ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

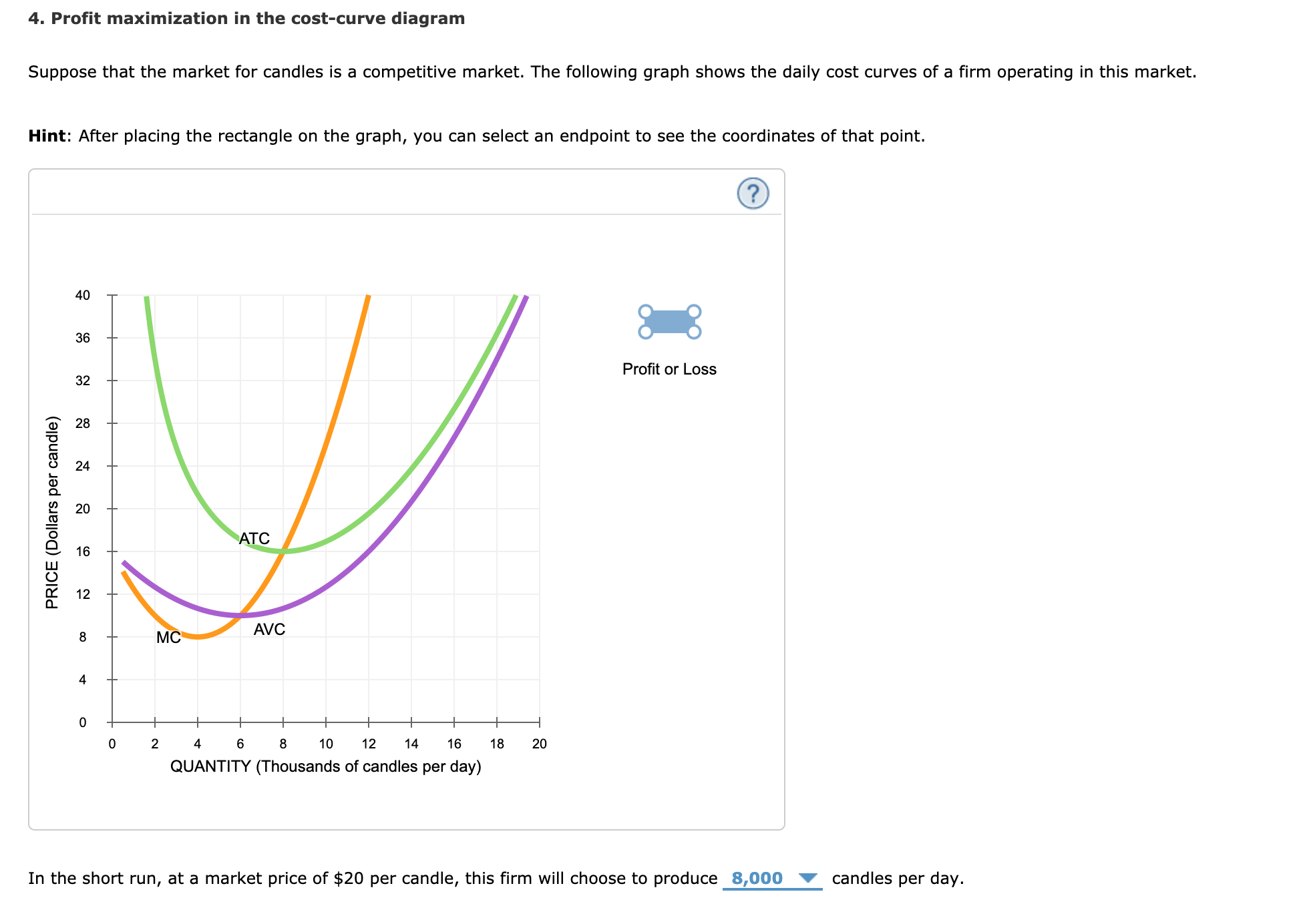

4. Profit maximization in the cost-curve diagram

Suppose that the market for candles is a competitive market. The following graph shows the daily cost curves of a firm operating in this market.

Hint: After placing the rectangle on the graph, you can select an endpoint to see the coordinates of that point.

Transcribed Image Text:4. Profit maximization in the cost-curve diagram

Suppose that the market for candles is a competitive market. The following graph shows the daily cost curves of a firm operating in this market.

Hint: After placing the rectangle on the graph, you can select an endpoint to see the coordinates of that point.

40

36

Profit or Loss

32

28

24

20

ATC

16

12

AVC

8

MC

4

4

6

8

10

12

14

16

18

20

QUANTITY (Thousands of candles per day)

In the short run, at a market price of $20 per candle, this firm will choose to produce 8,000

candles per day.

PRICE (Dollars per candle)

Transcribed Image Text:QUANTIT IousanTUS or candiEs per day)

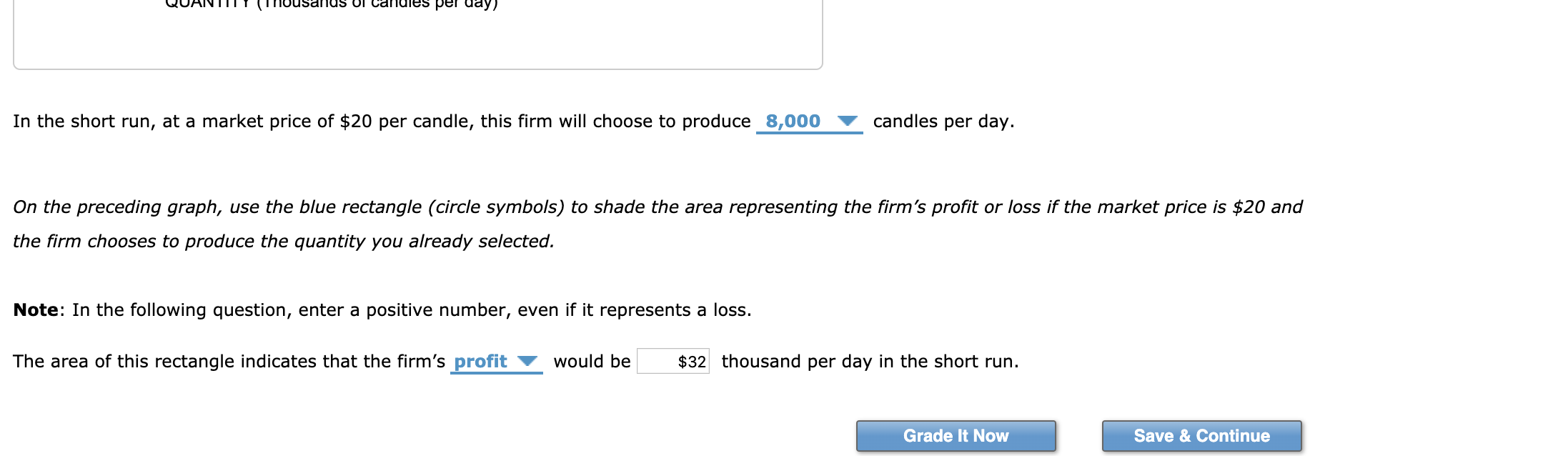

In the short run, at a market price of $20 per candle, this firm will choose to produce 8,000

candles per day.

On the preceding graph, use the blue rectangle (circle symbols) to shade the area representing the firm's profit or loss if the market price is $20 and

the firm chooses to produce the quantity you already selected.

Note: In the following question, enter a positive number, even if it represents a loss.

The area of this rectangle indicates that the firm's profit

would be

$32 thousand per day in the short run.

Grade It Now

Save & Continue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. Profit maximization in the cost-curve diagram Suppose that the market for frying pans is a competitive market. The following graph shows the daily cost curves of a firm operating in this market Hint: After placing the rectangle on the graph, you can select an endpoint to see the coordinates of that point. 100 90 Profit or Loss 80 70 ATC 60 50 40 30 AVC 20 MC 10 5 10 15 20 25 30 35 40 45 50 QUANTITY (Thousands of pans per day) In the short run, at a market price of $50 per pan, this firm will choose to produce 37,500 pans per day. PRICE (Dollars perpan)arrow_forwardBrody's firm produces trumpets in a perfectly competitive market. The table below shows Brody's total variable cost. He has a fixed cost of $240, and the price per trumpet is $60.-Calculate the average total cost of producing 6 trumpets. Show your work. -Calculate the marginal cost of producing the 11th trumpet. -What is Brody's profit-maximizing quantity? Use marginal analysis to explain your answer. -At the profit-maximizing quantity you determined in part (c), calculate Brody's profit or loss. Show your work. -Brody also produces saxophones at a loss in a perfectly competitive market. Draw a correctly labeled graph for Brody's firm showing the following at a market price of $200. -Brody's profit-maximizing quantity of saxophones -Brody's loss, completely shaded Quantity Total Variable cost 6 $120 7 $145 8 $165 9 $220 10 $290 11 $390arrow_forwardMmarrow_forward

- Profit maximization using total cost and total revenue curves Suppose Caroline runs a small business that manufactures shirts. Assume that the market for shirts is a competitive market, and the market price is $20 per shirt. The following graph shows Caroline's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for shirts quantities zero through seven (inclusive) that Caroline produces. Caroline's profit is maximized when she produces______ shirts. When she does this, the marginal cost of the last shirt she produces is ______, which is (GREATER OR LESS) than the price Caroline receives for each shirt she sells. The marginal cost of producing an additional shirt (that is, one more shirt than would maximize her profit) is _____, which is (GREATER OR LESS) than the price Caroline receives for each shirt she sells. Therefore, Caroline's profit-maximizing quantity corresponds to the…arrow_forward9. Problems and Applications Q9 The market for apple pies in the city of Ectenia is competitive and has the following demand schedule: Each producer in the market has a fixed cost of $6 and the following marginal cost: Quantity Marginal Cost (Dollars) 1 1 2 3 4 5 6 Complete the following table by computing the total cost and average total cost for each quantity produced. Quantity Total Cost Average Total Cost (Ples) (Dollars) (Dollars) 1 2 3 4 3 8 10 12 14 The price of a pie is now $11. At a price of $11, making a profit of O True O Fal pies are sold in the market. Each producer makes True or False: The market is in long-run equilibrium. Suppose that in the long run there is free entry and exit. In the long run, each producer earns a profit of each producer makes pies, so there are The market price is producers operating. pies, so there are At this price, producers in this market, each pies are sold in this market, andarrow_forwardOnly typed answerarrow_forward

- please also do the graph and the choices for the first blank is 2000, 7500, 8000, 10000 and the choices for the second blank is profit or economic loss thank you!!!arrow_forwardFarmer Lee grows strawberries. The average total cost and marginal cost of growing strawberries in the long run for an individual farmer are illustrated in the graph to the right. Suppose the market price is $7.05 per box. If so, then farmers will strawberries until the market price is $ number rounded to two decimal places.) per box. (Enter a numeric the market for a real enter exit Price and cost (dollars per box) 10- 9- 8- 5- 3- 2- 1. 0 MC ATC 10 20 30 40 50 60 70 80 90 100 Quantity of strawberries (boxes per week) oarrow_forward3. Two poultry farms supply companies with chicken feeds. The unit costs of shipping from the farms to the companies are given on the table below. The farm's goal is to minimize the cost of meeting customer's demands. (a) Generate a mathematical model for finding the least cost way of shipping chicken feeds from the farms to the companies. (b) if the demand of company number 2 increased by 3 units. By how much would the costs increase? Show your solution. Ic). Solve the total cost using the solver add-in in excel From Company 1 Company 2 Company 3 Supply Farm A 55 65 80 35 Farm B 10 15 25 50 Demand 10 10 10arrow_forward

- Figure: Cost Curves for Corn Producers Price, cost of bushel $30 26 MC 22 18 ATC AVC 14 10 1 3 4 7 Quantity of corn (bushels) Reference: Ref 12-3 (Figure: Cost Curves for Corn Producers) Look at the figure Cost Curves for Corn Producers. The market for corn is perfectly competitive. If the price of a bushel of corn is $10, in the short run, the farmer will produce of corn and earn an ec omic equal to 2 bushels; profit; $0 2 bushels; loss; just more than $80 per bushel 3 bushels; profit; loss, -$15 4 bushels; profit; just less than $80 per bushelarrow_forward3. Profit maximization using total cost and total revenue curves Suppose Bob runs a small business that manufactures teddy bears. Assume that the market for teddy bears is a competitive market, and the market price is $25 per teddy bear. The following graph shows Bob's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for teddy bears quantities zero through seven (inclusive) that Bob produces. TOTAL COST AND REVENUE (Dollars) 200 175 150 125 100 75 50 25 0 -25 O ☐ ☐ 0 1 2 3 4 5 QUANTITY (Teddy bears) ☐ 6 Total Cost 7 8 O Total Revenue Profit ?arrow_forwardUse the following graphs for questions 22 and 23. At what price would a firm exit the market? (a) Relationship of total cost to total variable cost and total fixed cost (b) Relationship of marginal cost to average total cost, average variable cost, and average fixed cost Total Costs (dollars) 700 Cost 150 Per 140 TC Unit 130 TVC (dollars) 120 MC 600 110 100 500 90 80 400 70 60 ATC 300 TFC 50 AVC 40 AFC 200 30 20 TFC 100 10 AFC 0 1 2 3 4 5 6 7 8 9 10 11 12 0 1 2 3 4 5 6 7 8 9 10 11 12 Quantity of Output Quantity of Output (units per hour) (units per hour) O $20 O $30 $45 $50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education