ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Suppose that the central bank in this economy is concerned that inflation is too high and wants to lower the inflation rate by 6 percentage points per

year. A reduction in the rate of inflation is known as

To reduce inflation from 8% to 2% in the short run, the central bank would

have to accept an unemployment rate of

%

True or False: If people have rational expectations, the economy may not have to endure an unemployment rate as high as predicted by the short-run

Phillips curve.

True

False

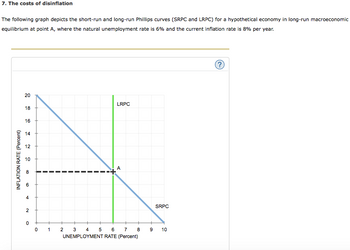

Transcribed Image Text:7. The costs of disinflation

The following graph depicts the short-run and long-run Phillips curves (SRPC and LRPC) for a hypothetical economy in long-run macroeconomic

equilibrium at point A, where the natural unemployment rate is 6% and the current inflation rate is 8% per year.

INFLATION RATE (Percent)

20

18

16

14

12

10

8

4

2

0

01

LRPC

A

SRPC

2 3 4 5 6 7 8 9 10

UNEMPLOYMENT RATE (Percent)

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- I need help soon as possible please. I only have one hour to finish.arrow_forwardConsider an economy for which wage and price inflation are initially 3% under a zero output gap. Calculate price inflation by the end of the current period under a new output gap of 6%. (Hint: you need to use the Phillips curve equation)arrow_forward1. Aggregate demand, aggregate supply, and the Phillips curve In the year 2027, aggregate demand and aggregate supply in the imaginary country of Aso-Kuju are represented by the curves AD2027 and AS on the following graph. The price level is currently 102. The graph also shows two potential outcomes for 2028. The first possible aggregate demand curve is given by the curve labeled ADA curve, resulting in the outcome given by point A. The second possible aggregate demand curve is given by the curve labeled ADB, resulting in the outcome given by point B. PRICE LEVEL 108 107 106 105 104 103 102 101 100 0 AD 2027 2 4 B AS ADB ADA 8 10 6 OUTPUT (Trillions of dollars) 12 14 16 (?) Suppose the unemployment rate is 7% under one of these two outcomes and 5% under the other. Based on the previous graph, you would expect outcome B▼ to be associated with the lower unemployment rate (5%). If aggregate demand is high in 2028, and the economy is at outcome B, the inflation rate between 2027 and 2028…arrow_forward

- Please mark true or false for the following statements. 1. When there are adaptive expectations, it implies that there is persistence (inertia) in inflation:arrow_forwardThe Short-Run Phillips Curve given by T = E (x) – 0.4 (u – 10) + v Suppose that the economy has adaptive expectations and no inflation shocks. If inflation goes down by 3.3 percentage points a year from today, what is the unemployment rate one year from now? Round your answer to the nearest two decimal place. Write your answer in percentage terms so if your answer is 10%, write 10.arrow_forwardConsider the model of unemployment with job separation rate s = 0.05 and job finding rate f = 0.20. If the unemployment rate U = 10,000, L = 200,000, and E = 190,000 then what will the natural rate of unemployment be? Please show your calculation. If U were to fall to 5,000 because of an exogenous shock, how would the unemployment rate change in the short run? In the long run? If s were to fall to 0.03 because of an exogenous shock, how would the unemployment rate change in the short run? In the long run?arrow_forward

- Consider a version of the Phillips curve where a proportion of wages, 1 >> 0, are now indexed to the rate of inflation. In these labor contracts, nominal wages move one-for-one with the actual price level. The remaining proportion of wages, (1-2), are set on the basis of expected inflation: nt λnt (1) et+ (m+z)-aut (2) a. Suppose that лet=πt-1. Solve for the natural rate of unemployment (the rate such that t=t-1). Is the natural rate of unemployment different as a result of wage indexation? b. Re-write the Phillips curve in terms of the difference between чt and un using the value for un you calculated in (a). How does wage indexation impact the way changes in inflation respond to deviations of the unemployment rate from the natural rate? What is the intuition for this result?arrow_forwardConsider the Friedman-Phelps model of the Phillips Curve as discussed in lecture. Assume the economy is currently at Y-full employment. When the Fed sells government securities to the public, and there are no other exogenous shocks to the economy, which one of the following is predicted to happen? The actual inflation rate increases, and the unemployment rate increases permanently. O The actual inflation rate increases, and the unemployment rate increases first and then gradually goes back to the natural rate of unemployment. O The actual inflation rate decreases, and the unemployment rate increases first and then gradually goes back to the natural rate of unemployment. The actual inflation rate decreases, and the unemployment rate increases permanently. The actual inflation rate decreases, and the unemployment rate decreases first and then gradually goes back to the natural rate of unemployment.arrow_forwardAccording to the St. Louis Federal Reserve the natural unemployment rate is 4.44 percent (Q2 2022 B) and the U.S. Bureau of Labor Statistics (BLS) estimates the U.S. unemployment rate (U3, March 2022 ) to be 3.6 percent. If you expect unemployment to continue to fall the short-run Phillips curve would predict: O A decrease in the inflation rate. An increase in the inflation rate. A decrease in the unemployment rate. An increase in the unemployment rate.arrow_forward

- The equation of the Phillips curve from 1970 to 1995 is: -17.4-1.2u₁. The natural rate of unemployment using this curve is 6.2%. (round your answer to one decimal place) The equation of the Phillips curve from 1996 to 2018 is: x=2.8% -0.16+ Which of the following explains why the natural rate of unemployment cannot immediately be calculated from the Philips curve? A. The expression only provides Ⓡ and a. B. The equation does not include a specific value for expected inflation. C. The expression only provides (m + z) and . D. None of the above. Using the line drawing tool, accurately graph the Phillips relation=2.8% -0.16 with inflation on the vertical axis and unemployment on the horizontal axis. Carefully follow the instructions above and only draw the required object. What is the natural rate of unemployment using the relation = 2.8% -0.16u, under the assumption that the value of x=2% The natural rate of unemployment fell to 5% between 1970-1995 and 1996-2018? (round your answer to…arrow_forwardWhich of the following is true about the Phillips curve? The empirical relationship between unemployment and inflation in the US disappeared after the 1970s. This means that the theoretical Phillips curve does not represent the world well. For a researcher to identify the theoretical Phillips curve from empirical data, the economy must be subject to supply shocks. The empirical Phillips curve implies that a government must choose between either low unemployment and high inflation or high unemployment and low inflation. When inflation expectations adjust, the negative empirical correlation between inflation and unemployment might disappear.arrow_forwardSuppose that the public expects that inflation will be high and that episodes of high unemployment are politically difficult for policymakers. Is it possible for the economy to be at a bad equilibrium as a result of people’s expectations of inflation (i.e. expectations trap)? Explain in terms of a Phillips Curve diagram.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education