ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

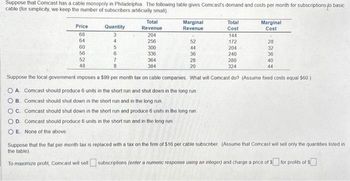

Transcribed Image Text:Suppose that Comcast has a cable monopoly in Philadelphia. The following table gives Comcast's demand and costs per month for subscriptions to basic

cable (for simplicity, we keep the number of subscribers artificially small)

Total

Revenue

204

256

300

204

336

240

7

364

280

8

384

324

Suppose the local government imposes a $99 per month tax on cable companies. What will Comcast do? (Assume fixed costs equal $60.)

O A. Comcast should produce 6 units in the short run and shut down in the long run.

O B. Comcast should shut down in the short run and in the long run

OC. Comcast should shut down in the short run and produce 6 units in the long run

OD. Comcast should produce 6 units in the short run and in the long run

OE. None of the above

Price

68

64

60

56

52

48

Quantity

3

4

5

6

Marginal

Revenue

52

44

36

28

20

Total

Cost

144

172

Marginal

Cost

28

32

36

40

44

Suppose that the flat per-month tax is replaced with a tax on the firm of $16 per cable subscriber (Assume that Comcast will sell only the quantities listed in

the table)

To maximize profit, Comcast will sell subscriptions (enter a numeric response using an integer) and charge a price of $ for profits of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- BYOB is a monopolist in beer production and distribution in the imaginary economy of Hopsville. Suppose that BYOB cannot price discriminate; that is, it sells its beer at the same price per can to all customers. The following graph shows the marginal cost (MC), marginal revenue (MR), average total cost (ATC), and demand (D) for beer in this market. Place the black point (plus symbol) on the graph to indicate the profit-maximizing price and quantity for BYOB. If BYOB is making a profit, use the green rectangle (triangle symbols) to shade in the area representing its profit. On the other hand, if BYOB is suffering a loss, use the purple rectangle (diamond symbols) to shade in the area representing its loss. 4.00 Esc 3.50 + PRICE (Dollars per can) 3.00 + 2.50 78°F Sunny 2.00 1.50 1.00 + MC 0.50 + F1 1 F2 Ö- @ ATC F3 0+ # F4 F5 ▬ Monopoly Outcome 0 Profit COL F6 Loss O F7 1 F8 n F9 F10 F11 F12 2 Fn Lock ( 1 6/2 Insert Prt Scarrow_forwardYou have been granted a monopoly in the avocado market. The market demand for avocados is Q = 2000 – 2P. Your cost structure is such that your total costs are TC = 1000+ 400Q. (limit: whatever needed) What is your profit maximizing price and quantity? Explain this in words and show it graphically. What are the profit, producer surplus and consumer surplus? The government is thinking about breaking your monopoly into ten identical firms and giving ownership to 10 random people. Correspondingly, each firm would have a fixed cost of $1000 and a marginal production cost of $400 per unit. In this perfectly competitive environment, what would be the equilibrium price and quantity? Explain this in words and show it graphically. What are the profit per firm, producer surplus and consumer surplus that correspond to your answer to part d)? How much would you be willing to pay to keep the government from taking your monopoly away? Explain.arrow_forward!arrow_forward

- A patent gave Sony a legal monopoly to produce a robot dog called Aibo ("eye-BO"). The Chihuahua-size pooch robot can sit, beg, chase balls, dance, and play an electronic tune. When Sony started selling the toy in July 1999, it announced that it would sell 3,000 Aibo robots in Japan for about $2,000 each and a limited litter of 2,000 in the United States for $2,500 each. Suppose that Sony's marginal cost of producing Aibos is $500. Its inverse demand curve is Pj = 3500 - 0.5Qj in Japan and Pa = 4500 - Qa in the United States. Solve for the equilibrium prices and quantities (assuming that U.S. customers cannot buy robots from Japan). The equilibrium quantity in Japan is 3000 and the price, pj, is $ 2000. (round your answers to the nearest integer) The equilibrium quantity in the U.S. is 2000 and the price, pa, is $ 2500. (round your answers to the nearest integer) Show how the profit-maximizing price ratio depends on the elasticities of demand in the two countries. Pj Pa 1+1/a 2,000…arrow_forwardQuestion 5: Jimmy has a room that overlooks, from some distance, a major league baseball stadium. He decides to rent a telescope for $50 a week and charge his friends and classmates to use it to peep at the game for 30 seconds. He can act as a monopolist for renting out "peeps". For each person who takes a 30 second peep, it costs Jimmy $.20 to clean the eyepiece. Jimmy believes he has the following demand for his service: Price of a Peep $1.20 Quantity of peeps demanded 1.00 90 100 150 200 250 300 70 60 50 350 40 30 400 450 20 10 500 550 a) For each price, calculate the total revenue from selling peeps and themarginal revenue per peep. Price Quantity TR MR $1.20 100 90 100 150 200 70 250 60 300 350 50 40 30 400 450 20 500 10 550 b) At what quantity will Jimmy's profit be maximized? What price will he charge? What will his total profit be? c) Jimmy's landlady complains about all the visitors coming into the building and tells Jimmy to stop selling peeps. Jimmy discovers, though, if he…arrow_forwardv THE VIRTUAL MONOPOLY OF EPIPENS BY THE APLIA ECONOMICS CONTENT TEAM In 2007, as part of a $6.7 billion deal with Merck & Co., Inc., one of the largest pharmaceutical companies in the world, Mylan N.V., an American generic and specialty pharmaceuticals company, acquired the EpiPen, an epinephrine injection device used to treat the potentially fatal allergic reaction known as anaphylaxis. At the time, EpiPen was not a household brand that everyone knew, but efforts by Mylan's CEO Heather Bresch changed the landscape for this device. According to Jen Wieczner, in an article in Fortune: "She poured marketing resources into the product, and embarked on an awareness and political campaign to get more EpiPens into schools and other public institutions. Today, 47 states have laws about making epinephrine auto-injectors available at school in case of an anaphylaxis incident, largely as a result of Bresch's efforts" (Jen Wieczner, "Mylan CEO Blamed Obama Care for EpiPen Sticker Shock,"…arrow_forward

- 1. Calculate the profit-maximizing quantity and price for the non-student market. (attached Figure A: Non-Students) 2. Calculate the profit-maximizing quantity and price for the student market. (attached Figure B: Students) 3. Calculate the profit if the firm charges both the non-students and students the same price of $20. (attached Figure A: Non-Students and Figure B: Students) 4. Calculate the profit if the monopoly firm perfectly price discriminates. (attached Figure A: Non-Students and Figure B: Students)arrow_forwardYou have been granted a monopoly in the avocado market. The market demand for avocados is Q = 2000 – 2P. Your cost structure is such that your total costs are TC = 1000+ 400Q. (limit: whatever needed) What is your profit maximizing price and quantity? Explain this in words and show it graphically. What are the profit, producer surplus and consumer surplus? The government is thinking about breaking your monopoly into ten identical firms and giving ownership to 10 random people. Correspondingly, each firm would have a fixed cost of $1000 and a marginal production cost of $400 per unit. In this perfectly competitive environment, what would be the equilibrium price and quantity? Explain this in words and show it graphically. What are the profit per firm, producer surplus and consumer surplus that correspond to your answer to part d)? How much would you be willing to pay to keep the government from taking your monopoly away? Explain.arrow_forwardPlease no written by handarrow_forward

- To answer this question, you will want to work out the answer using a graph on a piece of scratch paper (not turned in). You are going to compare the outcomes in the case where there is perfect competition to the monopoly case. So, as an intermediate step, you will need to compute the equilibrium outcomes under competition and monopoly. Suppose that you have the following information about the demand for oil. Price ($/barrel) 80 70 60 50 40 30 20 10 Suppose that the marginal cost to produce a barrel of oil is $20. What is the deadweight loss if the oil market is a monopoly? Quantity demanded(# barrels) 5 6 7 8 9 10 11 12arrow_forwardA patent gave Sony a legal monopoly to produce a robot dog called Aibo ("eye-BO"). The Chihuahua-size pooch robot can sit, beg, chase balls, dance, and play an electronic tune. When Sony started selling the toy in July 1999, it announced that it would sell 3,000 Aibo robots in Japan for about $2,000 each and a limited litter of 2,000 in the United States for $2,500 each. Suppose that Sony's marginal cost of producing Aibos is $500. Its inverse demand curve is P₁ = 3500-0.5Q in Japan and Pa = 4500-Qa in the United States. Solve for the equilibrium prices and quantities (assuming that U.S. customers cannot buy robots from Japan). The equilibrium quantity in Japan is 3000 and the price, p, is $ 2000. (round your answers to the nearest integer) The equilibrium quantity in the U.S. is 2000 and the price, p, is $ 2500 (round your answers to the nearest integer) Show how the profit-maximizing price ratio depends on the elasticities of demand in the two countries. I Pl 2,000 1+1/a 1+1/ Pa…arrow_forwardFigure 15-11 Price (dollars per subscription) B MC E Demand Quantity (subscriptions MR per month) In 2011, Verizon was granted permission to enter the market for cable TV in Upstate New York, ending the virtual monopoly that Time Warner Cable had in most local communities in the region. Figure 15-11 shows the cable television market in Upstate New York. Refer to Figure 15-11. Suppose the local government imposes a $2.50 per month tax on cable companies. What happens to the price charged by the cable company following the imposition of this tax? O The price rises from PM but it increases by an amount greater than $2.50 to reflect the monopoly's markup. O The price remains at PM- O The price rises from PM to (PM + $2.50). O The price rises from PM but it increases by an amount less than $2.50.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education