ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

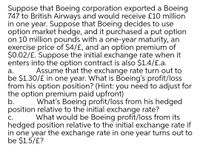

Transcribed Image Text:Suppose that Boeing corporation exported a Boeing

747 to British Airways and would receive £10 million

in one year. Suppose that Boeing decides to use

option market hedge, and it purchased a put option

on 10 million pounds with a one-year maturity, an

exercise price of $4/£, and an option premium of

$0.02/£. Suppose the initial exchange rate when it

enters into the option contract is also $1.4/£.a.

Assume that the exchange rate turn out to

а.

be $1.30/£ in one year. What is Boeing's profit/loss

from his option position? (Hint: you need to adjust for

the option premium paid upfront)

b.

position relative to the initial exchange rate?

What's Boeing profit/loss from his hedged

What would be Boeing profit/loss from its

С.

hedged position relative to the initial exchange rate if

in one year the exchange rate in one year turns out to

be $1.5/£?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Given that price level of Singapore is 105, the price level of New Zealand is 125 and the real exchange rate Q(NZD/SGD) = 1.2000, what is S(NZD/SGD)? Choose the answer that is closest to your calculation. a. 0.9921 b. 0.7000 c. 1.0080 d. 1.4286arrow_forwardSuppose the interest rate in Japan is 9%, and inflation is expected to be 4%. Meanwhile, the expected inflation in Singapore is 11%, and the Australian interest rate is 14%. To the nearest whole number, what is the best estimate of the one - year forward exchange premium (discount) at which the Australian dollar would be trading at relative to the Singapore dollar? INSTRUCTIONS: 1. Be precise in the formulas you use. 2. Please input your final answer without percentage signs (%).arrow_forwardThe forward rate of exchange is 2 , the spot rate of exchange is 1.75. The US has a bond of 9% interest and Canada has a bond for 5% interest. What is the amount you can collect in US dollars for the Canada bond on an investment of $10,000? Group of answer choices $10,937.50 and the Canadian investment is worse than the US investment $10,900 and the Canadian investment is better than the US investment $10,900 and the Canadian investment is worse than the US investment $10,937.50 and the Canadian investment is better than the US investmentarrow_forward

- Help.... Urgent...arrow_forward33 The law of volatility states that similar goods or commodities in different countries should remain at the same price after conversion of currencies according to current exchange rates. True or False True Falsearrow_forward2 Suppose that the current spot exchange rate is €0.8250/$ and the three-month forward exchange rate is €0.8132/5. The three-month interest rate is 5.80 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €825,000 Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.arrow_forward

- 6arrow_forwardA British money financier is managing €10 million and wants to invest it in safe bonds either in France or United Kingdom for one year. The one-year interest rate on such assets is 0.63% in Britain and 0% in France. The one-year forward euro-pound exchange rate is 1.121 €/£ (euros per pound). Assume that the covered interest parity condition (CIP) always holds and to ensure consistency, treat the UK as home country. What is the current euro-pound spot exchange rate? Explain and show your work.arrow_forwardSuppose that the annual rate of returns on dollar deposits equals 2% and the rate of returnon euro deposits is 1%. Furthermore, assume that expected exchange rate in a year is$1.1=1 euro and the current exchange rate is $1.08=1 euro. Should you invest in dollardeposits or euro deposits?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education