Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

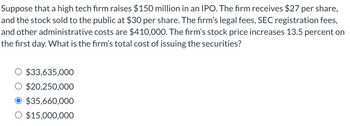

Transcribed Image Text:Suppose that a high tech firm raises $150 million in an IPO. The firm receives $27 per share,

and the stock sold to the public at $30 per share. The firm's legal fees, SEC registration fees,

and other administrative costs are $410,000. The firm's stock price increases 13.5 percent on

the first day. What is the firm's total cost of issuing the securities?

$33,635,000

$20,250,000

$35,660,000

O $15,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Borg Security Systems is considering the sale of 12,000 shares of stock to finance development of a new security product. The firm has 40,000 shares of common stock outstanding, par value of $1.00 per share. The firm has $60,000 in additional paid-in capital and $80,000 in retained earnings. Borg's investment bankers estimate that new shares will bring in $5.15 per share. If Borg goes ahead with the new stock issue, what will be the change in book value per share? Group of answer choices −$1.00 +$0.15 +$0.56 +$1.00 $0arrow_forwardHelparrow_forwardBQ, Incorporated, is considering making an offer to purchase iReport Publications. The vice president of finance has collected the following information: BQ iReport Price-earnings ratio 12.2 8.8 Shares outstanding 1,500,000 165,000 Earnings $ 4,600,000 $ 680,000 Dividends $ 960,000 $ 410,000 BQ also knows that securities analysts expect the earnings and dividends of iReport to grow at a constant rate of 4 percent each year. BQ management believes that the acquisition of iReport will provide the firm with some economies of scale that will increase this growth rate to 6 percent per year. a. What is the value of iReport to BQ? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What would BQ’s gain be from this acquisition? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If BQ were to offer $36 in cash for each share of iReport, what would the…arrow_forward

- An all-equity firm currently has 1,000,000 shares of stock outstanding and is considering borrowing $5,000,000 at 10% and buying back one-fourth of those shares. Assume a tax rate of 30% and EBIT is $ 1,500,000. Should this company undertake the capital restructuring and why?arrow_forwardVijayarrow_forwardSuppose that the newspaper publishing company described above expected net earnings is $85 million and the firm is going public and will issue 15 million shares of stock. What is the price of the IPO using the P/E ratio if the forward P/E of comparable newspapers is 15x?arrow_forward

- Caspian Water needs to raise $59.00 million by issuing additional shares of stock. If the market estimates Caspian Water will pay a dividend of $2.12 next year (D1 2.12), which will grow at 3.99% forever and the cost of equity to be 12.82%then how many shares of stock must the firm sell? 1 ) None of the answers in this list is within 100 shares of the correct answer 2) 312,890 3) 2,457,406 4 ) 4,128,970 5 ) 915,939 6 ) 2.975,934arrow_forwardCullumber, Inc., a high-technology firm in Portland, raised a total of $60 million in an IPO. The company received $27 of the $30 per share offering price. The firm’s legal fees, SEC registration fees, and other out-of-pocket costs were $350,000. The firm’s stock price increased 17 percent on the first day of trading. What was the total cost to the firm of issuing the securities?arrow_forwardA firm goes public. The firm receives $38 for each of the 4.5 million shares sold. The initial offering price was $40.25 per share, and the stock rose to $43.15 per share is the first few minutes of trading. The firm paid $2,485,000 in direct legal and other costs and $665,800 in indirect cost. What were the total direct cost of this offer?arrow_forward

- River Cruises is all-equity-financed with 100,000 shares. It now proposes to issue $300,000 of debt at an interest rate of 12% and use the proceeds to repurchase 30,000 shares at $10 per share. Profits before interest are expected to be $130,000. What is the ratio of price to expected earnings for River Cruises before it borrows the $300,000? What is the ratio after it borrow?arrow_forwardA firm has 5 million shares outstanding with a market price of $35 per share. The firm has $10 million in extra cash (short-term investments) that it plans to use in a stock repurchase; the firm has no other financial investments or any debt. What is the firm's value of operations after the repurchase? Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places. $ million How many shares will remain after the repurchase? Round your answer to the nearest whole number. sharesarrow_forwardABC Corporation has debt with a value of $100 million and common stock with a market value of $200 million .Investors expect 6% return on the debt and a a 15% return on the stock Assume perfect capital markets. Suppose ABC issues $100 million of new stock to buy back the debt. What is the expected return of the stock after this transaction? Suppose instead ABC corporation issues $50 million of new debt to repurchase stock. what is the expected return of the stock after this transaction,If the risk of the debt does not change? Would the expected return of the stock be higher or lower than in part (i)? If the risk of the debt increases,arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education