Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

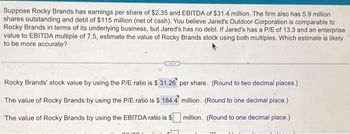

Transcribed Image Text:Suppose Rocky Brands has earnings per share of $2.35 and EBITDA of $31.4 million. The firm also has 5.9 million

shares outstanding and debt of $115 million (net of cash). You believe Jared's Outdoor Corporation is comparable to

Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of 13.3 and an enterprise

value to EBITDA multiple of 7.5, estimate the value of Rocky Brands stock using both multiples. Which estimate is likely

to be more accurate?

Rocky Brands' stock value by using the P/E ratio is $31.26 per share. (Round to two decimal places.)

million. (Round to one decimal place.)

The value of Rocky Brands by using the P/E ratio is $ 184.4

The value of Rocky Brands by using the EBITDA ratio is $

million. (Round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- baker industries net income is $24,000 ,its interest expense is $6000, and its take rate is 40%. it notes payable equals 23,000 , long term debt equals 70,000, and common equity equals 240,000. the firm's finances with only debt and common equity, so it has no preferred stock. What is the firm’s ROE and ROIC ?arrow_forwardBrookman Inc's latest EPS was $2.75, its book value per share was $22.75, it had 275,000 shares outstanding, and its debt/total invested capital ratio was 44%. The firm finances using only debt and common equity, and its total assets equal total invested capital. How much debt was outstanding? Do not round your intermediate calculations. a. $5,013,938 b. $4,571,531 c. $4,768,156 d. $5,358,031 e. $4,915,625arrow_forwardBarclay Corp is operating in a country K where the corporate tax is 40%, personal income tax on bond investment is 25% while the personal tax on stock is 29%. Assume the firm’s earnings before interest and taxes is $5,400,000 and cost of equity with zero debt is 9%. (Please Show Work) If Barclay current has $12 million total market value of debt financing, what would be the market value of the company of Barclay Corp in this country K?(Please Show Work) What is the proportion of debt (wd) and equity (ws) financing for Barclay Corp with financial leverage? (Please Show Work)arrow_forward

- You own another business with Assets on the books valued at $400,000. These assets were financed with Debt and Equity, where the D/E ratio was 3.0. If the cost of debt capital was 7% and the cost of equity capital was 19%, then what was the WACC of the firm? This is what I came up with. Is it correct? [3.0 * 0.07 * (1-0)] + (3.0 * 0.19) [0.21] + 0.57 = 0.78 or 78%arrow_forwardUse the information below to build a properly formatted income statement. A: The firm has 12,640,500 shares outstanding and EPS is $3.20.Calculate Net Income . B: The firm's corporate tax rate is 40%. Calculate the firm's EBT. C: After completing A and B above, what is the firm's corporate tax expense? D: The firm's Revenue is $183,600,000 and its operating margin is 45.00%. Calculate EBIT. E: After completing the above: Gross Profit is 1.65 times its EBIT . Calculate Gross Profit . F: Given the above information, calculate the firm's Operating Expenses . G: Given the above information, calculate the firm's Interest Expense .arrow_forwardBunny Hip and Hop Brewery has $1,710,000 in assets and $661,000 of debt. It reports net income of $102,000 a. What is its ROA? (Do not round intermediate calculations, Round the final answer to 2 decimal places.) Return on assets b. What is the return on shareholders' equity? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Return on equity c. If the firm has an asset turnover ratio of 18 times, what is the profit margin? (Round the final answer to 2 decimal places) Profit marginarrow_forward

- SodaFizz has debt outstanding that has a market value of $3 million. The company’s stock has a book value of $2 million and a market value of $6 million. What are the weights in SodaFizz’s capital structure?arrow_forwardFlimsy Safe Room’s, Inc. has total assets of $1,000,000. The firm has $100,000 in inventory. It has $300,000 in long-term debt and $400,000 in current assets. The common stockholders’ equity is $400,000. The firm does not have any preferred stock outstanding. What is Flimsy Safe Room's total debt ratio defined as total liabilities to total assets? Question 1 options: A) 0.6 = 60% B) 0.4 = 40% C) 0.5 = 50% D) 0.3 = 30%arrow_forwardBaker Industries' net income is $24,000, its interest expense is $4,000, and its tax rate is 25%. Its notes payable equals $24,000, long-term debt equals $75,000, and common equity equals $240,000. The firm finances with only debt and common equity, so it has no preferred stock. What are the firm's ROE and ROIC? Do not round intermediate calculations. Round your answers to two decimal places. ROE: ROIC: 10 Hide Feedback Partially Correctarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education