A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

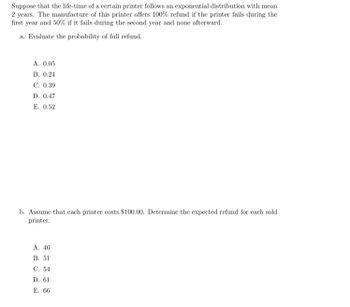

Transcribed Image Text:**Suppose that the life-time of a certain printer follows an exponential distribution with mean 2 years. The manufacturer of this printer offers a 100% refund if the printer fails during the first year and 50% if it fails during the second year and none afterward.**

a. Evaluate the probability of full refund.

A. 0.05

B. 0.24

C. 0.39

D. 0.47

E. 0.52

b. Assume that each printer costs $100.00. Determine the expected refund for each sold printer.

A. 46

B. 51

C. 54

D. 61

E. 66

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The price of oil was steadily increasing by 3% a year for a 10-year period. The cause was general inflation and the effect was increasing prices. There was a 40% spike in the price of oil during the spring and summer of 2006. What could have been a hidden variable that caused this jump in prices? O a) the 2006 election O b) the age of the drilling platforms c) a volcano in the South Pacific O d) hurricanes in the Gulf of Mexicoarrow_forwardAssume that the economy can experience high growth, normal growth, or recession. Under these conditions, you expect the folowing stock market returns for the coming year State of the Econony High Growth Normal Grovth Recession Probability 0.2 0.7 0.1 Return 334 13% -336 a. Compute the expected value of a $1,000 investment over the coming year, If you invest $1,000 today, how much money do you expect to have next year? What is the percentage expected rate of return? Instructions: Enter dollar values rounded to the nearest whole dollar and percentages rounded to one decimal place. The expected value is $1 and the expected rate of return is b. Compute the standard deviation of the percentage return over the coming year Standard deviation cif the resk-free return is 7 percent, what is the risk premium for a stock market investment? Risk premium OSarrow_forwarda. Using mathematical notation, list the three properties of a stationary time series.b. A classic example of non-stationary time series is the Random Walk Model, State the equation of the random walk without drift.c. Derive the mean of the equation you stated in part (b)d. Derive the Variance of the equation you stated in part (b) Only typed solution.arrow_forward

- For each probability and percentile problem, draw the picture.The time (in years) after reaching age 60 that it takes an individual to retire is approximately exponentially distributed with a mean of about 6 years. Suppose we randomly pick one retired individual. We are interested in the time after age 60 to retirement. In a room of 1,000 people over age 79, how many do you expect will NOT have retired yet? (Round your answer to the nearest whole number.) peoplearrow_forwardThe figure below shows survival probabilities from all-cause mortality over 20 years in participants over 50 years of age who have normal glucose, glucose intolerance, and Type II diabetes mellitus. Estimate the 5-year survival probability for Type II diabetes. a. approximately 10% b. approximately 60% c. approximately 76% d. approximately 84%arrow_forwardIn major league baseball, a no hitter is a game in which a pitcher, or pitchers, doesn't give up any hits throughout the game. No hitters occur at a rate of about three per season. Assume that the duration of time between no hitters is exponential. a. what is the probability that an entire season elapses with a single no-hitter? b. If an entire season elapses without any no hitters, what is the probabilty that there are no no hitters in the following season? c. What is the probabilty that there are more than 3 no hitters in a single season?arrow_forward

- Here is civilian unemployment cate 1982-1995 Civilian Unemployment Cate 1982-1995 year 1982 1986 1988 1990 1992 । ११५ Rode 9.7 7.0 5.4 5.5 7.4 6.1 yeRr 1984 1987 198% 1991 1993 1995 Rode 7.5 6.2 5.3 6.7 6.8 5.6 Make deta. dime plot o thearrow_forwardK Suppose a basketball player is an excellent free throw shooter and makes 92% of his free throws (i.e., he has a 92% chance of making a single free throw). Assume that free throw shots are independent of one another. Suppose this player gets to shoot three free throws. Find the probability that he misses all three consecutive free throws. Round to four decimal places. OA. 0.2213 OB. 0.9995 OC. 0.0005 OD. 0.7787arrow_forwardIn a certain city, projections for the next year indicate there is a 20% chance that electronics jobs will increase by 1300, a 50% chance that they will increase by 400, and a 30% chance they will decrease by 900. Find the expected change in the number of electronics jobs in that city in the next year. The expected change is an increase of __________ jobs.arrow_forward

- Show work for every step. Two types of customers (Preferred and Regular) call a service center. Preferred customers call with rate 3 per hour, and Regular customers call with rate 5 per hour. The interarrival times of the calls for each customer type are exponentially distributed. If the call center opens at 8:00 AM, what is the probability that the first call (regardless of customers type who calls) is received before 8:15 AM?arrow_forward10 The observed insurance policy deviates from the predicted policy, on average, by _______ ($1,000) a 44.465 b 49.406 c 54.895 d 60.994arrow_forwardSuppose that you are offered the following "deal." You roll a six sided die. If you roll a 6, you win $12. If you roll a 3, 4 or 5, you win $5. Otherwise, you pay $6.a. Complete the PDF Table. List the X values, where X is the profit, from smallest to largest. Round to 4 decimal places where appropriate. X P(X) b. Find the expected profit. $ (Round to the nearest cent)c. Interpret the expected value. This is the most likely amount of money you will win. You will win this much if you play a game. If you play many games you will likely win on average very close to $2.50 per game. d. Based on the expected value, should you play this game? Yes, since the expected value is 0, you would be very likely to come very close to breaking even if you played many games, so you might as well have fun at no cost. No, this is a gambling game and it is always a bad idea to gamble. Yes, since the expected value is positive, you would be very likely to come home with more…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON