ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

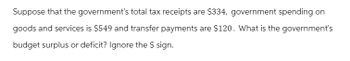

Transcribed Image Text:Suppose that the government's total tax receipts are $334, government spending on

goods and services is $549 and transfer payments are $120. What is the government's

budget surplus or deficit? Ignore the $ sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Using the budget data below, calculate the change in the debt-to-GDP ratio from the end of 2019 to end of 2020. Year Budget Surplus Debt (as of January 1) GDP 2019 100 800 5000 2020 150 blank 5600arrow_forwardThe Federal Budget is divided into Mandatory and Discretionary spending. Decide which statement is correct. 1. Social Security is mandatory and interest on national debt is mandatory 2. Military spending is mandatory and interest on national debt is mandatory 3.Interest on national debt is discretionary and Medicare is discretionary 4.Medicare is mandatory and military spending is discretionary.arrow_forwardAnswer plzzarrow_forward

- The Borrowings of the Government and the fiscal deficit are $30,000 Is this situation true or false?arrow_forwardWhich of the following is NOT a component of federal fiscal policy? A. Federal tax revenues B. Federal government expenditures C. Federal budget deficit D. All of the above are components of federal fiscal policyarrow_forwardProblems with the federal government budget process include: a. budgeting that increases the flexibility of discretionary fiscal policy. b. most of the expenditures being for entitlement programs. c. budgeting that allows the President too much discretion in spending decisions. d. a budget outline that needs to be approved with at least a two-thirds majority vote. e. a brief budgeting that does not allow Congress to study whether the budget is an appropriate tool for fiscal policy.arrow_forward

- The largest single portion of the federal budget is devoted to A. interest payments on the national debt.B. national defense.C. Medicare and Medicaid.D. education.E. Social Security and unemployment compensation.arrow_forwardHow should the government execute Fiscal Policy?arrow_forward11. Study Questions and Problems #11 Suppose you are the economic policy adviser to the president and are asked what should be done to eliminate a federal deficit. You would recommend to government spending and taxes.arrow_forward

- What is the relationship between the government deficit and debt? Why is it essential that governments make the payments on their debts?arrow_forwardWhich of the following statements about state budget is wrong? a. Budget may be annual or biennial b. About half of the states have dual budget system - operating budget and capital budget c. Most operate under the balanced budget requirement d. All governors have item veto powerarrow_forwardWhen the total revenues in the federal government are greater than the total expenses in a given year, the budget: A. is balanced. B. has a profit. C. has a deficit. D. has a surplus.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education