ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

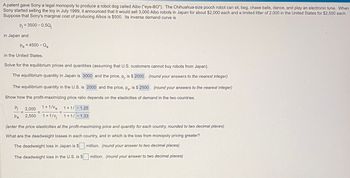

Transcribed Image Text:A patent gave Sony a legal monopoly to produce a robot dog called Aibo ("eye-BO"). The Chihuahua-size pooch robot can sit, beg, chase balls, dance, and play an electronic tune. When

Sony started selling the toy in July 1999, it announced that it would sell 3,000 Aibo robots in Japan for about $2,000 each and a limited litter of 2,000 in the United States for $2,500 each.

Suppose that Sony's marginal cost of producing Aibos is $500. Its inverse demand curve is

Pj = 3500 - 0.5Qj

in Japan and

Pa = 4500 - Qa

in the United States.

Solve for the equilibrium prices and quantities (assuming that U.S. customers cannot buy robots from Japan).

The equilibrium quantity in Japan is 3000 and the price, pj, is $ 2000. (round your answers to the nearest integer)

The equilibrium quantity in the U.S. is 2000 and the price, pa, is $ 2500. (round your answers to the nearest integer)

Show how the profit-maximizing price ratio depends on the elasticities of demand in the two countries.

Pj

Pa

1+1/a

2,000

1+1/-1.25

2,500 1+1/ 1+1/-1.33

(enter the price elasticities at the profit-maximizing price and quantity for each country, rounded to two decimal places)

What are the deadweight losses in each country, and in which is the loss from monopoly pricing greater?

The deadweight loss in Japan is $

The deadweight loss in the U.S. is $

million. (round your answer to two decimal places)

million. (round your answer to two decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Consider a firm, Shamrock Ink, that has some monopoly power in the market for green ink pads. The demand for their green ink pads is P = 2500 – 2.5Q with an associated marginal revenue of MR= 2500 – 5Q. Where Q is thousands of ink pads. Their marginal cost of producing green ink pads is MC = 20Q. In order to maximize profit, Shamrock Ink should produce thousand ink pads and charge a price of $ (Round answers to two decimals if necessary.)arrow_forwardFor people with life-threatening allergies, carrying a device that can automatically inject epinephrine (called an autoinjector) is a necessity. In the summer of 2016, Mylan, the maker of the widely used autoinjector EpiPen, found itself with a virtual monopoly. A year earlier its primary competitor, Auvi-Q, was recalled amid fears that it would malfunction and deliver the wrong dose. In addition, the FDA denied the drug producer, Teva, from releasing a generic autoinjector. Prior to these events, a two-pack EpiPen sold for approximately $100. But during that summer, Mylan raised the price to over $650 per pack, leading to extensive news coverage, popular online petitions, and outrage on the part of consumers. Mylan countered that many consumers received their EpiPens through their medical insurance, hence they were protected from the price increase. For those who didn't have insurance coverage and had to pay the full price, Mylan offered a $300 savings card. a. In the graph, shade the…arrow_forwardUse the following graph of a monopoly market to answer this question: P $13 $10 150 300 Which of the following statements is an accurate interpretation of the graph? This firm engages in perfect price discrimination; 150 of its customers are willing to pay exactly $13, and 150 are willing to pay exactly $10. This firm price-discriminates by selling its product for $13 to the 150 consumers willing to pay at least $13, and selling it for $10 to the 150 consumers willing to pay between $10 and $13. This firm engages in price discrimination by negotiating on price with each of its customers. This firm price-discriminates by selling its product for $13 to the 150 consumers willing to pay at least $13, and selling it for $10 to the 300 consumers willing to pay between $10 and $13. This firm engages in perfect price discrimination; 150 of its customers are willing to pay exactly $13, and 300 are willing to pay exactly $10.arrow_forward

- Graphically show a monopoly firm that currently sells 250 units of output at a price of $60/unit, where the marginal revenue of the 250th unit is $40, the marginal cost of the 250th unit is $50, and the average total cost at 250 units is $60. [Hint: Based on the information given, is the quantity you’re asked to show the profit-maximizing quantity? Think about what has to be true for profit-maximization.] Based on the graph and assuming the firm attempts to profit maximize (and succeeds), what would happen to price, quantity, MR, MC, and ATC? (rise, fall, or stay the same?)arrow_forwardIn the linear example illustrated in the figure to the right, how does charging the monopoly a specific tax of t = $8 per unit affect the monopoly optimum and the welfare of consumers, the monopoly, and society (where society's welfare includes tax revenue)? What is the incidence of the tax on consumers? Determine how imposing the tax affects the monopoly optimum. Use the line drawing tool to show how the tax affects the monopoly's cost of production by drawing a new marginal cost curve with the tax. Label this line 'MC¹'. Carefully follow the instructions above, and only draw the required objects. p, $ per unit 26- 24- 22- 20- 18- 16- 14- 12- 10- 8- 6- 4- 2- 0- 0 2 3 4 MC D MR 5 6 7 8 9 10 11 12 13 Q, Units per dayarrow_forwardNot sure how to complete the chartarrow_forward

- To answer this question, you will want to work out the answer using a graph on a piece of scratch paper (not turned in). You are going to compare the outcomes in the case where there is perfect competition to the monopoly case. So, as an intermediate step, you will need to compute the equilibrium outcomes under competition and monopoly. Suppose that you have the following information about the demand for oil. Price ($/barrel) 80 70 60 50 40 30 20 10 Suppose that the marginal cost to produce a barrel of oil is $20. What is the deadweight loss if the oil market is a monopoly? Quantity demanded(# barrels) 5 6 7 8 9 10 11 12arrow_forwardA patent gave Sony a legal monopoly to produce a robot dog called Aibo ("eye-BO"). The Chihuahua-size pooch robot can sit, beg, chase balls, dance, and play an electronic tune. When Sony started selling the toy in July 1999, it announced that it would sell 3,000 Aibo robots in Japan for about $2,000 each and a limited litter of 2,000 in the United States for $2,500 each. Suppose that Sony's marginal cost of producing Aibos is $500. Its inverse demand curve is P₁ = 3500-0.5Q in Japan and Pa = 4500-Qa in the United States. Solve for the equilibrium prices and quantities (assuming that U.S. customers cannot buy robots from Japan). The equilibrium quantity in Japan is 3000 and the price, p, is $ 2000. (round your answers to the nearest integer) The equilibrium quantity in the U.S. is 2000 and the price, p, is $ 2500 (round your answers to the nearest integer) Show how the profit-maximizing price ratio depends on the elasticities of demand in the two countries. I Pl 2,000 1+1/a 1+1/ Pa…arrow_forwardYou are considering entering a market serviced by a monopolist You are considering entering a market serviced by a monopolist. You currently earn $0 economic profits, while the monopolist earns $5. If you enter the market and the monopolist engages in a price war, you will lose $5 and the monopolist will earn $1. If the monopolist doesn’t engage in a price war, you will each earn profits of $2.There are two possible solutions or equilibria. What are they? You are considering entering a market serviced by a monopolistarrow_forward

- MelCo’s Xamoff The global pharmaceuticals giant, MelCo, has had great success with Xamoff, and over-thecounter medicine that reduces exam-related anxiety. A patent currently protects Xamoff from competition, although rumors persist that similar products are in development. Two years ago, MelCo sold 25 million units for a price of $10 for a package of ten. Last year it raised the price to $11, and sales fell to 22 million units. Finally, a financial analyst estimates the cost of production at $2 per package. (a) Estimate the elasticity of demand for this product at $10. Is this price too high or too low? (b) Estimate the elasticity of demand for this product at $11. Is this price too high or too low? (c) Based on your answers to (a) and (b), what can we say about MelCo’s profit-maximizing price?arrow_forwardBYOB is a monopolist in beer production and distribution in the imaginary economy of Hopsville. Suppose that BYOB cannot price discriminate; that is, it sells its beer at the same price per can to all customers. The following graph shows the marginal cost (MC), marginal revenue (MR), average total cost (ATC), and demand (D) for beer in this market. Place the black point (plus symbol) on the graph to indicate the profit-maximizing price and quantity for BYOB. If BYOB is making a profit, use the green rectangle (triangle symbols) to shade in the area representing its profit. On the other hand, if BYOB is suffering a loss, use the purple rectangle (diamond symbols) to shade in the area representing its loss. Suppose that BYOB charges $2.50 per can. Your friend Charles says that since BYOB is a monopoly with market power, it should charge a higher price of $3.00 per can because this will increase BYOB’s profit. Complete the following table to determine whether Charles is…arrow_forwardConsider the local telephone company, a natural monopoly. The following graph shows the demand curve for phone services, the company's marginal revenue curve (labeled MR), its marginal cost curve (labeled MC), and its average total cost curve (labeled AC). (Hint: Click a point on the graph to see its exact coordinates.) PRICE (Dollars per month) 160 140 120 100 80 60 40 20 0 0 1 MR 2 3 4 567 QUANTITY (Thousands of households per month) AC MC D 8 (?)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education