ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

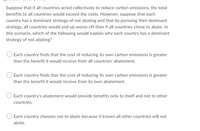

Transcribed Image Text:Suppose that if all countries acted collectively to reduce carbon emissions, the total

benefits to all countries would exceed the costs. However, suppose that each

country has a dominant strategy of not abating and that by pursuing their dominant

strategy, all countries would end up worse off than if all countries chose to abate. In

this scenario, which of the following would explain why each country has a dominant

strategy of not abating?

Each country finds that the cost of reducing its own carbon emissions is greater

than the benefit it would receive from all countries' abatement.

Each country finds that the cost of reducing its own carbon emissions is greater

than the benefit it would receive from its own abatement.

Each country's abatement would provide benefits only to itself and not to other

countries.

Each country chooses not to abate because it knows all other countries will not

abate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Two countries the US (U) and Fiji (F). Each country i E {U, F} can decide whether to impose a positive tax on the emissions of its polluting firms (t¡> 0) or to impose no tax (t; = 0). We can think of a representative firm that chooses whether to produce using a polluting technology (q = P) or a clean technology (q = C). The polluting technology generates profits of л(P) = 11. The clean technology generates profits of л(P) = 10 and doesn't have to pay tax. Assume that when the firm is indifferent between the two technologies, it chooses the clean technology. Imposing a tax of t = 1, profits of firms using polluting technology would equal profits of firms using clean technology. Let us now turn to the decisions that the governments would make if they were inde- pendently choosing whether to impose a tax or not. In the US, firms using the clean technology emit a total of 0 tonnes of CO2 emissions, while firms using the polluting technology emit a total of 900 tonnes of CO2 emissions. In…arrow_forwardPlease help me with this question ASAParrow_forwardSuppose the government wants to reduce the total pollution emitted by three local firms. Currently, each firm is creating 4 units of pollution in the area, for a total of 12 pollution units. If the government wants to reduce total pollution in the area to 6 units, it can choose between the following two methods: Available Methods to Reduce Pollution 1. The government sets pollution standards using regulation. 2. The government allocates tradable pollution permits. Each firm faces different costs, so reducing pollution is more difficult for some firms than others. The following table shows the cost each firm faces to eliminate each unit of pollution. For each firm, assume that the cost of reducing pollution to zero (that is, eliminating all 4 units of pollution) is prohibitively expensive. Firm Cost of Eliminating the... First Unit of Pollution Second Unit of Pollution Third Unit of Pollution (Dollars) (Dollars) (Dollars) Firm X 90 125 180…arrow_forward

- Suppose the government wants to reduce the total pollution emitted by three local firms. Currently, each firm is creating 4 units of pollution in the area, for a total of 12 pollution units. If the government wants to reduce total pollution in the area to 6 units, it can choose between the following two methods: Available Methods to Reduce Pollution 1. The government sets pollution standards using regulation. 2. The government allocates tradable pollution permits. Each firm faces different costs, so reducing pollution is more difficult for some firms than others. The following table shows the cost each firm faces to eliminate each unit of pollution. For each firm, assume that the cost of reducing pollution to zero (that is, eliminating all 4 units of pollution) is prohibitively expensive. Firm Cost of Eliminating the... First Unit of Pollution Second Unit of Pollution Third Unit of Pollution (Dollars) (Dollars) (Dollars) Firm X 130 165 220…arrow_forwardAir pollution creates a negative externality—a cost suffered by a third party as a result of an economic transaction. A standard solution to a negative externality is a Pigouvian tax, a tax that raises the marginal private cost of pollution emissions to the level of the marginal social cost. The socially optimal quantity of pollution emissions is then determined by the intersection of the marginal private benefit, or demand, curve and the marginal social cost curve. The article notes that "putting a dollar value on the benefits of cleaner air has been difficult." Assuming this problem has been resolved, in the accompanying diagram, move the endpoints of line Smarginal social cost to show the marginal social cost curve. Then move the line labeled "Tax" to show the amount of the tax needed to limit emissions to the socially optimal level.arrow_forwardAn externality, which is sometimes also called a (Spillover OR Social cost) , can have a negative or a positive impact on the third party. An externality occurs when an exchange between a (Buyer and seller OR Population of two cities) has an impact on a third party who (Is not OR is) part of the exchange. For a negative externality, the private costs of an action are (Less or More) than the costs imposed on society as a whole. For a positive externality, the private benefits of an action are (Less or More) than the social benefits. An example of positive externality is (Vccination OR Good wether), whereas an example of negative externality is (Population OR Hurricane)arrow_forward

- The Centers for Disease Control and Prevention estimates that every alcoholic drink consumed generates roughly $2 in external economic costs. Briefly describe how you would model this externality in a supply and demand diagram (e.g. would you draw a social marginal cost curve or a social marginal benefit curve?).arrow_forwardQ.4 Government regulation of economic and social activities permeates our lives. While regulation in many instances yields important public benefits, regulations often are imposed on individuals and organizations with too little thought or analysis of what is gained in comparison with the losses incurred in time, money, indecision, and productivity. Further, the growth of government involvement in the market system sometimes constrains our ability to achieve fundamental economic and social goals. According to the World Bank study, regulation on business varies widely around the world and less developed countries tend to regulate the most. Recommend how government regulations can be more effective.arrow_forward#2. You have two periods. I've given you an externality with MEC=0.05q1. So, MB1=8-0.4q1 MB2=8-0.4q2. So, the externality is a cost realized in period 2 but caused by period 1's production choice. Q1 belongs to the first period, and Q2 is the second.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education