ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

4

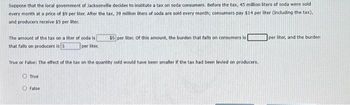

Transcribed Image Text:Suppose that the local government of Jacksonville decides to institute a tax on soda consumers. Before the tax, 45 million liters of soda were sold

every month at a price of $9 per liter. After the tax, 39 million liters of soda are sold every month; consumers pay $14 per liter (including the tax),

and producers receive $5 per liter.

The amount of the tax on a liter of soda is

that falls on producers is 5

per liter

True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on producers.

True

$5 per liter. Of this amount, the burden that falls on consumers is

False

per liter, and the burden

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 21arrow_forwardI need answer typing clear urjent no chatgpt used i will give upvotes full explanationarrow_forwardAt a price of $14, country 1 will (a) offer for export 9 units of this product. (b) seek to import 9 units of this product. (c) choose not to trade. (d) increase supply. (e) offer for export 18 units of this productarrow_forward

- Typed plz and Asap Please give me a quality solution thanksarrow_forwarduestion 3 If you want to minimize interest payments on a loan, you'll need one that has a simple interest rate so that yo John opened an account, and knew exactly how much it would be worth at the end of the year, because it used year. What is simple interest? Oa. Interest only on original amount saved or borrowed Ob. interest on original amount saved, borrowed and other interest earned Oc. a fee paid for the use of someone else's money Od. taxes on the original amount saved or borrowed L A Moving to another question will save this response. →arrow_forwardB9arrow_forward

- 16arrow_forwardctors) on of es 1. Relationship of data usage and bill Data Usage(GB/month) 0 10 20 30 Bill($/month) 10 30 50 70 A. Draw the graph, placing data usage horizontally(on the X axis) and bill vertically(On the Y axis). B. How much is the monthly fixed fee? C. How much is the charge per GB? D. What is the Equation that describes the relationship, where data usage is denoted by D, and bill by B? E. How much would be the charge for 50 GB use per month?arrow_forwardB. The late Anne Collins had 3 children, Mary, John and Hana who unfortunately all predeceased Anne leaving several Anne's grandchildren and great grandchildren. Unfortunately, Anne died intestate without a will or trust. She is survived by: Mary's daughters Emma and Joan John's son Patrick who has 2 children Joe and Frank; Frank has 1 child Eddy. Hana's daughter Elizabeth is also deceased leaving 2 children Jim and Eva. (i) Please fill in the table taking into consideration that Anne died without a will/trust and therefore the distribution shall be according to the CA intestacy laws (Modified Per Stirpes PC 240). Each Emma and Joan Mary's spouse Each of Patrick's 2 children Joe and Frank Each of Elizabeth's 2 children Jim and Eva Patrick's grandchild Eddy Patrick MPS Øarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education