ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

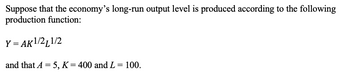

Transcribed Image Text:Suppose that the economy's long-run output level is produced according to the following

production function:

Y = AK1/2L1/2

and that A = 5, K = 400 and L = 100.

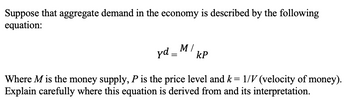

Transcribed Image Text:Suppose that aggregate demand in the economy is described by the following

equation:

yd_MkP

M/

=

Where M is the money supply, P is the price level and k = 1/V (velocity of money).

Explain carefully where this equation is derived from and its interpretation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Describe the potential impact of increasing interest rates on the components of aggregate demand. Explain the potential impact, if any, on aggregate supply. Examine the impact on real GDP and the average price level of an increase in the interest rates.arrow_forwardAssume that investment, government expenditures, taxes are autonomous.C = 2000 + 0.65* (Y-T)I = 900 – 50iG = 400T = 1500M = 1000P = 2L = 0.50Y-25ia.What is the value of the sensitivity money demand to the level of income?b.What is the value of the nominal supply?c.What expression represents the IS curve?d.What is the equilibrium interest rate, i*?e.What is the equilibrium income, Y*?arrow_forwardFor each of the changes below provide a narrative explanation and a graphical explanation of how the change will impact the economy's equilibrium price level and equilibrium quantity of output produced a) The federal reserve significantly increases the interest rate it pays banks for holding excess reserves. b) The government increases the income tax rate of households by 3%arrow_forward

- Please answer fastarrow_forwardDynamic aggregate demand (AD) can be derived using the quantity theory of money. Label the equation so that it accurately expresses the quantity theory of money in dynamic form growth in the money supply -+ Answer Bank unemployment growth in velocity inflation real economic growth marginal propensity to save Suppose that the velocity of money is stable, 4% real economic growth is occurring, the rate of inflation is 4%, unemployment is 5.3%, and the marginal propensity to save is 3%. By how much is the money supply growing? Enter your answer as a percentage.arrow_forwardSuppose the price level in the economy is fixed at P and the exogenous money supply is given by M, Suppose the LM curve for these values of exogenous variables is drawn as in the figure below where Y is aggregate output and r is interest rate. Consider two points A and B in the diagram Assuming all exogenous variables remain unchanged, pick the correct relation between the nominal money demand Md at point A and point B. Scroll down to view the full image. C A MAYA,TA) > Md(YB, TB) B Md(YA,TA)=Md(YB, TB) M(YA,TA)arrow_forwardThe text assumes that the natural rate of interest p is a constant parameter. Suppose instead that it varies over time, so now it has to be written as pt. How would this change affect the dynamic aggregate demand and dynamic aggregate supply? How would a shock to pt affect output, inflation, the nominal interest rate, and the real interest rate?arrow_forwardFor each of the changes below provide a narrative explanation and a graphical explanation of how the change will impact the economy's equilibrium price level and equilibrium quantity of output produced a) The federal reserve significantly increases the interest rate it pays banks for holding excess reserves. b) The government increases the income tax rate of households by 3%arrow_forwardQuestion 7 Which of the following are true about real and nominal demand? There may be more than one answer. a) A rise in the demand for real balances (Ma/P) raises equilibrium prices in the short-run. b) A drop in the demand for nominal balances (Ma) reduces equilibrium prices in the long-run. c) A change in government purchases can affect aggregate demand in the long-run. d) A change in government purchases can affect aggregate demand in the short-run.arrow_forwardQUESTION 2. Consider the following equations: MP Curve: r = 1 + 0.5 * TT IS Curve: Y = 1400 300r, Where r is the real interest rate in percentage points, Y is the real GDP in billions, and it is the inflation rate in percentage points. a) Using the MP and IS curves equations, obtain the Aggregate Demand equation. Show your work.arrow_forwardsubquestions a and b. * for a) - need to find the IS equation, also the LM equation and the equilibrium.arrow_forwardBased on research conducted by the Department of Economic Analysis, the government and policy advisors of an economy believe that the full employment GDP is $7500 billion, and Pe, the overall expected price level is 118. In addition, the researchers estimate that the short run aggregate supply equation is Y = Ypot + 80 (P- Pe), where Ypot is the potential level of output. In 2016, the population was 400 million, and the structure of the economy was described by the following equations for household consumption behavior and taxes received: C = 100+ 0.8DI, and T = 0.25Y where all monetary values are in billions of dollars. Government spending was fixed at $1700 billion, and firm's investment behavior was fixed at $800 billion. Trading is allowed in this economy and in 2016, trading occurred such that the trade account was balanced. That is, net exports (X-IM) was equal to zero. Question 17 of 20) Now consider that in in the following year (2017), the government decided to implement a…arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education