ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

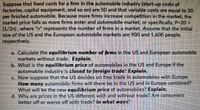

Transcribed Image Text:Suppose that fixed costs for a firm in the automobile industry (start-up costs of

factories, capital equipment, and so on) are 50 and that variable costs are equal to 20

per finished automobile. Because more firms increase competition in the market, the

market price falls as more firms enter and automobile market, or specifically, P-20 +

(1/2n), where "n" represents the number of firms in a market. Assume that the initial

size of the US and the European automobile markets are 900 and 1,600 people,

respectively.

a. Calculate the equilibrium number of firms in the US and European automobile

markets without trade. Explain.

b. What is the equilibrium price of automobiles in the US and Europe if the

automobile industry is closed to foreign trade? Explain.

C. Now suppose that the US decides on free trade in automobiles with Europe.

How many automobile firms will there be in the US and in Europe combined?

What will be the new equilibrium price of automobiles? Explain.

d. Why are prices in the US different with and without trade? Are consumers

better off or worse off with trade? In what ways?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assume the industrial conditions of red pepper production in the market for homogeneous products there are many manufacturers where each manufacturer has a market share (market share) the same, relatively small and can not affect the price of the change strategies carried out by these manufacturers in the market. If it is known that the function the demand is Q = 2000-P, and the total cost of each manufacturer is the same that is, TCi = 100 + 5q2i. Where Q = [2]I qi, where i is the producer of i and i is 1, 2, 3,..., n. Questions: - What is the number of companies in the long term of the competitive marketi perfect for this homogeneous product, where every company has the same market share? - What is the selling price of thi product in market? - Calculate the Herfindahl-Hirschman Index (HHI) of the red pepper producer industry here!arrow_forwardYou manage two chocolate factories. Using only these two factories, you must produce exactly 420 kgs of chocolate daily at lowest possible cost. Mathematically, you have: Q1 = Quantity produced at Chocolate Factory #1 Q2 = Quantity produced at Chocolate Factory #2 Daily total overall production: Q1 – Q2 = 420 At present, each factory produces half the overall requirement. This means that Q1 = 210, Q2 = 210 a) Following your logic , you realize that as long as the marginal cost is different between the two factories, you can lower overall cost while maintaining production at 420 kgs. So, to reduce the overall cost to the lowest possible, you decide to move more than 1 kilogram from one factory to another. As a result, each factory will produce a different quantity of chocolate while the overall daily production remains at 420 kgs. To minimize overall cost, how many kilograms will you order/instruct Factory #1 to produce? Q1 = ____________kgs And how many kilograms would you…arrow_forwardThe Energy Information Administration's forecast that world crude oil demand will likely outpace supply by 20 million barrels this year has also increased market uncertainty and driven up prices. Companies in the US steel and alumina industries have been urging the loosening of import restrictions because they fear running short of petrol. Despite the potential market effects, analysts believe that most steel and alumina companies won't be significantly impacted because crude oil only accounts for a small fraction of their overall costs. In general, rising crude oil prices are the result of a mix of supply and demand issues, market uncertainty, and other reasons. The price of this significant commodity will undoubtedly continue to be significantly influenced by global supply and demand dynamics, even though the precise trajectory of prices in the future is difficult to forecast. 1) Draw a graph to show this information.arrow_forward

- The demand and supply of pizza is defined by the following equations: Qd = D(P, Y ) = 1 + Y − 2P Qs = D(P, PM) = 2 P/PM where, Qd is quantity demand, P is the price of each pizza sold, Y is the average income of consumers, Qs is the quantity supplied, and Pm is the price of inputs used in the production of pizza. (a) List the endogenous and exogenous variables of this model (b) Find the equilibrium price Pe and quantity Qe of pizza as a function of the exogenous variables. (c) Use a simple demand and supply diagram to show what happens to the equilibrium price and quantity when there is an increase in one of the exogenous variables.arrow_forwardThe biological relationship between the growth for the fish population and the size of the fish population is g = 12S(1 - S/4) where g is the growth of the fish population and S is the size of the population. The size of the harvest is a function of the amount of human effort expended b = 3ES where E is the level of effort. Market price of fish per unit is $100 and a constant marginal cost of effort is $40. We can derive the free-access equilibrium effort level Ef by setting the net benefits function equal to zero. Then, E f = in one decimal place. Hint: Write the numberarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education