ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

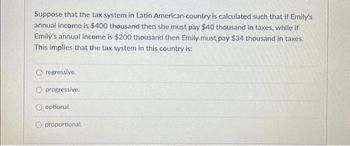

Transcribed Image Text:Suppose that the tax system in Latin American country is calculated such that if Emily's

annual income is $400 thousand then she must pay $40 thousand in taxes, while if

Emily's annual income is $200 thousand then Emily must pay $34 thousand in taxes.

This implies that the tax system in this country is:

regressive.

O progressive.

optional.

proportional.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Is the fiscal policy in South Africa sufficiently geared towards combating poverty?Discuss critically in an essay by using graphs in the answer as wellarrow_forwardUnder a proportional or flat tax, X O everyone pays the same dollar amount in income taxes O everyone pays the same tax rate O tax rates are assessed at a constant percentage of government spending O an individual's tax is based on his percentage of income versus total national income Question 4 Which of the following best describes a progressive tax policy? O People with higher incomes will pay more in taxes than people with higher incomes. O People with lower incomes will pay more in taxes than people with higher incomes. O People with higher incomes will pay a higher tax rate than people with lower incomes. O People with lower incomes will pay a higher tax rate than people with higher incomesarrow_forwardTRUE - OR - FALSE The distinctive characteristic of a progressive tax is that the dollars paid in taxes rise as income rises. O True O Falsearrow_forward

- Use the table below to choose the correct answer. Income Таx (dollars) (dollars) 10,000 2,000 20,000 4,000 40,000 8,000 The tax schedule shown here is regressive. O proportional. O progressive. O proportional up to $20,000 and regressive beyond that.arrow_forwardSuppose taxes are related to income as follows: Income Taxes $1,000 $200 $2,000 $350 $3,000 $450 a. What percentage of income is paid in taxes at each level? b. Is the tax rate progressive, proportional, or regressive? c. What is the marginal tax rate on the first $1,000 of income? The second $1,000? The third $1,000?arrow_forward4.7) Consider a national income tax that is structured as follows: Income Marginal tax rate $0-$10,000 0% $10,001-- $60,000 5% $60,001and above 0% For each of the following workers determine his or her marginal and average tax rate d. Would you describe the tax system as proportional, regressive, or progressive? Explainarrow_forward

- A proportional tax, sometimes referred to as a flat tax, is a kind of income tax wherein all taxpayers are taxed at the same percentage rate, no matter how high or low their income. A proportional tax system means that everyone experiences the same tax rate, whether low, middle, or high-income. Those who support a proportional tax argue that the system is fairest because the rules are simple and straightforward and no one is exempt; however, there is a huge con of proprtional taxes. Explain what that is. Essayarrow_forwardThe negative income tax has been proposed as a means The negative income tax has been proposed as a means of increasing both the efficiency and the equity of Canada’s tax system (see Applying Economic Concepts 18-1 on page 465). The most basic NIT can be described by two variables: the guaranteed annual income and the marginal tax rate. Suppose the guaranteed annual income is $8000 and the marginal tax rate on every dollar earned is 35 percent. With this NIT, after-tax income is given by After-tax income = 8000 + (1 – 0.35) X (Earned income) a. On a scale diagram with after-tax income on the vertical axis and earned income on the horizontal axis, draw the NIT relationship between earned income and after-tax income. b. What is the level of income at which taxes paid on earned income exactly equal the guaranteed annual income? c. The average tax rate is equal to total net taxes paid divided by earned income. Provide an algebraic expression for the average tax…arrow_forwardSuppose that the U.S. government decides to charge wine consumers a tax. Before the tax, 35 billion bottles of wine were sold every year at a price of $5 per bottle. After the tax, 28 billion bottles of wine are sold every year; consumers pay $6 per bottle (including the tax), and producers receive $3 per bottle. The amount of the tax on a bottle of wine is S burden that falls on producers is S |per bottle. Of this amount, the burden that falls on consumers is S per bottle, and the per bottle. True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on producers. True O Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education