FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Suppose that Charles holds the land for appreciation and that the vacation was actually a business trip. What is the deductible taxes from AGI?

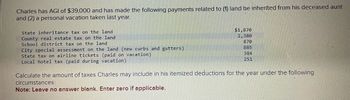

Transcribed Image Text:Charles has AGI of $39,000 and has made the following payments related to (1) land he inherited from his deceased aunt

and (2) a personal vacation taken last year.

State inheritance tax on the land

County real estate tax on the land

School district tax on the land

City special assessment on the land (new curbs and gutters).

State tax on airline tickets (paid on vacation).

Local hotel tax (paid during vacation).

$1,870

2,380

870

885

384

251

Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following

circumstances:

Note: Leave no answer blank. Enter zero if applicable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In almost all cases, making contributions to an RRSP will provide the deferral of income tax. In some cases, making such contributions may result in avoidance of tax. Explain these statements.arrow_forwardIn your own words, describe the similarities and differences between tax credits and tax deductions. Your response must include two (2) examples of each kind and a discussion on why you think credits are better than deductions, or if deductions are better than credits, or maybe you think they are equal! Tell us why you feel this way.arrow_forwardWhat are the deductibility of real property taxesarrow_forward

- Discuss how a sales tax is regressive.arrow_forward! Required information [The following information applies to the questions displayed below.] Charles has AGI of $46,000 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year. State inheritance tax on the land County real estate tax on the land School district tax on the land City special assessment on the land (new curbs and gutters) State tax on airline tickets (paid on vacation) Local hotel tax (paid during vacation) a. Suppose that Charles holds the land for appreciation. $1,370 1,760 795 Deductible taxes from AGI 714 Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: (Leave no answer blank. Enter zero if applicable.) 360 224arrow_forwardWhich of the following items IS included in gross income? O Municipal bond interest O Unemployment compensation received Scholarship for tuition and books O Inherited propertyarrow_forward

- This is US Tax and Law Study Guidearrow_forwardThe money you receive back because you have overpaid your taxes is called a tax return. a. true b. falsearrow_forwardEven though transfer taxes do not affect all individuals, individuals affected by a transfer tax can experience a high tax liability. What taxes are not considered a transfer tax? Tangible personal property is taxed by state and local governments. What is an example of something that is not considered tangible personal property? What is an example of something that excise tax is not levied on?arrow_forward

- What is the tax rate range for Social Security benefits received? How is the deductible amount of personal property tax figured for personal vehicles? Remember, the tax must be calculated based on the vehicle’s value (not its weight) in order to be deducted. Are donations of time and services deductible? What types of state and local taxes are deductible as itemized deductions on Schedule A?arrow_forward. What is the 'low income tax offset' (LITO)? What is the maximum LITO amount payable toeligible taxpayers? PLEASE PUT 3 REFERENCESarrow_forwardImpact on Taxes. From question 24, if Lawrence had forgotten a $5000 tax credit (instead of a $5000 tax deduction), how would his taxes be affected?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education