coefficients on the dummy variables is particularly important. (c) test the hypothesis that the specific trim does not affect the price of a Civic. Be sure to do all parts of the hypothesis test. (please fully describe steps if you are using Excel) Price Years Old KM EX EXT SE Sport Touring 6555 9 290363 0 0 0 0 0 9999 9 142258 0 0 0 0 0 10281 6 132644 0 0 0 0 0 12480 5 167125 0 0 0 0 0 12991 7 57398 0 0 0 0 0 12991 6 93046 0 0 0 0 0 12991…arrow_forward

- Please answer as many as your allowed too. Thank you :) A regression was run to determine if there is a relationship between the happiness index (y) and life expectancy in years of a given country (x).The results of the regression were: ˆyy^=a+bxa=-1.68b=0.168 (a) Write the equation of the Least Squares Regression line of the formˆyy^= + x(b) Which is a possible value for the correlation coefficient, rr? -1.417 1.417 0.702 -0.702 (c) If a country increases its life expectancy, the happiness index will increase decrease (d) If the life expectancy is increased by 0.5 years in a certain country, how much will the happiness index change? Round to two decimal places.(e) Use the regression line to predict the happiness index of a country with a life expectancy of 69 years. Round to two decimal places.arrow_forwardSuppose the following data were collected from a sample of 1515 CEOs relating annual salary to years of experience and the economic sector their company belongs to. Use statistical software to find the following regression equation: SALARYi=b0+b1EXPERIENCEi+b2SERVICEi+b3INDUSTRIALi+eiSALARY�=�0+�1EXPERIENCE�+�2SERVICE�+�3INDUSTRIAL�+��. Is there enough evidence to support the claim that on average, CEOs in the service sector have lower salaries than CEOs in the financial sector at the 0.010.01 level of significance? If yes, write the regression equation in the spaces provided with answers rounded to two decimal places. Else, select "There is not enough evidence." Copy Data CEO Salaries Salary Experience Service (1 if service sector, 0 otherwise) Industrial (1 if industrial sector, 0 otherwise) Financial (1 if financial sector, 0 otherwise) 144225144225 1010 11 00 00 187765187765 2020 00 00 11 142500142500 66 11 00 00 169650169650 2828 11 00 00 167250167250 3131 00…arrow_forwardThis table reports the regression coefficients when the returns of the size-institutionalownership portfolio (columns 1 and 2) returns are regressed on three variables: a constant(column 3), the stock market returns (column 4), and the change of the value weighted discountof the closed end fund industry (column 6). Columns 5 and 7 report the corresponding t-statistics of the coefficient estimates. Note that a t-statistic with an absolute value above 1.96means the coefficient estimate is significantly different from 0 at the 1% level. Column 8reports the R square of the regressions. Column 9 reports the mean institutional ownership ofeach portfolio. The last column reports the F-statistics for a multivariate test of the null hypothesis that the coefficient on ΔVWD in the Low (L) ownership portfolio is equal to theHigh (H) ownership portfolio. Two-tailed p-values are in parentheses. 1. What is the main finding of this Table? 2. What is the explanation for…arrow_forward

- Please look at the following regression table. The year is 2010. The data originates from the Penn World Table 9.0, from Harris et.al. 2014 from the World Bank and from the International Energy Agency. The variables are defined as follows: Lntran_pc = log of transportation energy consumption per capita (ktoe) Lnypcpenn =log of GDP per capita (USD) Ln_gasprice = log of pump price for gasoline (USD/liter) Ln_temperature = log of the average annual temperature (in C) Ln_annualprecip= log of annual precipitation (mm) Ln_land = log of the land area of a country OECD = a dummy (indicator) that takes on the value of 1 if the country is OECD member, zero otherwise. Please define (Gauss Markov) MLR 4, state if it is likely to hold or not in this case.arrow_forwardA year-long fitness center study sought to determine if there is a relationship between the amount of muscle mass gained y(kilograms) and the weekly time spent working out under the guidance of a trainer x(minutes). The resulting least-squares regression line for the study is y=2.04 + 0.12x A) predictions using this equation will be fairly good since about 95% of the variation in muscle mass can be explained by the linear relationship with time spent working out. B)Predictions using this equation will be faily good since about 90.25% of the variation in muscle mass can be explained by the linear relationship with time spent working out C)Predictions using this equation will be fairly poor since only about 95% of the variation in muscle mass can be explained by the linear relationship with time spent working out D) Predictions using this equation will be fairly poor since only about 90.25% of the variation in muscle mass can be explained by the linear relationship with time spent…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman