FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

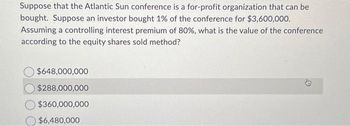

Transcribed Image Text:Suppose that the Atlantic Sun conference is a for-profit organization that can be

bought. Suppose an investor bought 1% of the conference for $3,600,000.

Assuming a controlling interest premium of 80%, what is the value of the conference

according to the equity shares sold method?

$648,000,000

$288,000,000

$360,000,000

$6,480,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- DRK, Incorporated, has just sold 80,000 shares in an initial public offering. The underwriters explicit fees were $48,000. The offering price for the shares was $64, but immediately upon issue, the share price jumped to $68.00. Required:a. What is the total cost to DRK of the equity issue?arrow_forwardDavid's Watersports Firm is considering a public offering of common stock. Its investment banker has informed the company that the retail price will be $16.85 per share for 550,000 shares. The company will receive $15.40 per share and will incur $180,000 in registration, accounting, and printing fees. A. What is the spread on this issue in percentage terms? What are the total expenses of the issue as a percentage of total value (at retail)? B. If the firm wanted to net $15.99 million from this issue, how many shares must be sold?arrow_forward1(A). If the minority price for a single share of stock of a company is $20, there are 500,000 shares of stock, and a person offers to buy the entire company for $14.5 million, what is the controlling interest premium being offered? (B) Based on the same information, what is the minority or non-controlling interest discount for this company?arrow_forward

- The management of LTTP Corp. is preparing for issuing equity to fund a new project. Rights offeris used. The company has determined that the ex-rights price would be $53. The current price is $58per share, and there are 10 million shares outstanding. The rights offer would raise a total of $45million. What is the subscription price?arrow_forwardSuppose a Sam's company in CA, completes an $95 million IPO priced to the public at $50 per share. The firm receives $47 per share, and the out-of-pocket expenses are $480,000. The stock’s closing price at the end of the first day is $59. What is the total cost to the firm of issuing the securities? $_______arrow_forwardYou bought a convertible bond issued by Zip Corp which has a conversion ratio of 50 common shares for each $1,000 bond. A) At what stock price per share would you make a profit (“in the money”) if you bought the bond at par? B) What would you expect the bond to sell for in the market if Zip Corp’s stock trades at $28.50 per share?arrow_forward

- A hypothetical corporation, Cascade Strategic & Innovative Solutions, has decided to raise capital through a rights offering. The company has 2,000,000 outstanding shares of stock with a market value of $55 per share. Cascade would like to raise an additional $15,000,000 in capital through a rights offering. The company will set the subscription price at $25 per new share. How many rights will be required to purchase 30 shares? 300 rights 10 rights 30 rights O 100 rightsarrow_forwardThe management of LTTP Corp. is preparing for issuing equity to fund a new project. Rights offeris used. The company has determined that the ex-rights price would be $53. The current price is $58per share, and there are 10 million shares outstanding. The rights offer would raise a total of $45million. What is the subscription price? can you handwrite it pleasearrow_forwardassume that you purchased a $1,000 convertible corporate bond. Also assume the bond can be converted to 28.5 shares of the firm’s stock. What is the dollar value that the stock must reach before investors would consider converting to common stock?arrow_forward

- (a) Describe what it means if a new company decides to issue its ordinary shares to investors in instalments, and why they might sell shares this way. (b) John’s Building Company needs to raise $100,000 cash from share investors and asks for your advice for designing the sale of the shares. He wants to sell ordinary shares. First, use your imagination to determine a reasonable sale price per share. Then, design a traditional 3 step instalment plan for collection of the cash from investors. Hint: you may consider that the Application period will commence on 1st February 2022. Outline the basic details of your plan, including beginning and ending dates for each stage of your plan.arrow_forwardBK Corporation has a value of operations equal to P2,100, short-term investments of P100, debt of P200, and 100 shares of stock. If BK converts its short-term investments to cash and repurchases P100 of its stock, what is the resulting estimated intrinsic stock price and how many shares remain outstanding?arrow_forwardCalculate the number of shares purchased with a $5,000 investment in a no load mutual fund with a net asset value of $7.45. The number of shares purchased is (Type an integer or decimal rounded to the nearest thousandth as needed.). COLLarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education