ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:11. Study Questions and Problems #11

Suppose you are the economic policy adviser to the president and are asked what should be done to eliminate a federal deficit.

You would recommend to

government spending and

taxes.

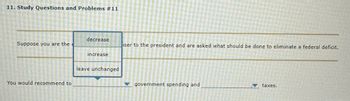

Transcribed Image Text:11. Study Questions and Problems #11

Suppose you are the

You would recommend to

decrease

increase

leave unchanged

iser to the president and are asked what should be done to eliminate a federal deficit.

government spending and

▼ taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What must be true about the level of government expenditures and tax revenues for the federal government to be running a balanced budget?arrow_forwardWhat are the positive and negative impacts of fiscal policy on businesses within an economy?arrow_forwardThe Borrowings of the Government and the fiscal deficit are $30,000 Is this situation true or false?arrow_forward

- How should the government execute Fiscal Policy?arrow_forwardDuring difficult economic times, why are uniform across-the-board budget cuts poor fiscal policy?arrow_forwardHow would a tax cut impact the National Budget and the National Debt? What are the pros and cons of running a deficit? Would you support such a tax cut and for whom should we impose the tax cut?arrow_forward

- Congress recently passed and President Biden signed the American Rescue Plan (ARP), which will add $1.9 trillion to the federal deficit over the next ten years. Even before this new spending, federal debt held by the public was slated to reach 107% of GDP by 2031, the highest in history. What do high deficits mean going forward?arrow_forwardIn year one government taxes are 590,000 and government spending is 600,000 in year two government taxes are 590,000 and government spending is 590,000 in year three government taxes are 630,000 and government spending is 600,000. What is the government deficit for year two and provide the size of the government debt or surplus at the end of all three year.arrow_forwardWhat is the relationship between the government deficit and debt? Why is it essential that governments make the payments on their debts?arrow_forward

- The government starts with a debt of $4 billion. In year one, the government runs a deficit of $600 million. In year two, the government runs a deficit of $1 billion. In year three, the government runs a surplus of $300 million. What is the total debt of the government at the end of year three? Show work.arrow_forwardWhat are some of the arguments for and against a requirement that the federal government budget be balanced every year?arrow_forwardIdentify the effects of fiscal policy on the economyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education