FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

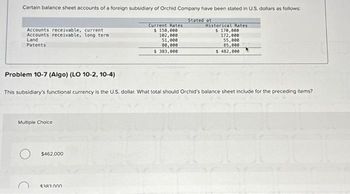

Transcribed Image Text:Certain balance sheet accounts of a foreign subsidiary of Orchid Company have been stated in U.S. dollars as follows:

Stated at

Accounts receivable, current

Accounts receivable, long term

Land

Patents

Multiple Choice

Problem 10-7 (Algo) (LO 10-2, 10-4)

This subsidiary's functional currency is the U.S. dollar. What total should Orchid's balance sheet include for the preceding items?

O $462.000

Current Rates

$ 150,000

102,000

51,000

80,000

$383,000

$383.000

Historical Rates

$ 170,000

172,000

55,000

85,000

$ 482,000

Transcribed Image Text:This subsidiary's functional currency is the U.S. dollar. What total should Orchid's balance sheet include for the preceding items?

Multiple Choice

$462,000

$383,000

$388,000

O $392.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Find the net exposure of the British subsidiary of the U.S. MNC with the following intra affiliate transactions shown. $15 $40 (Note: If you cannot view the image, you can download it here: Map.PNG) O $40 out $65 out E20 out. none of the optionsarrow_forwardStiff Sails Corporation, a U.S. company, operates a 100%-owned British subsidiary, SeaBeW Corporation. The U.S. dollar is the functional currency of the subsidiary. Financial statements for the subsidiary for the fiscal year-end December 31, 2024, are as follows: Sales Cost of Goods Sold Beginning Inventory Purchases Cost of Goods Sold Depreciation B. Goods Available For Sale Less: Ending Inventory Selling and Admin. Expenses Income Taxes Net Income Current Assets Cash Accts. Rec. Inventories Required: A. SeaBeWe Corporation Income Statement 155,000 171,000 285,000 611,000 SeaBeWe Corporation Partial Balance Sheet 310,000 265,000 575,000 285,000 290,000 79,000 155,000 32,000 July 1, 2022 Jan. 1, 2024 June 30, 2024 Dec. 31, 2024 Average for 2024 1. Cost of Goods Sold. 2. Depreciation Expense. 3. Equipment. Other Information: 1. Equipment costing 340,000 pounds was acquired July 1, 2022, and 38,000 was acquired June 30, 2024. Depreciation for the period was as follows: Pounds 650,000…arrow_forward15.7Aarrow_forward

- Looking for help with these two questions. 1. Prepare financial statements (income statement, statement of retained earnings, and balance sheet) for the Canadian subsidiary in its functional currency, Canadian dollars.2. Translate the Canadian dollar functional currency financial statements into U.S. dollars so that Sendelbach can prepare consolidated financial statements.arrow_forwardH2.arrow_forwardA U.S. parent owns a subsidiary in France, the subsidiary's accounts are maintained in euros, and its functional currency is the U.S. dollar. During the year, the euro has weakened against the U.S. dollar (U.S.$/€ rate has declined).Which one of the subsidiary's transactions below increases the amount of remeasurement losses reported when the subsidiary's accounts are translated to U.S. dollars?Select one:A. Inventory purchasesB. Depreciation expenseC. Sale of equity securitiesD. Sales revenue Plz answer fast without plagiarism.arrow_forward

- 7. A foreign subsidiary of the Bart Corporation has certain balance sheet accounts on December 31, 20X2. Information relating to these accounts in U.S. dollars is as follows: Restated at Current Rates Historical Rates Marketable (Available-for-Sale and Trading) securities $ 75,000 $ 85,000 Inventories, carried at average cost Refundable deposits Goodwill 600,000 25,000 55,000 $ 755,000 700,000 30,000 70,000 $ 885,000 What total should be included in Bart's balance sheet on December 31, 20X2, as a result of the preceding information? Foreign Currency is Functional Currency $780,000 $870,000 $755,000 $880,000 U.S. Dollar is Functional Currency $870,000 $755,000 $780,000 $880,000 xarrow_forwardOn January 1, 2024, Trenten Systems, a U.S.-based company, purchased a controlling interest in Grant Management Consultants located in Zurich, Switzerland. The acquisition was treated as a purchase transaction. The 2024 financial statements stated in Swiss francs are given below. GRANT MANAGEMENT CONSULTANTS Comparative Balance Sheets January 1 and December 31, 2024 Direct exchange rates for Swiss franc are: Required: A. Translate the year-end balance sheet and income statement of foreign subsidiary using the current rate method of translation. B. Prepare a schedule to verify the translation adjustment. Cash and Receivables Net Property, Plant, and Equipment 40,000 37,000 60,000 92,000 30,000 32,000 20,000 20,000 10,000 40,000 60,000 92,000 Totals Accounts and Notes Payable Common Stock Retained Earnings Totals GRANT MANAGEMENT CONSULTANTS Consolidated Income and Retained Earnings Statement for the Year Ended December 31, 2024 Jan. 1 Dec. 31 20,000 55,000 Revenues 75,000 Operating…arrow_forwardA U.S.-based multinational company has two subsidiaries, one in Mexico (local currency, Mexicanpeso, MP) and one in Japan (local currency, yen, ¥). Forecasts of business operations indicate the following short-term financing position for each subsidiary (in equivalent U.S. dollars): Mexico:$80 million excess cash to be invested (lent) Japan: $60 million funds to be raised (borrowed) Currency Item US $ MP ¥ Spot exchange rates MP11.60/US$ ¥108.25/US$ Forecast percentage change −3.00% +1.50% Interest rates Nominal Euromarket 4.00% 6.20% 2.00% Domestic 3.75% 5.90% 2.15% Effective Euromarket Domestic Euromarket and the domestic market; then indicate where the funds should be invested and raised.…arrow_forward

- Forex: Translation and RemeasurementThe following assets are held by a subsidiary in a foreign country: 1. At what amount should be reported as total assets if the financial statement is to be translated as of Jan. 31?2. At what amount should be reported as total assets if the financial statement is to be remeasured as of Jan. 31?arrow_forwardCertain balance sheet accounts of a foreign subsidiary of Roman, Inc., on December 31, 2010, have been translated into Philippine peso as follows: Translated at Current Rates P240,000 P200,000 85,000 80,000 150,000 170,000 P475,000 P450,000 The subsidiary's functional currency is the currency of the country in which it is located. What total amount should be included in Roman's December 31, 2010 consolidated balance sheet for the above accounts? Note receivable, long term. Prepaid rent Patent P450,000 P455,000 P475,000 P495,000 Historical Ratesarrow_forwardColumbia Corporation, a U.S.-based company, acquired a 100% interest in Swoboda Company in Lodz, Poland on January 1, Year 1 when the exchange rate for the Polish zloty was $0.25. Translate Swoboda’s financial statements into U.S dollars in accordance with U.S. GAAP at December 31, Year 2, using the three scenarios presented in the case and explain why the translation adjustments end up as positive or negative numbers. Read the case on page 325 of the textbook and submit an Excel file with your response to questions 1 and 2. For question 1, prepare the financial statements under each of the three scenarios as instructed.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education