ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

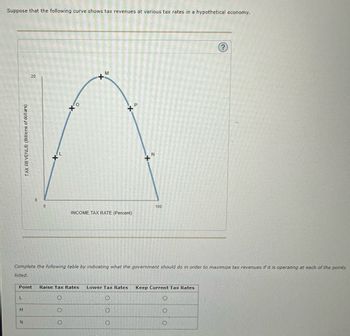

Transcribed Image Text:Suppose that the following curve shows tax revenues at various tax rates in a hypothetical economy.

TAX REVENUE (Billions of dollars)

L

20

3

0

N

0

L

O

M

O

O

XD

Complete the following table by indicating what the government should do in order to maximize tax revenues if it is operating at each of the points

listed.

INCOME TAX RATE (Percent)

Point Raise Tax Rates Lower Tax Rates Keep Current Tax Rates

O

N

100

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- please teach explain step by step, how is it like to graph?arrow_forwardFigure 4-11 LAFFER CURVE 100 C. A Tax Revenue Tax Rate (percent)arrow_forwarda) The government decides to impose a unit-tax on producers instead of a unit-sales tax on consumers, arguing that this will protect consumers from negative effects of the tax. Your response to this statement should be that O This is incorrect reasoning, because consumers actually will be affected more by the tax on production than a sales tax O This is incorrect reasoning, because consumers are always hit harder by a sales tax O This is incorrect reasoning, because it doesn't matter whether the tax is imposed on sales or production, the impact is the same O This is the correct reasoning, because consumers do not pay for the production. b) Tom likes eBooks and iTunes. eBooks cost $4 and provide a marginal utility of 10; iTunes cost $1 and provide a marginal utility of 3. To maximize utility for the given budget, Tom should O Buy more eBooks and fewer iTunes O Buy fewer eBooks and more iTunes O Not change his current consumption choicearrow_forward

- 4. The Laffer curve Government-imposed taxes cause reductions in the activity that is being taxed, which has important implications for revenue collections. To understand the effect of such a tax, consider the monthly market for gin, which is shown on the following graph. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. PRICE (Dollars per bottle) 100 90 80 20 10 0 0 Supply Demand 14 28 42 56 70 84 98 112 126 140 QUANTITY (Bottles) Graph Input Tool At this tax amount, the equilibrium quantity of gin is Market for Gin Suppose the government imposes a $20-per-bottle tax on suppliers. Quantity (Bottles) Demand Price (Dollars per bottle) Tax (Dollars per bottle) 56 60.00 20.00 Supply Price (Dollars per bottle) bottles, and the government collects $ ? 40.00 in tax revenue.arrow_forward4. The Laffer curve Government-imposed taxes cause reductions in the activity that is being taxed, which has important implications for revenue collections. To understand the effect of such a tax, consider the monthly market for gin, which is shown on the following graph. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. Graph Input Tool Market for Gin 100 I Quantity (Bottles Demand Price (Dollars per bottle) 90 Supply 56 80 Şupply Price (Dollars per bottle) 60.00 40.00 70 Tax Dollars per bottle) 20.00 * 60 50 40 30 Demand 20 10 0 14 28 42 56 70 84 98 112 126 140 QUANTITY (Bottles) Suppose the government imposes a $20-per-bottle tax on suppliers. At this tax amount, the equilibrium quantity of gin is bottles, and the government collects S in tax revenue. Now calculate the…arrow_forwardDirections: click on the graph in the window on the right and select Time Series to graph the U.S. public (federal) net outstanding debt as a percentage of GDP for the years 1940-2005. For Y Axis1 select Net Federal Debt, percentage of GDP. Use the figure to help determine which of the following statements are true. O A. The U.S. net federal debt to GDP ratio has been, for the most part, decreasing since the end of World War II, despite the fact that the U.S. economy was expanding and could afford a larger debt to GDP ratio. OB. As a result of the exceptionally large increases in U.S. government military expenditures in the first half of the 1940's, that were needed to win World War II, the net U.S. public debt to GDP ratio increased substantially, surpassing 100%. Since the late 1950's however, U.S. net federal debt to GDP ratio has fluctuated within a relatively small bend around the 40% line. OC. The net U.S. federal debt to GDP ratio follows a pattern that cannot have a meaningful…arrow_forward

- Real GDP Consumption (dollars) expenditure (dollars) 10 22.5 20 30 30 37.5 40 45 50 52.5 60 60 2 LAS 160 * SAS 150 140 130 120 AD 4 8 12 16 20 24 Real GDP (trillions of 2000 dollars) In the above table and figure, supposed that there is no import or proportional tax. To pull the economy back to the long-run equilibrium, the government can conduct a balanced budget operation by spending $ trillion. O 1) 1 O 2) 2 O 3) 4 4) 8 el (GDP deflator, 2000 = 100) Coarrow_forwardWhat would happen to output, employment, and the price level if the government increased spending on infrastructure, ceteris paribus? O Output would decrease, employment would decrease, and the price level would decrease O Output would decrease, employment would decrease, and the price level would increase O Output would decrease, employment would increase, and the price level would increase Output would increase, employment would increase, and the price level would decrease. O Output would increase, employment would increase, and the price level would increase Question 2(Multiple Choice Worth 5 points) (03.06 MC) Assume the price level is increasing, real GDP is decreasing, and the unemployment rate is increasing. Which event would explain this macroeconomic situation? OA positive supply shock OA negative supply shock A positive demand shock OA negative demand shock O insufficient dataarrow_forwardIn the United States, from the most recent fiscal data we reviewed in class, total government spending is roughly 39% of GDP; yet, using the expenditure method for calculating GDP, government expenditures on goods and services were only 17% of GDP. Which of the following most likely explains the difference? Select one: O a. Transfer payments are included in the second figure, but not the first one. O b. Transfer payments are included in the first figure, but not the second one. O c. Military (i.e. defense) spending on goods and services is included in the second figure, but not the first one. O d. Military (i.e. defense) spending on goods and services is included in the first figure, but not the second one.arrow_forward

- Suppose George made $20,000 last year and that he lives in the country of Harmony. The way Harmony levies income taxes, all citizens must pay 10 percent in taxes on their first $10,000 in earnings and then 50 percent in taxes on anything else they might earn. Given that George earned $20,000 last year, his marginal tax rate on the last dollar he earns will be rate for his entire income will be and his average tax O 10 percent; 50 percent O 50 percent; less than 50 percent O 10 percent; less than 50 percent O 50 percent; 50 percentarrow_forwardexplain step by step, how is it like to graph?arrow_forwardmacro question 6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education